DEF 14A: Definitive proxy statements

Published on August 25, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒ |

|

|

Filed by a Party other than the Registrant ☐ |

|

|

Check the appropriate box: |

|

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a 12 |

|

(Name of Registrant as Specified in its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

DOCPROPERTY "DocsID" \* MERGEFORMAT LEGAL_1:81761104.2

MACROBUTTON DocID \\4143-7635-1561 v8

2572 boul. Daniel-Johnson, 2nd Floor

Laval, Québec, Canada H7T 2R3

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the shareholders of Acasti Pharma Inc. (the “Corporation”):

NOTICE IS HEREBY GIVEN THAT that the annual meeting (the “Meeting”) of the shareholders of the Corporation will be held on October 10, 2023 at 1:00 p.m. Eastern Time. The Meeting will take place online only via a virtual meeting portal through which you can listen to the Meeting, submit questions and vote online. Registered shareholders and duly appointed proxyholders can attend the Meeting online at https://meetnow.global/MUK6PLU where they can participate, vote, or submit questions during the Meeting’s live webcast.

The Meeting will be held for the following purposes:

The accompanying Proxy Statement more fully describes the details of the business to be conducted at the Meeting. After careful consideration, the Board of Directors of Acasti Pharma Inc. (the “Board”) has unanimously approved the proposals and recommends that you vote FOR each nominee and proposal described in the Proxy Statement.

The Corporation is pleased to make use of the U.S. Securities and Exchange Commission rules that allow companies to furnish proxy materials to their shareholders via the internet. The Corporation believes the ability to deliver proxy materials electronically allows the Corporation to provide its shareholders with the information they need, while lowering the costs of delivery and reducing the environmental impact from the distribution of the Corporation’s proxy materials.

SIGNED IN LAVAL, QUEBEC, AS OF AUGUST 25, 2023. |

|

|

BY ORDER OF THE BOARD |

|

/s/ Prashant Kohli |

|

Prashant Kohli |

|

Chief Executive Officer |

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE VOTE VIA THE INTERNET, OVER THE TELEPHONE OR BY MAIL BY FOLLOWING THE INSTRUCTIONS FOUND ON THE NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS OR ON THE ENCLOSED PROXY CARD AS

MACROBUTTON DocID \\4143-7635-1561 v8

- 2 -

PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE AT THE MEETING IF YOU ATTEND THE MEETING VIRTUALLY. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A LEGAL PROXY FROM THAT INTERMEDIARY.

The Notice of Meeting will be mailed to you on or around August 25, 2023.

The directors of the Corporation have established August 18, 2023 as the record date (the “Record Date”) for the purpose of determining the Corporation’s shareholders which are entitled to receive notice of and to vote at the Meeting.

Shareholders who hold Class A common shares of the Corporation (the “Common Shares”) directly on the Record Date must vote via the internet at www.investorvote.com or telephone, return a proxy card by mail or attend the Meeting in person virtually in order to vote on the proposals. Shareholders who hold Common Shares indirectly on the Record Date through a brokerage firm, bank or other agent must return a voting instruction form to have their shares voted on their behalf. Brokerage firms, banks or other financial institutions that do not receive voting instructions from beneficial holders may, unless prohibited by each brokerage firm’s, bank’s or other financial institution’s internal policies, either vote these shares on behalf of the non-registered shareholders on certain “routine” matters or return a proxy leaving these shares un-voted, which is referred to as a “broker non-vote”.

A proxy can be submitted to Computershare Investor Services Inc. (“Computershare”) either in person, or by mail or courier, to 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, or via the internet at service@computershare.com. The proxy must be deposited with Computershare by no later than 5:00 p.m. Eastern Time on October 5, 2023, or if the Meeting is adjourned or postponed, not less than 48 hours, excluding Saturdays, Sundays and statutory holidays, before the commencement of such adjourned or postponed Meeting. If a shareholder who has submitted a proxy attends the Meeting via the webcast and has accepted the terms and conditions when entering the Meeting online, any votes cast by such shareholder on a ballot will be counted and the submitted proxy will be disregarded. Your shares will be voted in accordance with your instructions as indicated on the form of proxy, or if a form of proxy is returned without instructions, in the manner set forth in the Proxy Statement.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

of Shareholders to be held on October 10, 2023.

The Corporation’s Notice of 2023 Annual Meeting of Shareholders, Proxy Statement and Annual Report to Shareholders are available at www.envisionreports.com/acasti2023 in the “Investors” section.

MACROBUTTON DocID \\4143-7635-1561 v8

- 3 -

TABLE OF CONTENTS

GENERAL INFORMATION ABOUT MANAGEMENT INFORMATION CIRCULAR AND PROXY STATEMENT |

4 |

4 |

|

13 |

|

14 |

|

PROPOSAL NO. 2 — APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

20 |

23 |

|

24 |

|

24 |

|

36 |

|

36 |

|

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

37 |

38 |

|

38 |

|

39 |

|

39 |

|

39 |

|

39 |

|

39 |

|

40 |

|

47 |

|

48 |

|

SCHEDULE A – FORM OF PROXY |

A-1 |

MACROBUTTON DocID \\4143-7635-1561 v8

- 4 -

GENERAL INFORMATION ABOUT MANAGEMENT INFORMATION CIRCULAR AND PROXY STATEMENT

The information contained in this management information circular and proxy statement (the “Proxy Statement”) is provided in connection with the solicitation of proxies of the shareholders (the “Shareholders”) of Acasti Pharma Inc. (the “Corporation” or “Acasti”) by the management of the Corporation to be used at the 2023 annual meeting of shareholders of the Corporation (the “Meeting”) to be held virtually, on October 10, 2023 at 1:00 p.m. Eastern Time and any adjournments thereof, for the purposes set forth in the accompanying Notice Regarding the Availability of Proxy Materials (the “Notice of Meeting”). The Meeting will be held online at https://meetnow.global/ MUK6PLU, where you will be able to listen to the Meeting live, submit questions and vote online. To participate in the Meeting, you will need the control number included on your Notice of Meeting, the proxy card or on the instructions that accompanied your proxy materials. There will be no physical location for Shareholders and duly appointed proxyholders to attend. It is expected that the solicitation of proxies will be made primarily by mail. However, directors, officers and employees of the Corporation may also solicit proxies by telephone, fax or email. The cost of solicitation of proxies will be borne by the Corporation. The Corporation will provide copies of its proxy materials to brokerage firms, fiduciaries and custodians for forwarding to non-registered Shareholders who request printed copies of these materials and will reimburse these persons for their costs of forwarding these materials.

The Corporation anticipates that the Notice of Meeting will first be mailed on or about August 25, 2023 to all stockholders entitled to vote at the Meeting and it will post all proxy materials on the website referenced in the Notice of Meeting. The Notice of Meeting instructs you as to how you may access and review important information contained in the proxy materials online. The Notice of Meeting also instructs you on how you may submit your proxy via the internet, or, if you chose to request paper copies of proxy materials, the instructions for how you may submit your proxy can be found on the proxy card, or on the instructions that accompanied your proxy materials. If you receive a Notice of Meeting by mail and would like to receive a printed copy of the Corporation’s proxy materials, you should follow the instructions for requesting such materials included in the Notice of Meeting.

All references to “dollars” or the use of the symbol “$” are to United States dollars and use of the symbol “C$” refers to Canadian dollars.

QUESTIONS ABOUT THE MEETING AND VOTING YOUR SHARES

The Meeting will be hosted online by way of a live webcast beginning at 1:00 p.m. Eastern Time on October 10, 2023. Shareholders will NOT be able to attend the Meeting in person. A summary of the information Shareholders will need to attend the online Meeting is provided below.

How do I participate in the Meeting virtually?

Shareholders and duly appointed proxyholders can attend the Meeting online by going to https://meetnow.global/ MUK6PLU.

It is important that you are connected to the internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting.

Registered Shareholders and duly appointed proxyholders can participate in the Meeting by clicking “I have a login” and entering an assigned username and password before the start of the Meeting.

In order to participate online, Shareholders must have a valid 15-digit control number and proxyholders must have received an email from Computershare Investor Services Inc. (“Computershare”) containing a username. For registered Shareholders, the 15-digit control number located on the form of proxy or in the email notification you received is the username. For duly appointed proxyholders, Computershare will provide the proxyholder with a username after the voting deadline has passed. Voting at the Meeting will only be available for registered Shareholders

MACROBUTTON DocID \\4143-7635-1561 v8

- 5 -

and duly appointed proxyholders. Non-registered Shareholders who have not appointed themselves as proxyholders may attend the Meeting by clicking “I am a guest” and completing the online form.

Shareholders who wish to appoint a third-party proxyholder to represent them at the online Meeting must submit their proxy or voting instruction form (as applicable) prior to registering their proxyholder. Registering the proxyholder is an additional step once a Shareholder has submitted their proxy/voting instruction form. Failure to register a duly appointed proxyholder will result in the proxyholder not receiving a username to participate in the Meeting. To register a proxyholder, Shareholders must visit https://www.computershare.com/acasti by 5:00 p.m. Eastern Time on October 5, 2023 and provide Computershare with their proxyholder’s contact information, so that Computershare may provide the proxyholder with a username via email.

