10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on February 14, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

FORM

______________________________________

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

______________________________________

(Exact name of registrant as specified in its charter)

______________________________________

Québec, |

|

(State or other jurisdiction of |

(I.R.S. Employer |

(Address of principal executive offices, including zip code)

(Registrant’s telephone number, including area code)

______________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

☒ |

|

Smaller reporting company |

|

||

Emerging growth company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes

The number of outstanding common shares of the registrant, no par value per share, as of February 14 2022, was

ACASTI PHARMA INC.

QUARTERLY REPORT ON FORM 10-Q

For the Quarter Ended December 31, 2021

Table of Contents

|

|

Page |

|

||

7 |

||

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

21 |

|

|

|

|

Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

41 |

|

|

|

Item 4. |

Controls and Procedures |

41 |

|

|

|

|

||

42 |

||

|

|

|

42 |

||

|

|

|

60 |

||

|

|

|

60 |

||

|

|

|

60 |

||

|

|

|

60 |

||

|

|

|

61 |

||

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report contains information that may be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws, both of which we refer to in this quarterly report as forward-looking statements. Forward-looking statements can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not statements about the present or historical facts. Forward-looking statements in this quarterly report include, among other things, information or statements about:

Although the forward-looking statements in this quarterly report are based upon what we believe are reasonable assumptions, you should not place undue reliance on those forward-looking statements since actual results may vary materially from them. Important assumptions made by us when making forward-looking statements include, among other things, assumptions by us that:

3

In addition, the forward-looking statements in this quarterly report are subject to a number of known and unknown risks, uncertainties and other factors many of which are beyond our control, that could cause our actual results and developments to differ materially from those that are disclosed in or implied by the forward-looking statements, including, among others:

4

5

All of the forward-looking statements in this quarterly report are qualified by this cautionary statement. There can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the consequences or effects on our business, financial condition, or results of operations that we anticipate. As a result, you should not place undue reliance on the forward-looking statements. Except as required by applicable law, we do not undertake to update or amend any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are made as of the date of this quarterly report.

We express all amounts in this quarterly report in U.S. dollars, except where otherwise indicated. References to “$” and “U.S.$” are to U.S. dollars and references to “C$” or “CAD$” are to Canadian dollars.

Except as otherwise indicated, references in this quarterly report to “Acasti,” “the Corporation,” “we,” “us” and “our” refer to Acasti Pharma Inc. and its consolidated subsidiaries, including Acasti Pharma U.S., which is formerly Grace.

6

PART I. FINANCIAL INFORMATION

Item 1: Financial Information

Unaudited Condensed Consolidated Interim Financial Statements

7

Condensed Consolidated Interim Financial Statements of

(Unaudited)

ACASTI PHARMA INC.

Three and Nine Months ended December 31, 2021 and 2020

8

ACASTI PHARMA INC.

Condensed Consolidated Interim Balance Sheet

(Unaudited)

|

|

|

|

December 31, |

|

|

March 31, |

|

||

(Expressed in thousands of U.S. dollars except share data) |

|

Notes |

|

$ |

|

|

$ |

|

||

Assets |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

|

|

||

Cash and cash equivalents |

|

|

|

|

|

|

|

|

||

Short-term investments |

|

5 |

|

|

|

|

|

|

||

Receivables |

|

|

|

|

|

|

|

|

||

Assets held for sale |

|

7 |

|

|

|

|

|

|

||

Prepaid expenses |

|

|

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Right of Use asset |

|

|

|

|

|

|

|

|

||

Intangible assets |

|

4 |

|

|

|

|

|

|

||

Total assets |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

|

|

||

Trade and other payables |

|

|

|

|

|

|

|

|

||

Lease liability |

|

|

|

|

|

|

|

|

||

Derivative warrant liabilities |

|

8 |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Derivative warrant liabilities |

|

8 |

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Shareholders’ equity: |

|

|

|

|

|

|

|

|

||

Common shares |

|

4,9(a) |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

|

|

||

Accumulated other comprehensive loss |

|

|

|

|

( |

) |

|

|

( |

) |

Accumulated deficit |

|

|

|

|

( |

) |

|

|

( |

) |

Total shareholder’s equity |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

15 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

Total liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

||

See accompanying notes to unaudited Interim financial statements.

9

ACASTI PHARMA INC.

Condensed Consolidated Interim Statements of Loss and Comprehensive Loss

(Unaudited)

Three and Nine Months ended December 31, 2021 and 2020

|

|

|

|

Three-month ended |

|

|

Nine Months ended |

|

||||||||||

|

|

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

||||

(Expressed in thousands of U.S dollars, except per share data) |

|

Notes |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Revenues from product sales |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cost of sales of products |

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

Research and development expenses, net of government assistance |

|

10 |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

General and administrative expenses |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Sales and marketing expenses |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Impairment of intangible assets |

|

6 |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|||

Impairment of equipment |

|

7 |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|||

Impairment of Other asset and prepaid |

|

7 |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||

Loss from operating activities |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Financial income (expenses) |

|

12 |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss and total comprehensive loss |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic and diluted loss per share |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

See accompanying notes to unaudited interim financial statements

10

ACASTI PARMA INC.