Registered Shareholders that have a 15-digit control number, along with duly appointed proxyholders who were assigned a username by Computershare, will be able to vote and submit questions during the Meeting. To do so, please go to https://meetnow.global/MUK6PLU prior to the start of the Meeting to login. Click on “I have a login” and enter your 15-digit control number or username. Non-registered Shareholders who have not appointed themselves to vote at the Meeting may login as a guest, by clicking on “I am a Guest” and completing the online form. Non-registered Shareholders who do not have a 15-digit control number or username will only be able to attend as a guest, which allows them listen to the Meeting; however, they will not be able to vote or submit questions. Please see the information below for an explanation of why certain Shareholders may not receive a form of proxy.

If you are using a 15-digit control number to login to the online Meeting and you accept the terms and conditions, you will be revoking any and all previously submitted proxies. However, in such a case, you will be provided the opportunity to vote by ballot on the matters put forth at the Meeting. If you DO NOT wish to revoke all previously submitted proxies, DO NOT accept the terms and conditions, in which case you can only enter the Meeting as a guest.

To attend and vote at the virtual Meeting, a United States non-registered beneficial holder who holds Class A common shares of the Corporation (the “Common Shares”) indirectly through a brokerage firm, bank or other agent must first obtain a valid legal proxy from its broker, bank or other agent and then register in advance of the Meeting. Follow the instructions from your broker or bank included with these proxy materials or contact your broker, bank or other agent to request a legal proxy form. After first obtaining a valid legal proxy from your broker, bank or other agent, to then register to attend the Meeting, you must submit a copy of your legal proxy to Computershare. Requests for registration should be directed to Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario, Canada, M5J 2Y1 or service@computershare.com. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. Eastern Time on October 5, 2023. You will receive a confirmation of your registration by email after Computershare receives your registration materials. You may then attend the Meeting and vote your Common Shares at https://meetnow.global/MUK6PLU during the Meeting. Please note that in order to vote you are required to register your appointment as proxyholder at https://www.computershare.com/acasti.

Who can vote at the Meeting?

Shareholders that hold Common Shares of the Corporation as at August 18, 2023 (the “Record Date”) are entitled to attend and vote at the Meeting. Shareholders who wish to be represented by proxy at the Meeting must, to entitle the person appointed by the proxy to attend and vote, deliver their proxies at the place and within the time set forth in this Proxy Statement.

The Corporation’s authorized capital consists of an unlimited number of no par value Common Shares and an unlimited number of no par value Class B, Class C, Class D and Class E preferred shares (collectively the “Preferred Shares”), issuable in one or more series.

As at the Record Date, there were a total of 7,448,033 Common Shares issued and outstanding and no Preferred Shares issued and outstanding. Each Common Share entitles its holder to one vote.

MACROBUTTON DocID \\4143-7635-1561 v8

- 6 -

How do I appoint a third-party proxyholder?

Shareholders who wish to appoint a third-party proxyholder to represent them at the online Meeting must submit their proxy or voting instruction form (if applicable) prior to registering your proxyholder. Registering your proxyholder is an additional step once you have submitted your proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a username to participate in the Meeting. To register a proxyholder, Shareholders must visit https://www.computershare.com/acasti by 5:00 p.m. Eastern Time on October 5, 2023 and provide Computershare with their proxyholder’s contact information, so that Computershare may provide the proxyholder with a username via email.

A proxy can be submitted to Computershare either in person, or by mail or courier, to 100 University Avenue, 8th Floor, Toronto, Ontario, Canada, M5J 2Y1, or via the internet at service@computershare.com. The proxy must be deposited with Computershare by no later than 5:00 p.m. Eastern Time on October 5, 2023, or if the Meeting is adjourned or postponed, not less than 48 hours, excluding Saturdays, Sundays and statutory holidays, before the commencement of such adjourned or postponed Meeting. If a Shareholder who has submitted a proxy attends the Meeting via the webcast and has accepted the terms and conditions when entering the Meeting online, any votes cast by such Shareholder on a ballot at the Meeting will be counted and the previously submitted proxy will be disregarded.

Without a username, proxyholders will not be able to vote at the Meeting.

What is the quorum for the Meeting?

The by-laws of the Corporation and Nasdaq Stock Market (“Nasdaq”) rules applicable to the Corporation require a quorum of Shareholders representing at least 33 1⁄3% of the Common Shares outstanding on the Record Date to conduct business at the Meeting.

What is the difference between registered and non-registered (beneficial) Shareholders?

The voting process is different depending on whether you are a registered or non-registered (i.e., beneficial) Shareholder:

You are a registered Shareholder if your name appears on your share certificate or in the registers of the Corporation maintained by Computershare. Your proxy form tells you whether you are a registered Shareholder. The Corporation will mail copies of the Notice of Meeting directly to registered Shareholders. The Notice of Meeting instructs you as to how you may access and review important information contained in the proxy materials, including the Proxy Statement, form of proxy and annual report online.

Only registered Shareholders or the persons they appoint as their proxies are permitted to vote at the Meeting.

In many cases, Common Shares beneficially owned by a non-registered Shareholder are registered either:

MACROBUTTON DocID \\4143-7635-1561 v8

- 7 -

The Corporation will provide copies of its proxy materials to such intermediaries for forwarding to non-registered Shareholders who request printed copies of these proxy materials and will reimburse these persons for their costs of forwarding these proxy materials.

Intermediaries are required to forward the Notice of Meeting to non-registered Shareholders, and often use a service provider for this purpose. Non-registered Shareholders will either:

Under applicable securities laws, a beneficial owner is an “objecting beneficial owner” (or “OBO”) if such beneficial owner has or is deemed to have provided instructions to the intermediary holding the securities on such beneficial owner’s behalf objecting to the intermediary disclosing ownership information about the beneficial owner in accordance with such laws. If you are an OBO, you received these materials from your intermediary, or its agent and your intermediary is required to seek your instructions as to how to vote your Common Shares. The Corporation has agreed to pay for intermediaries to deliver to OBOs the Notice of Proxy and, if so requested, the proxy materials and the relevant voting instruction form. The voting instruction form that is sent to an OBO by the intermediary or its agent should contain an explanation as to how you can exercise your voting rights, including how to attend and vote directly at the Meeting. Please provide your voting instructions to your intermediary as specified in the voting instruction form.

In either case, the purpose of these procedures is to permit non-registered Shareholders to direct the voting of the Common Shares they beneficially own.

If you are a non-registered Shareholder who receives a voting instruction form and who wishes to vote at the Meeting (or have another person attend and vote on your behalf), you should print your name, or that of such other person, on the voting instruction form and return it to the intermediary or its service provider. If you are a non-registered Shareholder who receives a proxy form and who wishes to vote at the Meeting (or have another person attend and vote on your behalf), you should strike out the names of the persons set out in the proxy form and write your name or the name of such other person in the blank space provided and submit it to Computershare at the address set out at (b) above.

In all cases, non-registered Shareholders should carefully follow the instructions of their intermediary, including those regarding when, where and by what means the voting instruction form or proxy form must be delivered.

MACROBUTTON DocID \\4143-7635-1561 v8

- 8 -

A non-registered Shareholder may revoke voting instructions which have been given to an intermediary at any time by written notice to the intermediary.

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

The Corporation has elected to provide access to its proxy materials on the internet. Accordingly, the Corporation is sending the Notice of Meeting to its Shareholders. All Shareholders will have the ability to access the proxy materials on the website referred to in the Notice of Meeting or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials on the internet or to request a printed copy may be found in the Notice of Meeting. In addition, Shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Corporation encourages Shareholders to take advantage of the availability of the proxy materials on the internet to help reduce the environmental impact of the Meeting.

How do I vote?

A registered Shareholder or a non-registered Shareholder who has appointed themselves or a third-party proxyholder to represent them at the Meeting will appear on a list of Shareholders prepared by Computershare, the Corporation’s transfer agent and registrar, for the Meeting. To have their Common Shares voted at the Meeting, each registered Shareholder or proxyholder will be required to enter their control number or username provided by Computershare at https://meetnow.global/MUK6PLU prior to the start of the Meeting. In order to vote, non-registered Shareholders who appoint themselves as a proxyholder must first register with Computershare at https://www.computershare.com/acasti after submitting their voting instruction form in order to receive a username.

Most non-registered Shareholders who have not waived the right to receive proxy materials will receive a voting instruction form. Registered Shareholders will, and some non-registered Shareholders may, receive a form of proxy. Shareholders should follow the procedures set out below, depending on what type of form they receive.

If you are a non-registered Shareholder who wishes to attend and vote at the Meeting (or wishes to have another person attend and vote on your behalf), you must complete, sign and return the voting instruction form in accordance with the directions provided and a form of proxy giving the right to attend and vote will be forwarded to you.

Or

Less frequently, a non-registered Shareholder will receive, as part of the proxy materials, a form of proxy that has already been signed by the intermediary (typically by a facsimile or stamped signature), which is restricted as to the number of Common Shares beneficially owned by the non-registered Shareholder but which is otherwise uncompleted. In such a case, if you are a non-registered Shareholder and do not wish to attend and vote at the Meeting (or wish to have another person attend and vote on your behalf), you must complete the form of proxy and deposit it with Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Canada, M5J 2Y1. If you are a non-registered Shareholder and you wish to attend and vote at the Meeting (or wish to have another person attend and vote on your behalf), you must strike out the names of the persons named in the proxy and insert your (or such other person’s) name in the blank space provided.