Condensed Consolidated Interim Statements of Changes in Shareholder’s Equity

(Unaudited)

Three and Nine Months ended December 31, 2021 and 2020

|

|

|

|

|

Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

(Expressed in thousands of U.S. dollars except share data) |

|

Notes |

|

|

Number |

|

|

Dollar |

|

|

Additional |

|

|

Accumulated |

|

|

Accumulated |

|

|

Total |

|

|||||||

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|||||||

Balance, March 31, 2021 |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

Net loss and total comprehensive loss for the period |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Cumulative translation adjustment |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|||

Stock based compensation |

|

|

13 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Balance at June 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Net income and total comprehensive income for the period |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|||

Cumulative translation adjustment |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Stock based compensation |

|

|

13 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Common shares issued in relation to merger with Grace via share-for-share |

|

|

4 |

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Balance at September 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Net loss and total comprehensive loss for the period |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Cumulative translation adjustment |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|||

Stock based compensation |

|

|

13 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

Fees related to share-for-share issuance for merger with Grace |

|

|

4 |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Balance at December 31, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|||||

|

|

|

|

Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

(Expressed in thousands of US dollars except for share data) |

|

Notes |

|

Number |

|

|

Dollar |

|

|

Additional |

|

|

Accumulated |

|

|

Accumulated |

|

|

Total |

|

||||||

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||||

Balance, March 31, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

Net loss and total comprehensive loss for the period |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Cumulative translation adjustment |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Net proceeds from shares issued under the at-the-market (ATM) program |

|

9(a) |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Stock based compensation |

|

13 |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Balance at June 30, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

Net loss and total comprehensive loss for the period |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Cumulative translation adjustment |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Net proceeds from shares issued under the at-the-market (ATM) program |

|

9(a) |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Stock based compensation |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Balance at September 30, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Net loss and total comprehensive loss for the period |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Cumulative translation adjustment |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Net proceeds from shares issued under the at-the-market (ATM) program |

|

9(a) |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Stock based compensation |

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Balance at December 31, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

11

ACASTI PHARMA INC.

Condensed Consolidated Interim Statements of Cash Flows

(Unaudited)

Three and Nine Months ended December 31, 2021 and 2020

|

|

|

|

Three Months ended |

|

|

Nine Months ended |

|

||||||||||

|

|

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

||||

(thousands of U.S. dollars) |

|

Notes |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Cash flows used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss for the period |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Amortization of intangible assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Depreciation of equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Impairment of intangible assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Impairment of equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Impairment of Other Asset and prepaid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Stock-based compensation |

|

13 |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|||

Change in fair value of warrant liabilities |

|

8 |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Write off of deferred financing costs of at-the-market (ATM) program |

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Unrealized foreign exchange (gain) loss |

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Changes in non-cash working capital items |

|

14 |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Net cash used in operating activities |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash flows from (used in) investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Acquisition of equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|||

Acquisition of short-term investments |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Maturity of short-term investment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net cash from (used in) investing activities |

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash flows from (used in) financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net proceeds from issuance of common shares under the at-the-market (ATM) |

|

9(a) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Deferred financing costs paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|||

Net cash from (used in) financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Effect of exchange rate fluctuations on cash and cash equivalents |

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Translations effects on cash and cash equivalents related to reporting currency |

|

|

|

|

( | ) |

|

|

|

|

|

( |

) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net (decrease) increase in cash and cash equivalents |

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||

Cash and cash equivalents, beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash and cash equivalents, end of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash and cash equivalents are comprised of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash equivalents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

See accompanying notes to unaudited interim financial statements.

12

ACASTI PHARMA INC.

Notes to Condensed Consolidated Interim Financial Statements

(Unaudited)

(Expressed in thousands of U.S. dollars except share data)

Three and Nine Months ended December 31, 2021 and 2020

1. Nature of operation

Acasti Pharma Inc. (“Acasti” or the “Corporation”) is incorporated under the Business Corporations Act (Québec) (formerly Part 1A of the Companies Act (Québec)). The Corporation is domiciled in Canada and its registered office is located at 3009 boul. de la Concorde East, Suite 102, Laval, Québec, Canada H7E 2B5.

In January 2020 and August 2020, the Corporation released Phase 3 TRILOGY clinical study results for the Corporation’s lead drug candidate, CaPre. The TRILOGY studies did not meet the primary endpoint which resulted in the Corporation’s Board of Directors deciding not to proceed with a filing of an NDA with the FDA. With the completion of the TRILOGY studies beginning in the second half of fiscal 2021, marketing and research and development activities and expenses were reduced while management undertook a strategic review, and some CaPre related equipment and other assets were and continue to be classified as held for sale as they are expected to be sold.

In August 2021, the Corporation completed the acquisition via a share-for-share merger of Grace Therapeutics, Inc. (“Grace”) a privately held emerging biopharmaceutical company focused on developing innovative drug delivery technologies for the treatment of rare and orphan diseases. The post-merger Corporation is focused on building a late-stage specialty pharmaceutical company specializing in rare and orphan diseases and focused on developing and commercializing products that improve clinical outcomes using novel drug delivery technologies. The Corporation seeks to apply new proprietary formulations to existing pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, more convenient delivery and increased patient compliance; all of which could result in improved patient outcomes. The active pharmaceutical ingredients chosen by the Corporation for further development may be already approved in the target indication or could be repurposed for use in new indications.

The Corporation has incurred operating losses and negative cash flows from operations in each year since its inception. The Corporation expects to incur significant expenses and continued operating losses for the foreseeable future. The Corporation expects its expenses will increase substantially in connection with its ongoing activities, particularly as it advances clinical development for the first three drug candidates in the Corporation’s pipeline; continues to engage contract manufacturing organizations (“CMOs”) to manufacture its clinical study materials and to ultimately develop large-scale manufacturing capabilities in preparation for commercial launch; seeks regulatory approval for its product candidates; and adds personnel to support its product development and future product launch and commercialization.

The Corporation does not expect to generate revenue from product sales unless and until it successfully completes drug development and obtains regulatory approval, which the Corporation expects will take several years and is subject to significant uncertainty. To date, the Corporation has financed its operations primarily through public offerings and private placements of its common shares, warrants and convertible debt and the proceeds from research tax credits. Until such time that the Corporation can generate significant revenue from product sales, if ever, it will require additional financing, which is expected to be sourced from a combination of public or private equity or debt financings or other non-dilutive sources, which may include fees, milestone payments and royalties from collaborations with third parties. Arrangements with collaborators or others may require the Corporation to relinquish certain rights related to its technologies or drug product candidates. Adequate additional financing may not be available to the Corporation on acceptable terms, or at all. The Corporation’s inability to raise capital as and when needed would have a negative impact on its financial condition and its ability to pursue its business strategy.

The Corporation remains subject to risks similar to other development stage companies in the biopharmaceutical industry, including compliance with government regulations, protection of proprietary technology, dependence on third party contractors and consultants and potential product liability, among others.

Reverse stock split

On August 26, 2021, the shareholders of the Corporation approved a resolution to undertake a reverse split of the common stock within a range of 1-6 to 1-8 with such specific ratio to be approved by the Acasti Board. All references in these financial statements to number of common shares, warrants and options, price per share and weighted average number of shares outstanding prior to the reverse split have been adjusted to reflect the approved reverse stock split of 1-

2. Summary of significant accounting policies:

Basis of presentation

These unaudited Consolidated Interim Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and on a basis consistent with those accounting principles followed by the Corporation and disclosed in note 2 of its most recent Annual Consolidated Financial Statements, except as disclosed in note 3 – Recent accounting pronouncements and policies and note 4 Acquisition of Grace, and should be read in conjunction with such statements and notes thereto.

13

Use of estimates

The preparation of these financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, income, and expenses. Actual results may differ from these estimates.

Estimates are based on management’s best knowledge of current events and actions that management may undertake in the future. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

Estimates and assumptions include the measurement of derivative warrant liabilities (note 8), stock-based compensation (note 12), assets held for sale (note 5), supply agreement (note 15), acquisition of Grace and valuation of intangibles (note 4). Estimates and assumptions are also involved in measuring the accrual of services rendered with respect to research and development expenditures at each reporting date, including whether contingencies should be accrued for, as well as in determining which research and development expenses qualify for investment tax credits and in what amounts. The Corporation recognizes the tax credits once it has reasonable assurance that they will be realized. Recorded tax credits are subject to review and approval by tax authorities and, therefore, could be different from the amounts recorded.

Intangible assets - acquired in-process research and development

In a business combination, the fair value of in-process research and development (“IPR&D”) acquired is capitalized and accounted for as indefinite-lived intangible assets, and not amortized until the underlying project receives regulatory approval, at which point the intangible assets will be accounted for as definite-lived intangible assets and amortized over the remaining useful life or discontinued. If discontinued, the intangible asset will be written off. Research and development (“R&D”) costs incurred after the acquisition are expensed as incurred.

The estimated fair values of identifiable intangible assets were determined using the "income approach" which is a valuation technique that provides an estimate of the fair value of an asset based on market participant expectations of the cash flows an asset would generate over its remaining useful life. Some of the assumptions inherent in the development of these asset valuations include the estimated net cash flows for each year for the asset (including net revenues, cost of products sold, R&D costs, and selling and marketing costs), the appropriate discount rate necessary to measure the risk inherent in each future cash flow stream, the life cycle of each asset, the potential regulatory and commercial success risk, competitive trends impacting the asset and each cash flow stream, as well as other factors.

Indefinite-lived assets are not amortized but are subject to an impairment review annually and more frequently when indicators of impairment exist. An impairment of indefinite-lived intangible assets would occur if the fair value of the intangible asset is less than the carrying value.

The Corporation tests indefinite-lived intangible assets for impairment by first assessing qualitative factors to determine whether it is more likely than not that the fair value is less than its carrying amount. If the Corporation concludes it is more likely than not that the fair value is less than it's carrying amount, a quantitative impairment test is performed. For its quantitative impairment tests, the Corporation uses an estimated future cash flow approach that requires judgment with respect to estimated net cash flows for each year for the asset (including net revenues, cost of products sold, R&D costs, and selling and marketing costs), the appropriate discount rate necessary to measure the risk inherent in each future cash flow stream, the life cycle of each asset, the potential regulatory and commercial success risk, competitive trends impacting the asset and each cash flow stream, as well as other factors. The use of alternative estimates and assumptions could increase or decrease the estimated fair value of the assets and potentially result in different impacts to the Corporation's results of operations.