To attend and vote at the virtual Meeting, a United States non-registered beneficial holder who holds Common Shares indirectly through a brokerage firm, bank or other agent must first obtain a valid legal proxy from your broker, bank

MACROBUTTON DocID \\4143-7635-1561 v8

- 9 -

or other agent and then register in advance to attend the Meeting. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a legal proxy form. After first obtaining a valid legal proxy from your broker, bank or other agent, to then register to attend the Meeting, you must submit a copy of your legal proxy to Computershare. Requests for registration should be directed to Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario, Canada, M5J 2Y1 or service@computershare.com. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. Eastern Time on October 5, 2023. You will receive a confirmation of your registration by email after Computershare receives your registration materials. You may attend the Meeting and vote your shares at https://meetnow.global/MUK6PLU during the Meeting. Please note that you are required to register your appointment as proxyholder at https://www.computershare.com/acasti.

Shareholders should follow the instructions on the forms they receive, and non-registered Shareholders should contact their intermediaries promptly if they need assistance.

The Notice of Meeting is being sent and the proxy materials are being made available to both registered and non-registered owners of Common Shares. The Corporation is sending the Notice of Meeting indirectly to non-objecting beneficial owners (as defined in National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”)). The Corporation intends to pay for intermediaries to forward the Notice of Meeting to objecting beneficial owners (as defined in NI 54-101).

To request a printed copy of the proxy materials, please contact your intermediary, if you are a non-registered Shareholder, or if you are a registered Shareholder, contact Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario, Canada, M5J 2Y1.

The following items of business will be covered at the Meeting:

As of the date of this Proxy Statement, management of the Corporation is not aware of any such other business.

The board of directors of the Corporation (the “Board”) recommends a vote:

MACROBUTTON DocID \\4143-7635-1561 v8

- 10 -

You may select “For” or “Withhold” with respect to each nominee for director under Proposal 1. Under the Corporation’s Majority Voting Policy (as defined below under Proposal 1: Election of Directors), if the votes in favor of the election of a director nominee represent less than a majority of the Common Shares voted and withheld, the nominee will submit his or her resignation promptly after the Meeting for the consideration of the Board. After reviewing the matter, the Board’s decision as to whether to accept or reject the resignation offer will be disclosed to the public within 90 days of the Meeting. The Board has the discretion to accept or reject a resignation. The nominee will not participate in any Board deliberations on the resignation offer. The policy does not apply in circumstances involving contested elections.

You may select “For,” “Against” or “Abstain” with respect to Proposal 2. The affirmative vote of a majority of the votes cast at the Meeting is required for the approval for Ernst & Young LLP as the Corporation’s independent registered public accounting firm until the close of the next annual meeting of Shareholders and to authorize the Board to fix such auditor’s remuneration.

You may select “For”, “Against” or “Abstain” with respect to Proposal 3. The affirmative vote of a majority of the votes cast at the Meeting is required for the approval, on an advisory (non-binding) basis, of the compensation of the named executive officers, as disclosed in this Proxy Statement. The results of the vote on the proposal are not binding on the Board.

A Shareholder who has given a proxy may revoke it, as to any proposal on which a vote has not already been cast pursuant to the authority conferred by it, by an instrument in writing executed by the Shareholder or by the Shareholder’s attorney authorized in writing or, if the Shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized. The revocation of a proxy, in order to be acted upon, must be deposited with Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario, Canada, M5J 2Y1 at any time but no less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the day of the Meeting, or any adjournment thereof at which the proxy is to be used, or, by a registered Shareholder, with the Secretary or the Chair of the Meeting on the day of the Meeting or any adjournment thereof, or in any other manner permitted by law.

In addition, a proxy may be revoked by the Shareholder by submitting a new vote on the internet, by telephone, by attending and voting at the Meeting (note that simply attending the Meeting will not, by itself, revoke your proxy) or executing another form of proxy bearing a later date and depositing same at the offices of Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario, Canada, M5J 2Y1 no less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the day of the Meeting or, by a registered Shareholder, with the Secretary or the Chair of the Meeting at the time and place of the Meeting or any adjournment thereof or by the Shareholder personally attending the Meeting and voting his or her shares.

The persons named in the enclosed form of proxy are directors or officers of the Corporation. Each Shareholder who is entitled to vote at the Meeting is entitled to appoint a person, who need not be a Shareholder, to represent him or her at the Meeting other than those whose names are printed on the accompanying form of proxy by inserting such other person’s name in the blank space provided in the form of proxy and signing the form of proxy or by completing and signing another proper form of proxy. To be valid, the duly completed form of proxy must be deposited at the offices of Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario, Canada, M5J 2Y1 no less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the day of the Meeting or, by a

MACROBUTTON DocID \\4143-7635-1561 v8

- 11 -

registered Shareholder, with the Secretary or the Chair of the Meeting at the time and place of the Meeting or any adjournment thereof. The instrument appointing a proxyholder must be executed by the Shareholder or by his attorney authorized in writing or, if the Shareholder is a corporate body, by its authorized officer or officers.

All Common Shares represented at the Meeting by properly executed proxies will be voted, and where a choice with respect to any matter to be acted upon has been specified in the instrument of proxy, the Common Shares represented by the proxy will be voted, in accordance with such specifications. In the absence of any such specifications, the management designees, if named as proxy, will vote FOR all the matters set out herein. Instructions with respect to voting will be respected by the persons designated in the enclosed form of proxy. With respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters that may properly come before the Meeting, such Common Shares will be voted by the persons so designated at their discretion. At this time, management of the Corporation knows of no such amendments, variations or other matters.

This means that you own Common Shares that are registered under different accounts. For example, you may own some Common Shares directly as a registered Shareholder and other Common Shares as a non-registered Shareholder through an intermediary, or you may own Common Shares through more than one such organization. In these situations, you will receive multiple Notices of Meeting. It is necessary for you to complete and return all proxy cards and voting instruction forms in order to vote all of the Common Shares you own. Please make sure you return each proxy card or voting instruction form in the accompanying return envelope. You may also vote by internet, telephone, facsimile or email by following the instructions on your Notice of Meeting.

It is expected that the solicitation of proxies will be made primarily by mail. However, directors, officers and employees of the Corporation may also solicit proxies by telephone, fax or email. The Corporation has retained D.F. King to assist in obtaining proxies from Shareholders for the Meeting. The estimated cost of such services is $10,000, plus out-of-pocket expenses. If you have any questions or need assistance you may contact Zally Ahmadi of D.F. King at (212) 269-5550 or zally.ahmadi@dfking.com. The cost of solicitation of proxies will be borne by the Corporation.

Shareholder proposals intended to be presented in proxy materials pursuant to Rule 14a-8 of the Exchange Act relating to the Corporation’s 2024 annual meeting of Shareholders must be received by the Corporation on or before April 27, 2024 unless the date of the Meeting is changed by more than 30 calendar days from the date of the Meeting, in which case proposals must be received a reasonable time before the Corporation begins to print and mail its proxy materials, and must satisfy the requirements of the proxy rules promulgated by the U.S. Securities and Exchange Commission (“SEC”). For a proposal to be valid, it must comply with both the Business Corporations Act (Québec) (the “QBCA”) and the Exchange Act.

In order for a Shareholder proposal to be eligible for inclusion in the proxy statement for the Corporation’s 2024 annual meeting of Shareholders under the QBCA, the proposal must be in writing, accompanied by the requisite declarations and signed by the submitter and qualified Shareholders who at the time of signing are the registered or non-registered owners of Common Shares that, in the aggregate: (a) constitute at least 1% of the issued Common Shares; or (b) have a fair market value in excess of C$2,000. For the submitter or a qualified Shareholder to be eligible to sign the proposal, that Shareholder must have been the registered or non-registered owner of the Common Shares for an uninterrupted period of at least 6 months before the date the proposal is submitted.

In order for a Shareholder proposal to be eligible for inclusion in the proxy statement for the Corporation’s 2024 annual meeting of Shareholders under the Exchange Act, the Shareholder must submit the proposal in accordance with Rule 14a-8 of the Exchange Act, and the Shareholder must have continuously held at least $2,000 in market value for at least 3 years, $15,000 in market value for at least 2 years, or $25,000 in market value for at least 1 year by the date the Shareholder submits the proposal. In each case, the Shareholder must continue to hold those Common Shares through the date of the Corporation’s 2024 annual meeting of Shareholders.

MACROBUTTON DocID \\4143-7635-1561 v8

- 12 -

A Shareholder may submit a proposal outside the process of Rule 14a-8, which will not be eligible for inclusion in the proxy statement for the Corporation’s 2024 annual meeting of Shareholders. Notice of a proposal submitted outside this process must be given at least 45 days prior to the one-year anniversary of the day of mailing these proxy materials (unless the date of the 2024 annual meeting of Shareholders is changed by more than 30 calendar days from the date of the Meeting, in which case proposals must be received a reasonable time before the meeting). If a Shareholder fails to notify the Corporation of a Shareholder proposal that the Shareholder has not sought to include in the proxy statement by July 11, 2024, management proxyholders will have discretionary authority to vote on the matter, including discretionary authority to vote in opposition to the shareholder’s proposal.