In June 2016, the Financial Accounting Standards Board issued ASU 2016-13-Financial Instruments-Credit Losses (Topic 326), which amends guidance on reporting credit losses for assets held at amortized cost basis and available for sale debt securities. For assets held at amortized cost, the new guidance eliminates the probable initial recognition threshold in current U.S. GAAP and, instead, requires an entity to reflect its current estimate of all expected credit losses. The allowance for credit losses is a valuation account that is deducted from the amortized cost basis of the financial assets to present the net amount expected to be collected. ASU 2016-13 will affect loans, debt securities, trade receivables, net investments in leases, off balance sheet credit exposures, and any other financial assets not excluded from the scope that have the contractual right to receive cash. ASU 2016-13 is effective for annual periods, and interim periods within those annual periods, beginning after December 15, 2022. Management has not yet evaluated the impact of this ASU on the consolidated financial statements.

4. Acquisition of Grace

On August 27, 2021, the Corporation completed its acquisition of all outstanding equity interests in Grace Therapeutics Inc, via a merger. Grace, based in New Jersey and organized under the laws of Delaware, was a rare and orphan disease specialty pharmaceutical company.

In connection with the share-for-share noncash transaction, Grace was merged with a new wholly owned subsidiary of Acasti and became a subsidiary of Acasti. As a result, Acasti acquired Grace’s entire therapeutic pipeline consisting of three unique clinical stage and multiple pre-clinical stage assets supported by an intellectual property portfolio consisting of various granted and pending patents in various jurisdictions worldwide. Under the terms of the acquisition, each issued and outstanding share of Grace common stock was automatically converted into the right to receive Acasti common shares equal to the equity exchange ratio set forth in the merger agreement.

14

Consideration for acquisition

A total of

|

|

|

|

|

Total common shares issued |

|

|

|

|

Acasti share price (closing share price on August 27, 2021) |

|

$ |

|

|

Fair value of common shares issued |

|

$ |

|

|

The following table summarizes the preliminary fair value of assets acquired and liabilities assumed as of the acquisition date:

|

|

$ |

|

|

Assets acquired and liabilities assumed |

|

|

|

|

Cash and equivalents |

|

|

|

|

Prepaid expenses and other current assets |

|

|

|

|

Intangible assets – in-process research and development |

|

|

|

|

Accounts payable and accrued expenses |

|

|

( |

) |

Total assets acquired and liabilities assumed |

|

|

|

|

Intangible assets of $

Acquisition-related expenses, which were comprised primarily of regulatory, financial advisory and legal fees, totaled

Pro forma financial information

The following table presents the unaudited pro forma combined results of Acasti and Grace for the nine-months ended December 31, 2021, as if the acquisition of Grace had occurred on April 1, 2020:

|

|

nine months ended December 31, 2021 |

|

|

|

|

$ |

|

|

Net loss |

|

|

( |

) |

The unaudited pro forma condensed combined financial information was prepared using the acquisition method of accounting and was based on the historical financial information of Acasti and Grace. The unaudited pro forma financial information is not necessarily indicative of what the consolidated results of operations would have been had the acquisition been completed on April 1, 2020. In addition, the unaudited pro forma financial information is not a projection of future results of operations of the combined company, nor does it reflect the realization of any synergies or cost savings associated with the acquisition.

5. Short-term investments

The Corporation holds various marketable securities, with maturities greater than 3 months at the time of purchase, as follows:

|

|

December 31, |

|

|

March 31, |

|

||

|

|

$ |

|

|

$ |

|

||

Term deposits issued in US currency earning interest at ranges between 0.17% and 0.20% and maturing on various dates from March 4, 2022, to April 1, 2022 |

|

|

|

|

|

|

||

Term deposits issued in CAD currency earning interest at 0.58% maturing on April 1, 2022 |

|

|

|

|

|

|

||

Total short-term investments |

|

|

|

|

|

|

||

15

6. Impairment of intangible assets:

In prior years, the Corporation entered into agreements with Neptune Wellness Solutions Inc. ("Neptune") pursuant to which the Corporation obtained a license and exercised its option under the license agreement to pay in advance future royalties payable to Neptune. This license allowed the Corporation to exploit the intellectual property rights in order to conduct clinical trials for its CaPre drug candidate. The Corporation tests intangible assets for impairment should circumstances change or events occur that would indicate that the fair value of an asset may be below its carrying value. During the second quarter of fiscal 2021, the Corporation released its Phase 3 clinical programs data and its failure to meet its primary endpoints, and the resulting decision to not file an NDA to obtain FDA approval for CaPre. In addition, a significant share price reduction occurred. Due to these indicators of impairment under ASC 350, the Corporation undertook an analysis to determine the fair value of its intangible asset this quarter.