A Shareholder wishing to nominate an individual to be a director, other than pursuant to a requisition of a meeting made pursuant to the QBCA or a Shareholder proposal made pursuant to the QBCA and Exchange Act proxy access provisions described above, is required to comply with the Corporation’s advance notice bylaw (the “Advance Notice Bylaw”). The Advance Notice Bylaw provides, inter alia, that proper written notice of any such director nomination (the “Nomination Notice”) for an annual general meeting of Shareholders must be provided to the Chief Executive Officer of the Corporation not less than 30 days nor more than 65 days prior to the date of the annual general meeting of Shareholders; provided, however, that if the annual general meeting of Shareholders is to be held on a date that is less than 50 days after the date (the “Notice Date”) on which the first public announcement of the date of the annual general meeting was made, the Nomination Notice must be provided no later than the close of business on the 10th day following the Notice Date. The foregoing is merely a summary of provisions contained in the Advance Notice Bylaw and is qualified by the full text of the Advance Notice Bylaw provisions. The full text is set out in the Advance Notice Bylaw, a copy of which is filed under the Corporation’s profile at www.sedar.com or www.sec.gov.

To comply with the universal proxy rules, Shareholders who intend to solicit proxies in support of director nominees other than the Corporation’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than August 11, 2024, provided that if the date of the 2024 annual meeting of Shareholders has changed by more than 30 calendar days from the date of the Meeting, then notice must be provided by the later of 60 calendar days prior to the date of the 2024 annual meeting of Shareholders or the 10th calendar day following the day on which public announcement of the date of the 2024 annual meeting of Shareholders is first made by the Corporation.

If there are any amendments or variations in any of the proposals shown in the Proxy Statement, or any other matters which may properly come before the Meeting, Common Shares will be voted by the appointed proxyholder as he or she in their sole discretion sees fit.

As of the date of this Proxy Statement, the Board is not aware of any such amendments, variations or other matters to come before the Meeting. However, if any such changes that are not currently known to the Board should properly come before the Meeting, the Common Shares represented by your proxyholders will be voted in accordance with the best judgment of your proxyholders.

The Corporation currently expects that Computershare will tabulate the votes and serve as inspector of elections for the Meeting.

Preliminary voting results will be announced at the Meeting. Final voting results will be filed with the Canadian provincial securities regulatory authorities on SEDAR at www.sedar.com and will also be published in a Current Report on Form 8-K filed with the SEC on EDGAR at www.sec.gov within 4 business days of the Meeting.

MACROBUTTON DocID \\4143-7635-1561 v8

- 13 -

If you have any questions or require assistance in voting your Common Shares, please contact Tiffany Smith, Senior Director of Finance, at email: t.smith@acasti.com or telephone: (215) 219-5578 or Zally Ahmadi of D.F. King at (212) 269-5553 or zally.ahmadi@dfking.com.

Who may adjourn the Meeting?

The Meeting may be adjourned to any other time and any other place by Chair of the Meeting with the consent of the Shareholders present or represented at the Meeting and entitled to vote even when such Shareholders do not constitute a quorum. The Chair of the Meeting may also adjourn the meeting ex officio if he or she believes it is impossible to conduct the Meeting in an orderly manner.

PRESENTATION OF FINANCIAL STATEMENTS

The annual audited financial statements for the Corporation’s fiscal year ended March 31, 2023 (“Fiscal 2023”) and the report of the auditors thereon (the “Financial Report”) will be placed before the Meeting. The Financial Report was mailed to Shareholders who requested a copy and is also available as part of the Corporation’s annual report on Form 10-K for Fiscal 2023, which can be found on SEC’s EDGAR website at www.sec.gov and SEDAR at www.sedar.com and the Corporation’s website at www.acasti.com.

MACROBUTTON DocID \\4143-7635-1561 v8

- 14 -

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

The Corporation’s articles of incorporation currently provide that the Board may consist of a maximum of ten directors. The Board has determined to nominate each of the 5 persons listed below for election as a director at the Meeting, each of whom has indicated their willingness to serve if elected. The Board is currently composed of 3 directors.

The persons named in the enclosed form of proxy intend to vote for the election of the four nominees whose names are set forth below, unless otherwise instructed. Management does not contemplate that any such nominees will be unable to serve as a director of the Corporation. However, if, for any reason, any of the proposed nominees do not stand for election or are unable to serve as such, proxies in favor of management designees will be voted for another nominee at their discretion unless the Shareholder has specified in the Shareholder’s proxy that the Shareholder’s Common Shares are to be withheld from voting in the election of directors.

The directors are appointed at each annual meeting of the Shareholders to hold office for a term expiring at the close of the next annual meeting or until their respective successors are elected or appointed and will be eligible for re-election. A director appointed by the Board between meetings of Shareholders or to fill a vacancy will be appointed for a term expiring at the conclusion of the next annual Shareholders’ meeting or until his or her successor is elected or appointed and will be eligible for election or re-election.

The Board adopted a policy that entitles each Shareholder to vote for each nominee on an individual basis (the “Majority Voting Policy”). The Majority Voting Policy also stipulates that if the votes in favor of the election of a director represent less than a majority of the Common Shares voted and withheld, the nominee will submit his or her resignation promptly after the Meeting for the consideration of the Board. After reviewing the matter, the Board’s decision whether to accept or reject the resignation offer will be disclosed to the public within 90 days of the Meeting. The Board has discretion to accept or reject a resignation. The nominee will not participate in any Board deliberations on the resignation offer. The Majority Voting Policy does not apply in circumstances involving contested elections.

The following table sets out the name and the province or state and country of residence of each of the persons proposed for election as directors, age, all other positions and offices with the Corporation held by such person, and the year in which the person became a director of the Corporation. Current directors Donald Olds and Michael Derby are not standing for re-election at the Meeting.

Name, province or state, as the case may be, |

Age |

Title |

First year as director |

Vimal Kavuru |

54 |

Corporate Director and Chair of the Board |

2021 |

|

A. Brian Davis Pennsylvania, United States |

56 |

-- |

-- |

|

S. George Kottayil New Jersey, United States |

60 |

-- |

-- |

Prashant Kohli |

51 |

CEO of the Corporation |

-- |

Edward Neugeboren |

54 |

-- |

-- |

MACROBUTTON DocID \\4143-7635-1561 v8

- 15 -

The Audit Committee of the Board (the “Audit Committee”) is currently composed of Mr. Olds, as Chair, Mr. Kavuru and Mr. Derby. Mr. Kavuru replaced John Canan on the Audit Committee following Mr. Canan's resignation from the Board on March 30, 2023. The Governance and Human Resources Committee of the Board (the “GHR Committee”) is currently composed of Mr. Olds, as Chair, Mr. Kavuru and Mr. Derby. Mr. Kavuru replaced John Canan on the GHR Committee following Mr. Canan's resignation from the Board on March 30, 2023. Mr. Olds and Mr. Derby are not standing for re-election at the Meeting, and their respective Audit Committee and GHR Committee seats are expected to be filled by Mr. Davis and Mr. Neugeboren, respectively, upon conclusion of the Meeting if they are elected.

The following is a brief biography of the Corporation’s current directors, director nominees and the current executive officers of the Corporation:

Vimal Kavuru – Director Nominee and Chair of the Board. Mr. Kavuru, 54, has served as a director of the Corporation since August 2021. He has created and led several pharmaceutical companies. Mr. Kavuru brings, in his vision and management, a broad-based understanding of the global pharmaceutical industry with expertise in strategic planning, product and business development, and operations. In addition to previously serving as the Chairman of the Grace Therapeutics Inc. (“Grace Therapeutics”) board of directors, Mr. Kavuru is the Founder, Chairman and Chief Executive Officer of Rising Pharma Holdings, Inc., a U.S. generic pharmaceutical company, and Acetris Pharma Holdings, LLC, a generic pharmaceutical company serving U.S. government agencies, positions Mr. Kavuru has held since January 2013 and January 2016, respectively. Previously, Mr. Kavuru founded Citron Pharma and Lucid Pharma, each of which were sold to Aceto Corporation in 2016, Casper Pharma LLC, an emerging specialty brand pharmaceutical company, and Gen-Source RX, a national distributor of generic pharmaceuticals that was acquired by Cardinal Health in 2014. In 2007, Mr. Kavuru also co-founded Celon Labs, a specialty oncology and critical care pharmaceutical company that was acquired by Zanzibar Pharma Limited, a portfolio company of CDC Group. Mr. Kavuru was initially elected to the Board as a nominee of former shareholders of Grace Therapeutics in connection with the Corporation’s acquisition of Grace Therapeutics. He is a registered pharmacist in the state of New York, holds a B.S. in Pharmacy from HKE College of Pharmacy, Bulgarga, India, and attended Long Island University, Brooklyn, New York with specialization in industrial pharmacy. The Board believes that Mr. Kavuru’s management experience in the pharmaceutical industry, as well as his operational expertise, qualify him to serve on the Board.