In assessing the magnitude of any impairment of the license the Corporation considered all available evidence, including (i) significant adverse impact from business climate due to the Phase 3 clinical program’s failure to meet its primary endpoints, and the resulting decision to not file an NDA to obtain FDA approval for CaPre, and the resulting internal forecasts that no cash flows from the use of the license was possible, and (ii) management’s estimate that a market place participant would place minimal to no value on the license if it were to be sold on its own or in combination with other assets, recognized or not, which is a level 3 measurement in the fair value hierarchy which included unobservable inputs. Accordingly, an impairment loss of $

7. Assets held for sale

During the period, the Corporation determined to actively market for sale Other assets and Equipment and has met the criteria for classification of assets held for sale:

|

|

December 31, |

|

|

March 31, |

|

||

|

|

$ |

|

|

$ |

|

||

Other assets (a) |

|

|

|

|

|

|

||

Equipment (b) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

a. Other assets

Other assets represent krill oil (“RKO”) held by the Corporation that was expected to be used in commercial inventory scale up related to the development and commercialization of the CaPre drug candidate. Given that the development of CaPre will no longer be pursued by Acasti, the Corporation is expected to sell this reserve. The other asset is being recorded at the fair value less cost to sell, which has resulted in an impairment loss during the three and nine months ended December 31, 2021 of $

b. Equipment

December 31, 2021 |

|

Cost, net of |

|

|

Accumulated |

|

|

Net book |

|

|||

|

|

$ |

|

|

$ |

|

|

$ |

|

|||

Furniture and office equipment |

|

|

|

|

|

( |

) |

|

|

|

||

Computer equipment |

|

|

|

|

|

( |

) |

|

|

|

||

Laboratory equipment |

|

|

|

|

|

( |

) |

|

|

|

||

Production equipment |

|

|

|

|

|

( |

) |

|

|

|

||

|

|

|

|

|

|

( |

) |

|

|

|

||

Equipment is made up of laboratory, production, computer, and office equipment. Similar to the intangible assets and Other assets, the announcement of the discontinuation of the CaPre program resulted in an impairment trigger for the laboratory and production equipment. The impairment loss is based on management’s estimate of the fair value of the equipment less cost to sell, which is based primarily on estimated market prices obtained from brokers specialized in selling used equipment. These projections are based on Level 3 inputs of the fair value hierarchy and reflect the Corporation’s best estimate of market participants’ pricing of the assets as well as the general condition of the assets.

16

8. Derivative warrant liabilities

In connection with the Canadian public offering that closed on May 9, 2018, the Corporation issued a total of

In connection with the U.S. public offering that closed on December 27, 2017, the Corporation issued a total of

The derivative warrant liabilities are measured at fair value at each reporting period and the reconciliation of changes in fair value is presented in the following tables:

|

|

Warrant liabilities issued |

|

|

Warrant liabilities issued |

|

||||||||||

|

|

December 31, 2021 |

|

|

December 31, 2020 |

|

|

December 31, 2021 |

|

|

December 31, 2020 |

|

||||

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Balance – beginning of year |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Change in fair value |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Translation effect |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||

Balance – end of period |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Fair value per share issuable |

|

|

|

|

|

|

|

|

|

|

|

|

||||

The fair value of the derivative warrant liabilities was estimated using the Black-Scholes option pricing model and based on the following assumptions:

|

|

Warrant liabilities issued |

|

|

Warrant liabilities issued |

|

|||||||||||||

|

|

December 31, |

|

March 31, |

|

|

December 31, |

|

|

March 31, |

|

||||||||

Exercise price |

|

CAD$ |

|

|

CAD$ |

|

|

|

USD$ |

|

|

|

USD$ |

|

|

||||

Share price |

|

CAD$ |

|

|

CAD$ |

|

|

|

USD$ |

|

|

|

USD$ |

|

|

||||

Risk-free interest |

|

|

|

% |

|

|

% |

|

|

|

% |

|

|

|

% |

||||

Estimated life (years) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Expected volatility |

|

|

|

% |

|

|

% |

|

|

|

% |

|

|

|

% |

||||

Dividend |

|

|

nil |

|

|

nil |

|

|

|

nil |

|

|

|

nil |

|

||||

9. Capital and other components of equity

On February 14, 2019, the Corporation entered into an ATM sales agreement with B. Riley FBR, Inc. (“B. Riley”) pursuant to which common shares may be sold from time to time for aggregate gross proceeds of up to $

On June 29, 2020, the Corporation entered into an amended and restated sales agreement (the “Sales Agreement”) with B. Riley, Oppenheimer & Co. Inc. and H.C. Wainwright & Co., LLC (collectively, the “Agents”) to amend the existing ATM program. Under the terms of the Sales Agreement, which has a three-year term, the Corporation may issue and sell from time-to-time common shares having an aggregate offering price of up to $

On November 10, 2021, the Corporation filed a prospectus supplement relating to its at-the-market program with B. Riley, Oppenheimer& Co. Inc. and H.C. Wainwright & Co., LLC acting as agents. Under the terms of the ATM Sales Agreement and the prospectus supplement, the Corporation may issue and sell from time-to-time common shares having an aggregate offering price of up to $

17

During the nine months ended December 31, 2021,

The outstanding warrants of the Corporation are composed of the following as at December 31, 2021, and March 31, 2021:

|

|

December 31, 2021 |

|

|

March 31, 2021 |

|

||||||||||

|

|

Number |

|

|

Amount |

|

|

Number |

|

|

Amount |

|

||||

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

||||

Liability |

|

|

|

|

|

|

|

|

|

|

|

|

||||

May 2018 Canadian public offering warrants (i) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

December 2017 U.S. public offering warrants (ii) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

||||

December 2017 US public offering broker warrants (iii) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

February 2017 Canadian public offering warrants (iv) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

(i)

(ii)

(iii)

(iv)

10. Government assistance

Government assistance is comprised of a government grant from the Canadian federal government and research and development investment tax credits receivable from the Québec provincial government, which relate to qualifiable research and development expenditures under the applicable tax laws. The amounts recorded as receivables are subject to a government tax audit and the final amounts received may differ from those recorded. For the nine months ended December 31, 2021 and 2020, the Corporation recorded $

In September 2019, the Corporation was awarded up to CAD $

11. Revenues

In October 2020, the Corporation entered into an agreement with the Centre Integre Universitaire et des services sociaux de L’Estrie -Centre hospitalier Universitaire de Sherbrooke to start producing and selling Viral transport medium tubes to be utilized in testing related to the Covid-19 pandemic. Revenue is recognized when the product is received by the customer.

12. Net financial income

|

|

Three Months ended |

|

|

Nine Months ended |

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

||||

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Foreign exchange gain (loss) |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

Write-off of deferred financing fees related to at-the-market (ATM) program |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

|

Change in fair value of warrant liabilities |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|||

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Financial income |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|||

18

At December 31, 2021, the Corporation has in place a stock option plan for directors, officers, employees, and consultants of the Corporation (“Stock Option Plan”). An amendment of the Stock Option Plan was approved by shareholders on August 26, 2021. The amendment provides for an increase to the existing limits for common shares reserved for issuance under the Stock Option Plan as well as certain changes to the minimum vesting period applicable to options granted to directors under the Stock Option Plan.

The Stock Option Plan continues to provide for the granting of options to purchase common shares. The exercise price of the stock options granted under this amended plan is not lower than the closing price of the common shares on the TSXV at the close of markets the day preceding the grant. The maximum number of common shares that may be issued upon exercise of options granted under the amended Stock Option Plan shall not exceed 10% of the aggregate number of issued and outstanding shares of the Corporation. This resulted in an increase from

The total number of shares issued to any one consultant within any twelve-month period cannot exceed

The following table summarizes information about activities within the Stock Option Plan for the three and nine-month periods ended:

|

|

December 31, 2021 |

|

|

December 31, 2020 |

|

||||||||||

|

|

Weighted average |

|

|

Number of |

|

|

Weighted average |

|

|

Number of |

|

||||

|

|

CAD$ |

|

|

|

|

|

CAD$ |

|

|

|

|

||||

Outstanding at beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Granted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Exercised |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Forfeited |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

Expired |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Outstanding at end of period |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Exercisable at end of period |

|

|

|

|

|

|

|

|

|

|

||||||

The fair value of options granted was estimated using the Black-Scholes option pricing model, resulting in the following weighted average assumptions for the options granted:

|

Three Months ended |

|

|

Nine Months ended |

|

||||||||||||

|

December 31, |

|

December 31, |

|

|

December 31, |

|

December 31, |

|

||||||||

|

|

$ |

|

|

$ |

|

|

|

$ |

|

|

$ |

|

||||

Exercise price |

CAD $ |

|

|

CAD $ |

|

|

|

CAD $ |

|

|

CAD $ |

|

|

||||

Share price |

CAD $ |

|

|

CAD $ |

|

|

|

CAD $ |

|

|

CAD $ |

|

|

||||

Weighted average grant-date fair value per award |

CAD $ |

|

|

CAD $ |

|

|

|

CAD $ |

|

|

CAD $ |

|

|

||||

Volatility |

|

|

% |

|

|

|

|

|

|

% |

|

|

|

||||

Risk-free interest rate |

|

|

% |

|

|

|

|

|

|

% |

|

|

|

||||

Expected life |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Dividend |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Stock-based compensation payment transactions

The fair value of stock-based compensation transactions is measured using the Black-Scholes option pricing model. Measurement inputs include share price on measurement date, exercise price of the instrument, expected volatility (based on weighted average historic volatility for a duration equal to the estimated weighted average life of the instruments, life based on the average of the vesting and contractual periods for employee awards as minimal prior exercises of options in which to establish historical exercise experience; and contractual life for broker warrants), and the risk-free interest rate (based on government bonds). Service and performance conditions attached to the transactions, if any, are not taken into account in determining fair value. The expected life of the stock options is not necessarily indicative of exercise patterns that may occur. The expected volatility reflects the assumption that the historical volatility over a period similar to the life of the options is indicative of future trends, which may also not necessarily be the actual outcome.

Compensation expense recognized under the Stock Option Plan for the three and nine-month periods ended December 31, 2021, and December 31, 2020 was as follows:

19

|

|

Three Months ended |

|

|

Nine Months ended |

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

||||

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Research and development expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

General and administrative expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sales and marketing expenses |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|||

(a) Changes in non-cash operating items

|

|

Three Months ended |

|

|

Nine Months ended |

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

||||

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Receivables |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|||

Inventory |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

Prepaid expenses |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||

Trade and other payables |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

15. Commitments and contingencies

Research and development contracts and contract research organizations agreements

We utilize contract manufacturing organizations, for the development and production of clinical materials and contract research organizations to perform services related to our clinical trials. Pursuant to the agreements with these contract manufacturing organizations and contract research organizations, we have either the right to terminate the agreements without penalties or under certain penalty conditions.