Donald Olds – Current Director. Mr. Olds, 63, has served as a director of the Corporation since April 2018. Until his retirement in May 2019, Mr. Olds was the President and Chief Executive Officer of the NEOMED Institute, a research and development organization dedicated to advancing Canadian research discoveries to commercial success. Prior to NEOMED, from January 2014 to December 2016 he was the Chief Operating Officer of Telesta Therapeutics Inc., a TSX-listed biotechnology company, where he was responsible for finance and investor relations, manufacturing operations, business development, human resources, and strategy. In 2016, he led the successful sale of Telesta to a larger public biotechnology company. Prior to Telesta, he was President and Chief Executive Officer of Presagia Corp., and Chief Financial Officer and Chief Operating Officer of Aegera Therapeutics Inc., where he was responsible for clinical operations, business development, finance, and mergers and acquisitions. At both Telesta and Aegera, Mr. Olds was responsible for raising equity financing and leading regional and global licensing transactions with life sciences companies. Mr. Olds is currently lead director of Goodfood Market Corp, Chair of Aifred Health, lead director of Cannara Biotech Inc, and director of Presagia Corp. He has extensive past corporate governance experience serving on the boards of private and public for-profit and not-for-profit organizations. He holds an M.B.A. (Finance & Strategy) and M.Sc. (Renewable Resources) from McGill University. Mr. Olds is not standing for re-election at the Meeting.

Michael L. Derby – Current Director. Mr. Derby, 50, has served as a director of the Corporation since March 2022. He has more than two decades of experience and a proven track record within the biopharmaceutical industry, with particular expertise in strategic drug repurposing. Having founded or co-founded seven biopharmaceutical companies, he most recently launched TardiMed Sciences LLC, a company creation and investment firm in the life sciences, in January 2019. TardiMed has formed, capitalized and advanced multiple biopharmaceutical companies through development, including Timber Pharmaceuticals, Inc. (NYSE: TMBR), PaxMedica, Inc. (NASDAQ: PXMD), and Visiox Pharmaceuticals, Inc. Mr. Derby has served as Executive Chairman of the board of directors for each of these companies. Prior to TardiMed, in July 2015 Mr. Derby co-founded Castle Creek Pharmaceuticals, which he built into

MACROBUTTON DocID \\4143-7635-1561 v8

- 16 -

a multi-product, late clinical stage company focused on treating rare and debilitating dermatologic conditions. He also founded Norphan Pharmaceuticals, a biopharmaceutical company focused on the development of drugs for orphan neurologic disease, which he led through its early stages prior to selling the company to Marathon Pharmaceuticals LLC in 2013. Prior to founding and managing life sciences companies, Mr. Derby was a private equity investor and venture capitalist, and worked in management roles at Merck & Co. and Forest Laboratories Inc. Mr. Derby holds an M.B.A. from New York University’s Stern School of Business, a M.S. from the University of Rochester, and a B.S. from Johns Hopkins University. Mr. Derby is not standing for re-election at the Meeting.

A. Brian Davis – Director Nominee. Mr. Davis, 56, has nearly three decades of experience as a Chief Financial Officer and other executive financial positions in commercial and development-stage publicly traded life science companies. Mr. Davis has extensive knowledge and background related to public company accounting and financial reporting rules and regulations as well as the evaluation of financial results, internal controls and business processes. Since December 2021, Mr. Davis has been the Chief Financial Officer of XyloCor Therapeutics, Inc., a clinical-stage gene therapy company developing potential therapies for patients with cardiovascular disease. Mr. Davis was the Chief Financial Officer of Verrica Pharmaceuticals Inc., a publicly traded, NDA-stage dermatology therapeutics company, from October 2019 to July 2021. Prior to joining Verrica, Mr. Davis was the Chief Financial Officer of Strongbridge Biopharma plc, a public commercial-stage biopharmaceutical company, from March 2015 to September 2019. Mr. Davis was previously the Chief Financial Officer at Tengion, Inc., a publicly traded regenerative medicine company until Tengion, Inc. filed for bankruptcy in December 2014, and Neose Technologies, Inc., a publicly traded biopharmaceutical company. Mr. Davis is licensed as a certified public accountant, and received a B.S. in accounting from Trenton State College and an M.B.A. from The Wharton School at the University of Pennsylvania. The Board believes Mr. Davis’ experience serving as the chief financial officer at several other publicly traded biopharmaceutical companies as well as his knowledge and keen understanding of the issues facing biopharmaceutical companies position qualify him to serve on the Board.

S. George Kottayil, Ph.D. – Director Nominee. Dr. Kottayil, 60, has over two decades of experience in the pharmaceutical industry with specific expertise in product development and drug delivery. He has several approved patents to his credit and is an inventor on multiple US FDA approved drug products, a few that have achieved significant success. He co-founded two pharmaceutical drug development and drug delivery technology companies and was CEO and a member of its board of directors. Most recently, from October 2014, he co-founded and was CEO and Director of Grace Therapeutics Inc., a drug delivery company with a focus on rare and orphan disease which was acquired by Acasti Pharma Inc. in August 2021. Dr. Kottayil served as the Corporation’s Chief Operating Officer from September 2021 to May 2023. Dr. Kottayil has held senior positions in product development, business operations and general management at small to medium life science companies, successfully advancing drug products from bench to FDA approval and launch. He is the principal inventor of SUBSYS® – sublingual fentanyl spray that was approved by the FDA in 2012 for the treatment of breakthrough cancer pain. SUBSYS achieved peak annual sales of about US$200M and is the only product in its space that has shown statistically significant pain relief at 5 minutes (SPID 5). He directed business operations at Unimed Pharmaceuticals Inc., a division of Solvay Pharmaceuticals, now Abbvie. He played a key role in product development and obtaining FDA approval for the company’s NDA products most notably ANDROGEL®. ANDROGEL was the market leader in male hormone replacement therapy for well over a decade with peak annual revenues exceeding US$1 billion. ANDROGEL when launched in 2000 redefined the male hormone replacement therapy market which until then was well below US$50 million and was primarily served by ANDRODERM® patch and deep intra-muscular injections. He was instrumental in formulating and executing the strategy that resulted in the down-scheduling (CII to CIII – a first in the prescription drug industry) of the controlled prescription drug MARINOL® by the US DEA. MARINOL® was approved by the FDA for antiemesis in cancer chemotherapy and AIDS related wasting. It achieved peak annual sales of over US$200M post re-scheduling by the FDA and DEA. Dr. Kottayil graduated with a Ph.D. in Organic and Medicinal Chemistry from the University of Kentucky. The Board believes that Dr. Kottayil’s extensive industry and management experience, including his in-depth knowledge and leadership in successfully executing multiple pharmaceutical and clinical drug development programs that resulted in securing US FDA approval, qualify him to serve on the Board.

Prashant Kohli – Chief Executive Officer and Director Nominee. Prashant Kohli, 51, has served as the Corporation’s Chief Executive Officer since April 2023. He has over 20 years of commercialization experience leading strategy, sales, marketing, and product management. Prior to joining Acasti in August 2021, Mr. Kohli was VP, Commercial Operations of Grace Therapeutics since December 2017. He has expertise crafting go-to-market plans for products

MACROBUTTON DocID \\4143-7635-1561 v8

- 17 -

with unique value proposition that address critical unmet needs. He has built, deployed, and led sales and marketing from the ground-up with significant experience in organization design, recruiting, performance management, incentive compensation, and P&L accountability. He has successfully implemented evidence-based, consultative-selling model that is rooted in deep understanding of the health ecosystem including patients, providers, health systems, government, and payers. He has also designed strategic marketing plans that generate leads and increase share-of-voice, augmenting the salesforce with digital tactics that increase reach and frequency. He has extensive commercial experience with specialty and small molecule drugs including in rare and orphan diseases. Mr. Kohli has worked at Archi-Tech Systems, Cardinal Health, IMS Health, Rosenbluth, and Dun & Bradstreet. He has a BA in Computer Science and Math from Augustana College and an MBA from The Wharton School. The Board believes that Mr. Kohli’s extensive industry and management experience, including his experience as Chief Executive Officer of the Corporation, qualify him to serve on the Board.

Edward Neugeboren – Director Nominee. Mr. Neugeboren, 54, has over three decades of healthcare experience in pharmaceutical operations, business development, corporate management, investment banking, asset management and institutional equity research. Since January of 2016, Mr. Neugeboren has served as the Chief Strategy Officer of Cronus Pharma, LLC, a fully integrated R&D, manufacturing and sales & marketing pharmaceutical company and at which Mr. Kavuru is a principal. Mr. Neugebroren leads Cronus Pharma’s commercial operations, strategic planning and acquisitions and is also responsible for developing and executing overall corporate strategy as well as corporate and portfolio acquisitions and licensing. Previously, Mr. Neugeboren was the Chief Strategy Officer for the parent pharmaceutical group comprised of Rising Pharma Holdings, Inc., a generic pharmaceutical company and Casper Pharma, LLC, a specialty pharmaceutical company. Additionally, Mr. Neugeboren is Founder and Managing Partner of QuadView Healthcare Advisors, previously named ArcLight Advisors, LLC, a healthcare investment banking and business development firm. Mr. Neugeboren was previously a Managing Director of Ledgemont Capital Group, LLC, an investment banking firm providing strategic and financial advisory services to emerging healthcare and technology companies. Mr. Neugeboren was also a Managing Partner of Third Ridge Capital Management, LLC, a long/short U.S. equity hedge fund. Mr. Neugeboren was a managing member of Ledgemont Capital Group, LLC when it filed for voluntary bankruptcy in May 2013. Mr. Neugeboren holds Series 24, 7 and 63 Finra security licenses and has graduated with a BA in Economics from Union College. The Board believes that Mr. Neugeboren’s extensive healthcare experience in pharmaceutical operations, including his experience as Chief Strategy Officer of Cronus Pharma, LLC, qualify him to serve on the Board.