Supply contract

On October 25, 2019, the Corporation signed a supply agreement with Aker Biomarine Antartic. (“Aker”) to purchase raw krill oil product for a committed volume of commercial starting material for CaPre for a total value of $

Legal proceedings and disputes

In the ordinary course of business, the Corporation is at times subject to various legal proceedings and disputes. The Corporation assess its liabilities and contingencies in connection with outstanding legal proceedings utilizing the latest information available. Where it is probable that the Corporation will incur a loss and the amount of the loss can be reasonably estimated, the Corporation records a liability in its consolidated financial statements. These legal contingencies may be adjusted to reflect any relevant developments. Where a loss is not probable or the amount of loss is not estimable, the Corporation does not accrue legal contingencies. While the outcome of legal proceedings is inherently uncertain, based on information currently available, management believes that it has established appropriate legal reserves. Any incremental liabilities arising from pending legal proceedings are not expected to have a material adverse effect on the Corporation’s financial position, results of operations, or cash flows. However, it is possible that the ultimate resolution of these matters, if unfavorable, may be material to the Corporation’s financial position, results of operations, or cash flows. No reserves or liabilities have been accrued as at December 31, 2021.

20

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation

This management’s discussion and analysis (“MD&A”) is presented in order to provide the reader with an overview of the financial results and changes to our balance sheet as at December 31, 2021, and for the three-month period then ended. This MD&A also explains the material variations in our results of operations, balance sheet and cash flows for the three and nine months ended December 31, 2021 and 2020.

Market data, and certain industry data and forecasts included in this MD&A, were obtained from internal corporation surveys and market research and those conducted by third parties hired by us, publicly available information, reports of governmental agencies and industry publications, and independent third-party surveys. We have relied upon industry publications as our primary sources for third-party industry data and forecasts. Industry surveys, publications and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. We have not independently verified any of the data from third-party sources or the underlying economic assumptions they have made. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based upon our management’s or contracted third parties’ knowledge of our industry, have not been independently verified. Our estimates involve risks and uncertainties, including assumptions that may prove not to be accurate, and these estimates and certain industry data are subject to change based on various factors, including those discussed in this quarterly report and in our most recently filed annual report on Form 10-K.

This MD&A, approved by the Board of Directors on February 14, 2022, should be read in conjunction with our unaudited condensed consolidated interim financial statements for the three and nine-month periods ended December 31, 2021, and 2020 included elsewhere in this quarterly report. Our interim financial statements were prepared in accordance with U.S. GAAP.

All amounts appearing in this MD&A for the period-by-period discussions are in thousands of U.S. dollars, except share and per share amounts or unless otherwise indicated.

Business Overview

On August 27, 2021, we completed our acquisition of Grace via a merger following the approval of Acasti’s shareholders and Grace’s stockholders. Following completion of the merger, Grace became a wholly owned subsidiary of Acasti and was renamed Acasti Pharma U.S. Inc.

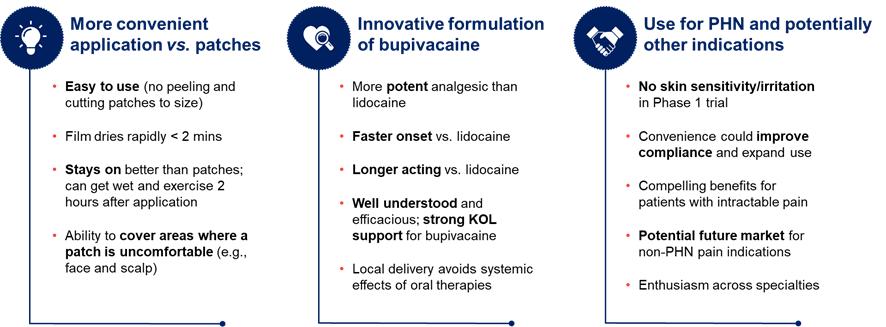

The successful completion of the merger positions Acasti to build a premier, late-stage specialty pharmaceutical company focused on developing and commercializing products for rare and orphan diseases that have the potential to improve clinical outcomes by using the Company’s novel drug delivery technologies. We seek to apply new proprietary formulations to approved and marketed pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, and more convenient drug delivery and increased patient compliance; all of which could result in improved patient outcomes. The active ingredients chosen by Acasti for further development may be already approved in a target indication or could be repurposed for use in new indications.

The existing well understood efficacy and safety profiles of these marketed compounds provides the opportunity for us to utilize the Section 505(b)(2) regulatory pathway under the Federal Food, Drug and Cosmetic Act (the “FFDCA”) for our reformulated versions of these drugs, and therefore may provide a potentially shorter path to regulatory approval. Under Section 505(b)(2), if sufficient support of a product’s safety and efficacy either through previous FDA experience or sufficiently within the scientific literature can be established, it may eliminate the need to conduct some of the early studies that new drug candidates might otherwise require.

In connection with the merger, we acquired Grace’s entire therapeutic pipeline, which has the potential to address critical unmet medical needs for the treatment of rare and orphan diseases. The pipeline consists of three unique clinical stage and multiple pre-clinical stage assets supported by an intellectual property portfolio of more than 40 granted and pending patents in various jurisdictions worldwide. These drug candidates aim to improve clinical outcomes by applying proprietary formulation and drug delivery technologies to existing pharmaceutical compounds to achieve improvements over the current standard of care, or to provide treatment for diseases with no currently approved therapies.