Brian Ford – Interim Chief Financial Officer. Mr. Ford, 65, served as the Corporation’s Chief Financial Officer from September 2020 to May 2023. Effective May 8, 2023, Mr. Ford’s employment as the Corporation’s Chief Financial Officer was terminated. Mr. Ford currently serves as the Corporation’s Interim Chief Financial Officer under contract with the Corporation. He brings over three decades of financial, project management and M&A experience within the healthcare and financial industries. Mr. Ford is an accomplished CPA-CA having served both publicly traded and privately owned organizations. Mr. Ford has been responsible for developing business recovery strategies, negotiating M&A transactions, as well as managing quarterly and yearly accounting reports. Prior to joining the Corporation in September 2020, most recently, Mr. Ford served as Chief Financial Officer and Senior Business Advisor at a private group of Ontario based medical clinics, including the largest chronic pain management practice in Canada from June 2017 to January 2020. Prior to that, from September 2009 to December 2016, Mr. Ford served as Chief Financial Officer at Telesta Therapeutics Inc. At Telesta Therapeutics, Mr. Ford helped develop a new business plan and was heavily involved in all capital transactions. Previously, Mr. Ford started his own consulting firm, Petersford Consulting, where he provided clients with finance and business risk services. Mr. Ford began his career at Ernst & Young in 1982, eventually becoming a Principal, Business Risk Services, developing essential business plans that evaluated revenue and cost profiles supporting budget planning and understanding drivers of growth, specifically with healthcare companies. Additionally, at Ernst & Young, Mr. Ford participated in and often led teams in due diligence assignments in relation to M&A or the sale of a business, having extensive experience in developing financial forecasts, product and market valuation, and audits of critical accounting and processes. Mr. Ford holds a B.A. in Economics, History, and English from the University of Guelph and has a Graduate Diploma in Accounting from the University of McGill. Mr. Ford is a member of the Chartered Professional Accountants of Ontario (CPA Ontario).

Dr. R. Loch Macdonald – Chief Medical Officer. Dr. Macdonald, 61, has served as the Corporation’s Chief Medical Officer since May 2023. Dr. Macdonald is a world-renowned practicing neurosurgeon-scientist and respected

MACROBUTTON DocID \\4143-7635-1561 v8

- 18 -

authority in subarachnoid hemorrhage. Dr. Macdonald acted as Professor, Department of Surgery, Division of Neurosurgery at the University of Toronto from January 2007 until December 2019, and was Head, Division of Neurosurgery, St. Michael's Hospital, University of Toronto from January 2007 until December 2015. He was Professor, Department of Neurological Surgery, Barrow Neurological Surgery, Barrow Neurological Institute, Phoenix, Arizona, from April 2018 until August 2018; Fellow, Department of Neurosurgery, University of Illinois Hospitals in Chicago, Illinois from December 2018 until June 2019; Clinical Professor, Department of Neurological Surgery, University of California Fresno, in Fresno, California from July 2019 until September 2021; and from October 2021 to the present has been Neurosurgeon, Community Physicians Group, Community Neurosciences Institute, Community Regional Medical Center and Medical Director of Neurosciences Research, Community Health Partners. Dr. Macdonald was also a founder of Edge Therapeutics, Inc. in 2009, where he was a member of the board of directors between 2009 and 2018 and was Chief Scientific Officer between 2011 and 2018. Dr. Macdonald completed his medical degree at the University of British Columbia, Vancouver, British Columbia and his PhD in Experimental Surgery at the University of Alberta in Edmonton, Alberta. He completed his Neurosurgery residency at the University of Toronto.

Carrie D’Andrea – VP Clinical Operations. Ms. D’Andrea, 51, has served as the Corporation’s Vice President – Clinical Operations since May 2023. Ms. D’Andrea is a highly experienced professional with 25 years of experience in the pharmaceutical and biotechnology industry who has built and led the planning, implementation, management, and execution of global Phase 2 and Phase 3 trials for a drug candidate for subarachnoid hemorrhage. Ms. D'Andrea was the Vice President of Clinical Operations for Edge Therapeutics Inc. from October 2014 until March 2019 and for EryDel SpA from October 2020 until April 2021. Ms. D’Andrea was a clinical operations consultant at Aegle Research from July 2021-August 2022 and Praxis Precisions Medicines from September 2022-May 2023. Ms. D’Andrea was named a Healthcare Businesswomen’s Association Rising Star in 2009 and Ms. D'Andrea received her master's degree in Pharmaceutical Quality and Regulatory Affairs from Temple University and teaches Clinical Trial Design and Operations at Rutgers University in the Master of Business and Science Program.

Amresh Kumar – VP of Program Management. Mr. Kumar, 43, has served as the Corporation’s Vice President – Program Management since May 2023. Mr. Kumar is an experienced drug development, CMC, and program management expert supporting investigational and marketed products for rare diseases and neurology. Mr. Kumar is the former product leader of GTX-104 while at Grace Therapeutics (which was acquired by the Corporation in August 2021). Mr. Kumar acted as the Sr. Director of Program Management at Foresee Pharmaceuticals Inc. from April 2022 until May 2023 and as Program Leader and Associate Director - R&D at Grace Therapeutics Inc. between March 2015 and January 2022. Mr. Kumar received a PhD in Pharmaceutical Science from Sunrise University, India, focusing on complex injectable drug delivery systems of highly soluble oncology drugs. He has published many research articles and has more than 10 granted patents and many patent applications worldwide to his credit.

To the knowledge of the Corporation, none of the Corporation’s current directors or director nominees are, or have been, as at the date of this Proxy Statement or within the 10 years prior to the date of this Proxy Statement, a director, chief executive officer (“CEO”) or chief financial officer (“CFO”) of any corporation (including the Corporation) that:

MACROBUTTON DocID \\4143-7635-1561 v8

- 19 -

To the knowledge of the Corporation, other than Mr. Davis and Mr. Neugeboren, none of the Corporation’s current directors or director nominees:

To the knowledge of the Corporation, no director or director nominee has been subject to:

Voting for election of directors is by individual voting and not by slate voting. Shareholders do not have the right to cumulative voting in the election of directors. You can vote your Common Shares for the election of all of these nominees as directors of the Corporation; or you can vote for some of these nominees for election as directors and withhold your votes for others; or you can withhold all of the votes attaching to the Common Shares you own and not vote for the election of any of these nominees as directors of the Corporation.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF THE NOMINEES AS DIRECTORS OF THE CORPORATION FOR THE ENSUING YEAR.

The voting rights pertaining to Common Shares represented by duly executed proxies in favor of the persons named in the accompanying form of proxy will be exercised, in the absence of specifications to the contrary, FOR the election of the nominees as directors of the Corporation for the ensuing year.

MACROBUTTON DocID \\4143-7635-1561 v8

- 20 -

PROPOSAL NO. 2 — APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

At the Meeting, Shareholders will be asked to appoint the firm of Ernst & Young LLP as the Corporation’s independent registered public accounting firm until the close of the next annual meeting of Shareholders or until their successor are appointed and to authorize the Board to fix such auditor’s remuneration. Ernst & Young LLP has been acting as auditors for the Corporation since February 22, 2023. Representatives of Ernst & Young LLP are expected to attend the Meeting and be available for questions.

KPMG LLP (“KPMG”) was previously the principal independent accountants for the Corporation. On February 22, 2023, the Audit Committee and Board approved the dismissal of KPMG as the Corporation’s independent registered public accounting firm. The report of KPMG on the consolidated financial statements of the Corporation as of and for the fiscal years ended March 31, 2022 and 2021 did not contain any adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended March 31, 2022 and 2021 and the subsequent interim period through the date of dismissal of KPMG, there were no (1) disagreements between the Corporation and KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements if not resolved to the satisfaction of KPMG, would have caused KPMG to make reference in connection with their opinion to the subject matter of the disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions), or (2) reportable events (as described in Item 304(a)(1)(v) of Regulation S-K).

The Corporation provided KPMG with a copy of the disclosures contained in the Corporation’s Current Report on Form 8-K filed on February 22, 2023 pertaining to KPMG’s dismissal prior to its filing with the SEC and requested KPMG furnish it a letter addressed to the Commission stating whether it agrees with the above statements. A copy of that letter, dated February 22, 2023, is filed as Exhibit 16.1 to the Corporation’s Current Report on Form 8-K filed on February 22, 2023.

On February 22, 2023, in connection with the Corporation’s dismissal of KPMG, the Board approved the engagement of Ernst & Young LLP as its new independent registered public accounting firm to audit the Corporation’s financial statements for Fiscal 2023. The decision to retain Ernst & Young LLP was recommended by the Audit Committee, and approved by the Board, after taking into account the results of a competitive review process and other business factors.

During the fiscal years ended March 31, 2022 and 2021 and the subsequent interim period through February 22, 2023, neither the Corporation nor anyone on its behalf consulted with Ernst & Young LLP regarding (i) the application of accounting principles to a specific transaction, either completed or proposed, (ii) the type of audit opinion that might be rendered on the Corporation’s financial statements and neither a written report nor oral advice was provided to the Corporation that Ernst & Young LLP concluded was an important factor considered by the Corporation in reaching a decision as to accounting, auditing or financial reporting issues, (iii) any matter that was the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions), or (iv) any reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE APPOINTMENT OF ERNST & YOUNG LLP AS THE CORPORATION’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM AND TO AUTHORIZE THE BOARD TO DETERMINE SUCH AUDITOR’S REMUNERATION.

To be adopted, the appointment of Ernst & Young LLP as the Corporation’s independent registered public accounting firm must be approved by at least a majority of the Shareholders present or represented by proxy at the Meeting.

The voting rights pertaining to Common Shares represented by duly executed proxies in favor of the persons named in the accompanying form of proxy will be exercised, in the absence of specifications to the contrary,

MACROBUTTON DocID \\4143-7635-1561 v8

- 21 -

FOR the appointment of Ernst & Young LLP as independent registered public accounting firm for the Corporation and to authorize the Board to determine such auditor’s remuneration.

For the fiscal year ended March 31, 2022 (“Fiscal 2022”) and Fiscal 2023, the Corporation was billed the following fees for audit, audit-related, tax, and all other services provided to the Corporation by KPMG LLP and Ernst & Young LLP, as applicable:

Fees |

Fiscal 2023 |

Fiscal 2022 |

Audit Fees(1) |

C$805,957 |

C$538,400 |

Audit-Related Fees(2) |

C$87,374 |

- |

Tax Fees(3) |

C$87,300 |

C$28,595 |

All Other Fees(4) |

- |

- |

Total Fees Paid |

C$980,632 |

C$566,995 |

Notes:

The Audit Committee approves all audit, audit-related services, tax services and other non-audit related services provided by the external auditors in advance of any engagement. Under the Sarbanes-Oxley Act of 2002, audit committees are permitted to approve certain fees for non-audit related services pursuant to a de minimis exception prior to the completion of an audit engagement. Non-audit related services satisfy the de minimis exception if the following conditions are met:

None of the services described above were approved by the Audit Committee pursuant to the de minimis exception during Fiscal 2023 and Fiscal 2022.

The information contained in the following Audit Committee Report shall not be deemed to be soliciting material or to be filed with the SEC, nor shall such information be incorporated by reference into any future filing under the

MACROBUTTON DocID \\4143-7635-1561 v8

- 22 -

Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Corporation specifically incorporates it by reference in such filing.

This report is furnished by the Audit Committee with respect to the Corporation’s financial statements for Fiscal 2023.

One of the purposes of the Audit Committee is to oversee the Corporation’s accounting and financial reporting processes and the audit of the Corporation’s annual financial statements. The Corporation’s management is responsible for the preparation and presentation of complete and accurate financial statements. The Corporation’s independent registered public accounting firm, Ernst & Young LLP, is responsible for performing an independent audit of the Corporation’s financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and for issuing a report on its audit.

In performing its oversight role, the Audit Committee has reviewed and discussed the Corporation’s audited financial statements for Fiscal 2023 with the Corporation’s management. Management represented to the Audit Committee that the Corporation’s financial statements were prepared in accordance with U.S. generally accepted accounting principles. The Audit Committee has discussed with Ernst & Young LLP the matters required to be discussed under Public Company Accounting Oversight Board standards. The Audit Committee has received the written disclosures and the letter from Ernst & Young LLP required by the applicable requirements of the Public Company Accounting Oversight Board regarding communications with audit committees concerning independence.

The Audit Committee has discussed with Ernst & Young LLP its independence and concluded that Ernst & Young LLP is independent from the Corporation and management.

Based on the review and discussions of the Audit Committee described above, the Audit Committee recommended to the Board that the Corporation’s audited financial statements for Fiscal 2023 be included in the Corporation’s Annual Report on Form 10-K for Fiscal 2023 for filing with the SEC.

Audit Committee

Mr. Donald Olds, as Chair

Mr. Vimal Kavuru

Mr. Michael L. Derby

MACROBUTTON DocID \\4143-7635-1561 v8

- 23 -

PROPOSAL NO. 3 — ADVISORY (NON-BINDING) VOTE ON THE COMPENSATION

OF THE CORPORATION’S NAMED EXECUTIVE OFFICERS

As required by U.S. federal securities laws, including the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Corporation is seeking a vote on an advisory (non-binding) basis to approve the compensation of its named executive officers, as disclosed in this Proxy Statement. This proposal, commonly known as a “say-on-pay” proposal, gives Shareholders the opportunity to endorse or not endorse the Corporation’s executive compensation program and policies. At the 2020 annual meeting of Shareholders, the Board recommended, and the Corporation’s Shareholders approved, holding an advisory vote on the compensation of the Corporation’s named executive officers every year.

As described under “Compensation of Named Executive Officers” below, the Corporation believes that its executive compensation program and policies are designed to support the Corporation’s long-term success by achieving the following objectives:

The Corporation urges Shareholders to read the section entitled “Compensation of Named Executive Officers” and the related narrative and tabular compensation disclosure included in this Proxy Statement. The section entitled “Compensation of Named Executive Officers” provides detailed information regarding the Corporation’s executive compensation program and policies, as well as the compensation of the Corporation’s named executive officers (“NEOs”).

At the Meeting, Shareholders will be asked to consider, and if thought advisable, to approve, on an advisory (non-binding) basis, with or without variation, the following resolution:

“RESOLVED THAT:

To be adopted, the advisory (non-binding) resolution approving the compensation of the named executive officers as disclosed in this Proxy Statement (the “Say-on-Pay Resolution”) must be approved by at least a majority of the Shareholders present or represented by proxy at the Meeting.

THE BOARD BELIEVES THE PASSING OF THE SAY-ON-PAY RESOLUTION IS IN THE BEST INTEREST OF THE CORPORATION AND RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE SAY-ON-PAY RESOLUTION.

The voting rights pertaining to Common Shares represented by duly executed proxies in favor of the persons named in the accompanying form of proxy will be exercised, in the absence of specifications to the contrary, FOR the Say-on-Pay Resolution.

MACROBUTTON DocID \\4143-7635-1561 v8

- 24 -

OTHER MATTERS

Management of the Corporation knows of no other matters to come before the Meeting other than those referred to in the Notice of Meeting. However, if any other matters that are not known to management should properly come before the Meeting, the accompanying form of proxy confers discretionary authority upon the persons named therein to vote on such matters in accordance with their best judgment.