Rare disorders represent an attractive area for drug development, and there remains an opportunity for Acasti to utilize already approved drugs that have established safety profiles and clinical experience to potentially address significant unmet medical needs. A key advantage of pursuing therapies for rare disorders is the potential to receive orphan drug designation (“ODD”) from the FDA. ODD provides for seven years of marketing exclusivity in the United States post-launch, provided certain conditions are met. Rare diseases also allow for more manageably scaled clinical trials and provide market opportunities that may require a smaller, more targeted commercial infrastructure.

The specific diseases targeted for drug development by Acasti are well understood although these patient populations may remain poorly served by available therapies or in some cases approved therapies do not yet exist. We aim to effectively treat debilitating symptoms that result from these underlying diseases.

Our three most advanced programs are:

21

Our management team possesses significant experience in drug delivery research and evaluation, clinical and pharmaceutical development and manufacturing, regulatory affairs, and business development, as well as being well-versed in late-stage drug development and commercialization. The Acasti team has been collectively involved in the development and approval of several successful marketed drugs, including TORADOL, NAPROSYN, ANDROGEL, SUBSYS, MARINOL and KEPPRA XR.

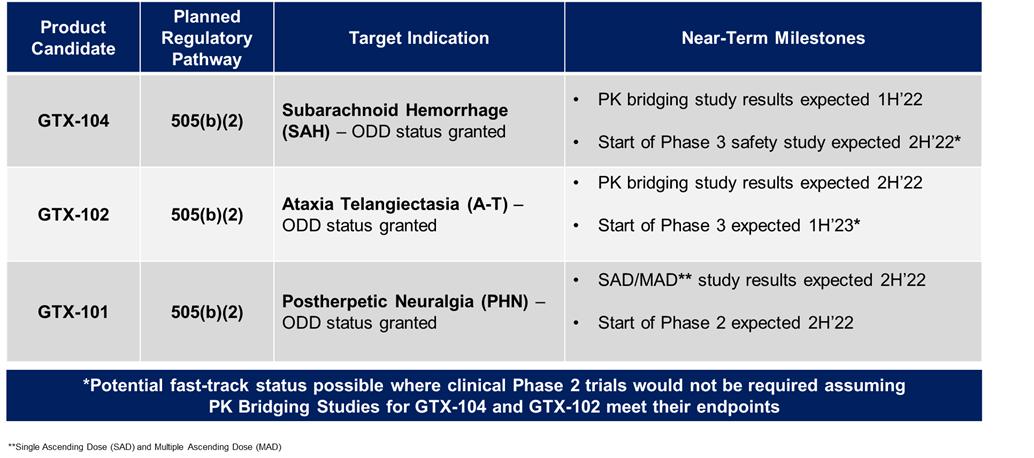

The table below summarizes planned key calendar year milestones for our three clinical drug candidates:

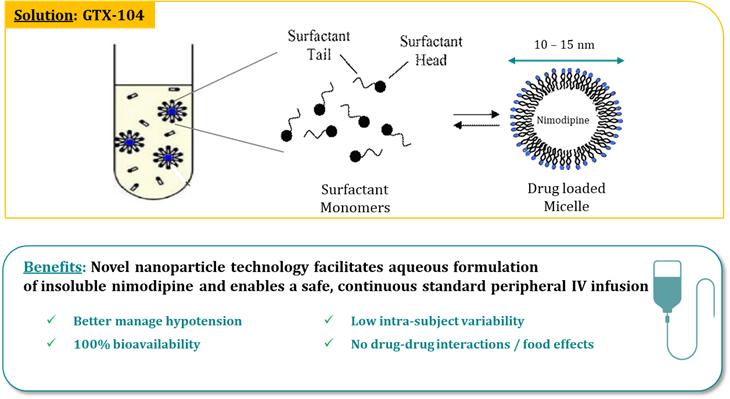

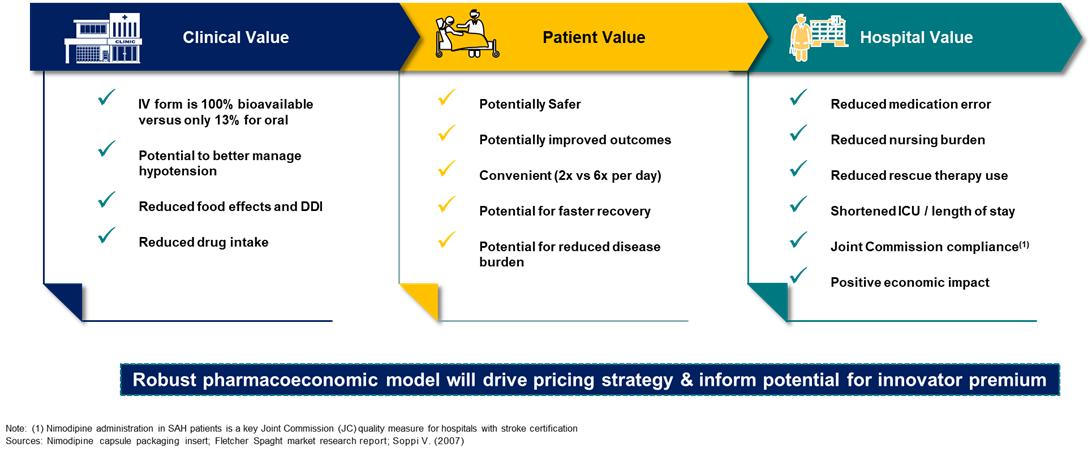

GTX-104 Overview