COMPENSATION OF NAMED EXECUTIVE OFFICERS

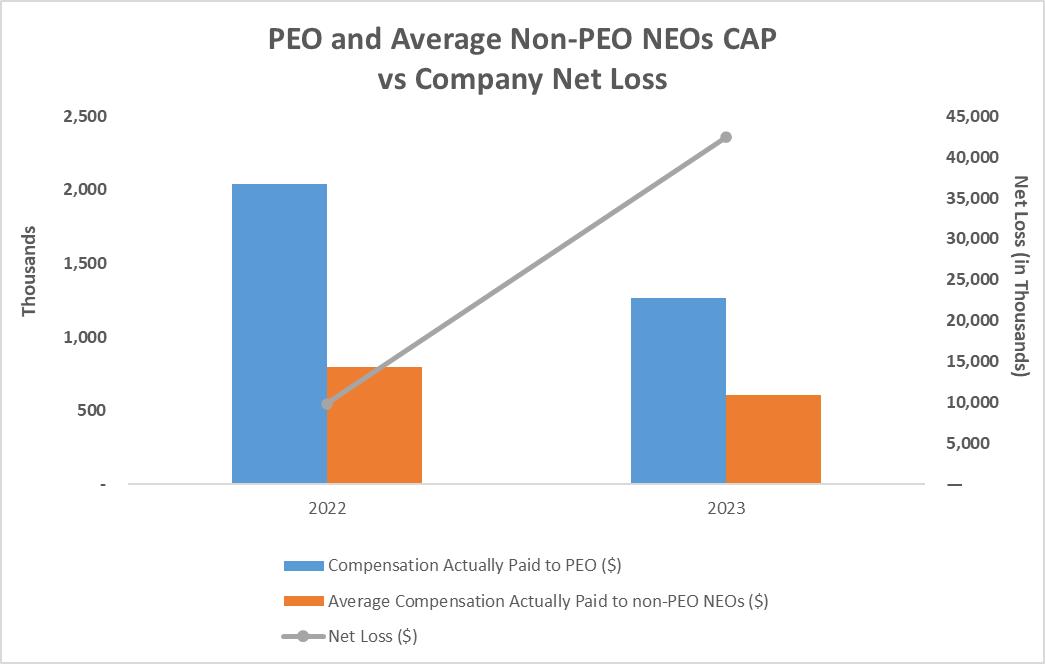

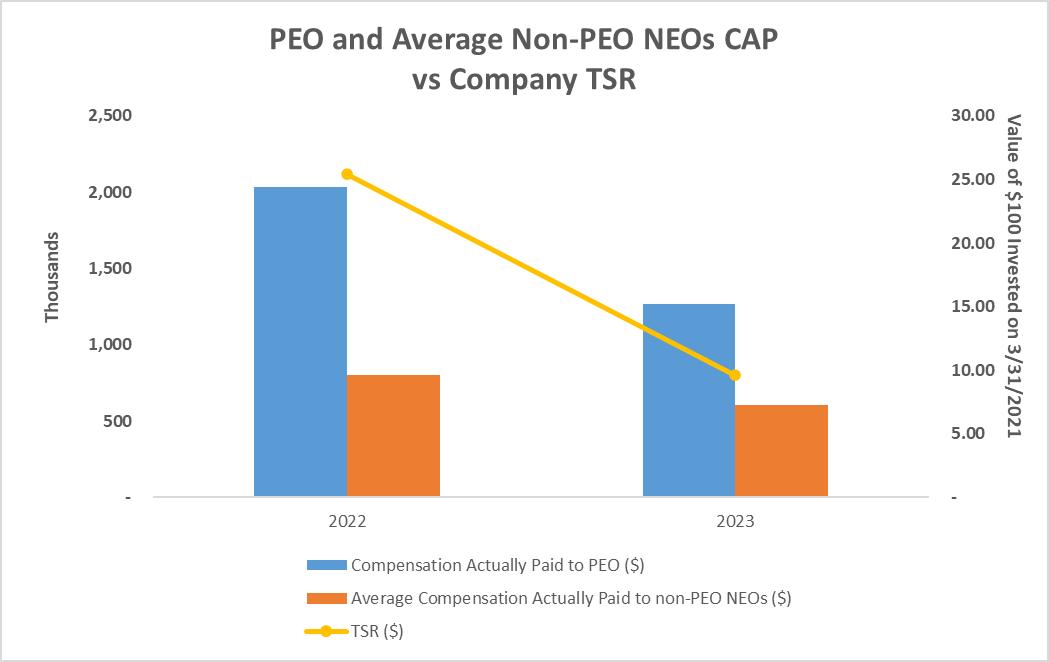

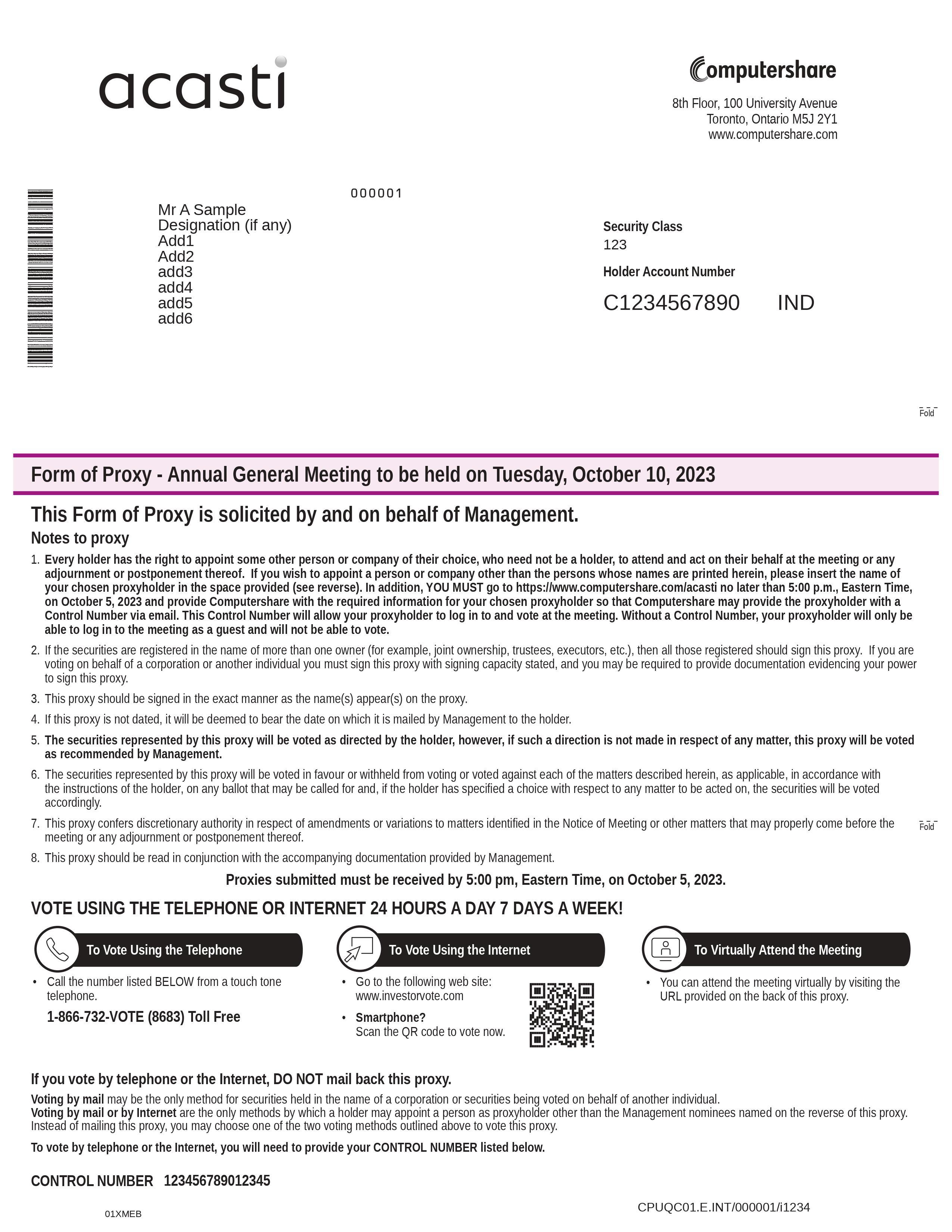

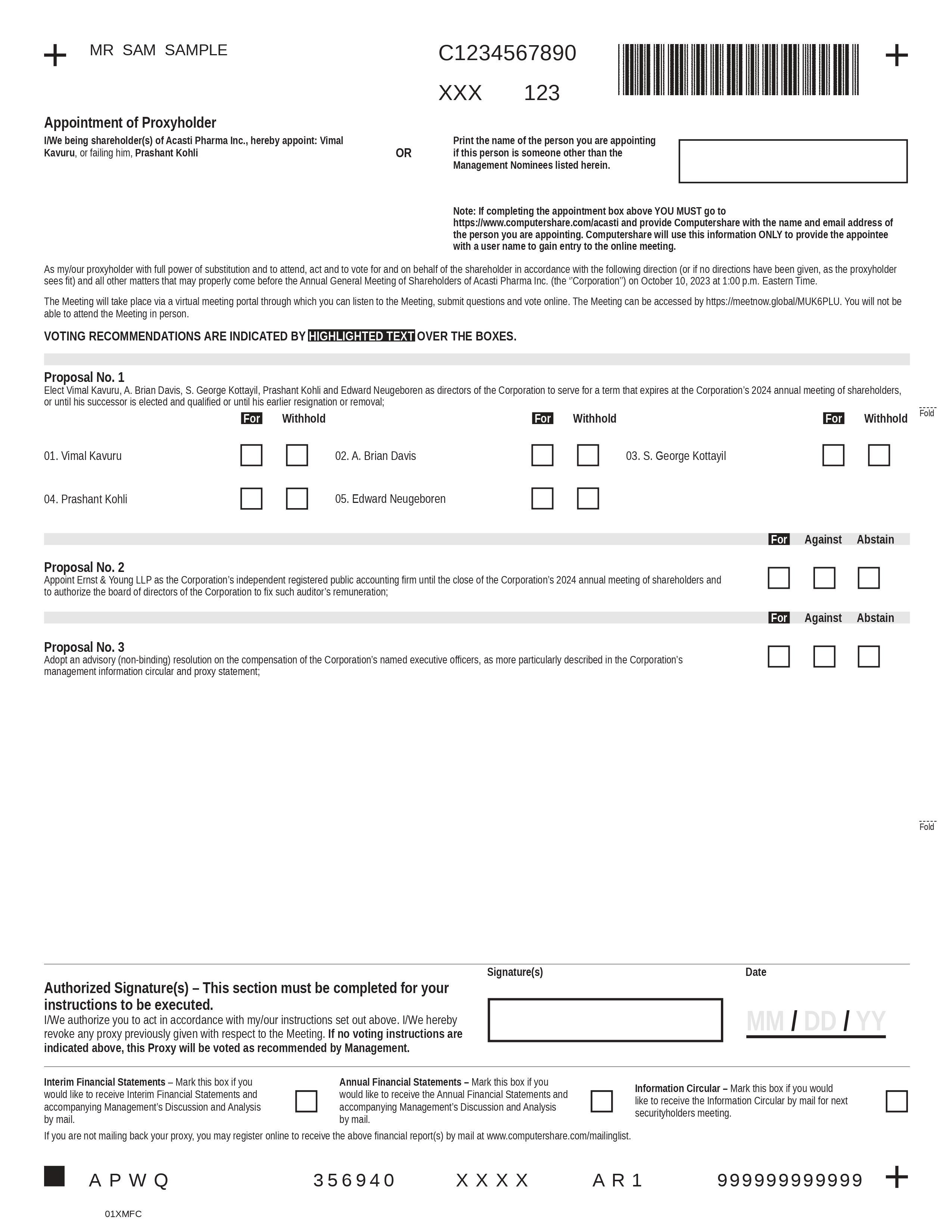

This section describes the compensation program for the Corporation’s NEOs. As a “smaller reporting company”, under SEC rules, the Corporation is not required to include a “Compensation Discussion and Analysis” section. However, in order to provide a greater understanding for Shareholders regarding the Corporation’s compensation policies with respect to NEOs, this Proxy Statement includes the following additional information regarding the compensation of the NEOs.