10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on November 14, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

FORM

______________________________________

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

______________________________________

(Exact name of registrant as specified in its charter)

______________________________________

Québec, |

|

(State or other jurisdiction of |

(I.R.S. Employer |

(Address of principal executive offices, including zip code)

(Registrant’s telephone number, including area code)

______________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

☒ |

|

Smaller reporting company |

|

||

Emerging growth company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes

The number of outstanding common shares of the registrant, no par value per share, as of November 14, 2022, was

ACASTI PHARMA INC.

QUARTERLY REPORT ON FORM 10-Q

For the Quarter Ended September 30, 2022

Table of Contents

|

|

Page |

|

||

7 |

||

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 |

|

|

|

|

Item 3. |

39 |

|

|

|

|

Item 4. |

39 |

|

|

|

|

|

||

40 |

||

|

|

|

40 |

||

|

|

|

40 |

||

|

|

|

40 |

||

|

|

|

40 |

||

|

|

|

40 |

||

|

|

|

41 |

||

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report contains information that may be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws, both of which we refer to in this quarterly report as forward-looking statements. Forward-looking statements can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not statements about the present or historical facts. Forward-looking statements in this quarterly report include, among other things, information or statements about:

Although the forward-looking statements in this quarterly report are based upon what we believe are reasonable assumptions, you should not place undue reliance on those forward-looking statements since actual results may vary materially from them. Important assumptions made by us when making forward-looking statements include, among other things, assumptions by us that:

3

In addition, the forward-looking statements in this quarterly report are subject to a number of known and unknown risks, uncertainties and other factors many of which are beyond our control, that could cause our actual results and developments to differ materially from those that are disclosed in or implied by the forward-looking statements, including, among others:

4

5

All of the forward-looking statements in this quarterly report are qualified by this cautionary statement. There can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the consequences or effects on our business, financial condition, or results of operations that we anticipate. As a result, you should not place undue reliance on the forward-looking statements. Except as required by applicable law, we do not undertake to update or amend any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are made as of the date of this quarterly report.

We express all amounts in this quarterly report in U.S. dollars, except where otherwise indicated. References to “$” and “U.S.$” are to U.S. dollars and references to “C$” or “CAD$” are to Canadian dollars.

Except as otherwise indicated, references in this quarterly report to “Acasti,” “the Company,” “we,” “us” and “our” refer to Acasti Pharma Inc. and its consolidated subsidiaries, including Acasti Pharma U.S., which is formerly Grace.

6

PART I. FINANCIAL INFORMATION

Item 1: Financial Information

Unaudited Condensed Consolidated Interim Financial Statements

7

Condensed Consolidated Interim Financial Statements of

(Unaudited)

ACASTI PHARMA INC.

Three and Six Months ended September 30, 2022 and 2021

8

ACASTI PHARMA INC.

Condensed Consolidated Interim Balance Sheet

(Unaudited)

|

|

|

|

September 30, |

|

|

March 31, |

|

||

(Expressed in thousands of U.S. dollars except share data) |

|

Notes |

|

$ |

|

|

$ |

|

||

Assets |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

|

|

||

Cash and cash equivalents |

|

|

|

|

|

|

|

|

||

Short-term investments |

|

5 |

|

|

|

|

|

|

||

Receivables |

|

|

|

|

|

|

|

|

||

Assets held for sale |

|

6 |

|

|

|

|

|

|

||

Prepaid expenses |

|

|

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Right of use asset |

|

|

|

|

|

|

|

|

||

Equipment |

|

|

|

|

|

|

|

|

||

Intangible assets |

|

4 |

|

|

|

|

|

|

||

Goodwill |

|

|

|

|

|

|

|

|

||

Total assets |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

|

|

||

Trade and other payables |

|

|

|

|

|

|

|

|

||

Lease liability |

|

|

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Derivative warrant liabilities |

|

|

|

|

|

|

|

|

||

Lease liability |

|

|

|

|

|

|

|

|

||

Deferred tax liability |

|

|

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Shareholders’ equity: |

|

|

|

|

|

|

|

|

||

Common shares |

|

4,7(a) |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

|

|

||

Accumulated other comprehensive loss |

|

|

|

|

( | ) |

|

|

( | ) |

Accumulated deficit |

|

|

|

|

( |

) |

|

|

( |

) |

Total shareholder’s equity |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

12 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

Total liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

||

See accompanying notes to unaudited interim financial statements.

9

ACASTI PHARMA INC.

Condensed Consolidated Interim Statements of Loss and Comprehensive Loss

(Unaudited)

Three and Six Months ended September 30, 2022 and 2021

|

|

|

|

Three months ended |

|

|

Six Months ended |

|

||||||||||

|

|

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

||||

(Expressed in thousands of U.S dollars, except per share data) |

|

Notes |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Research and development expenses, net of government assistance |

|

8 |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

General and administrative expenses |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Sales and marketing expenses |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Loss from operating activities |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Financial income (expenses) |

|

9 |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||

Income (loss) before income tax recovery |

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Income tax recovery |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net income (loss) and total comprehensive income (loss) |

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic and diluted loss per share |

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

See accompanying notes to unaudited interim financial statements

10

ACASTI PARMA INC.

Condensed Consolidated Interim Statements of Changes in Shareholder’s Equity

(Unaudited)

Three and Six Months ended September 30, 2022 and 2021

|

|

|

|

|

Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

(Expressed in thousands of U.S. dollars except share data) |

|

Notes |

|

|

Number |

|

|

Dollar |

|

|

Additional |

|

|

Accumulated |

|

|

Accumulated |

|

|

Total |

|

|||||||

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|||||||

Balance, March 31, 2022 |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

Net loss and total comprehensive loss for the period |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Cumulative translation adjustment |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Net proceeds from shares issued under the at-the-market (ATM) program |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Stock based compensation |

|

|

10 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Balance at June 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Net loss and total comprehensive loss for the period |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Cumulative translation adjustment |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Net proceeds from shares issued under the at-the-market (ATM) program |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Stock based compensation |

|

|

10 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Balance at September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

(Expressed in thousands of US dollars except for share data) |

|

Notes |

|

Number |

|

|

Dollar |

|

|

Additional |

|

|

Accumulated |

|

|

Accumulated |

|

|

Total |

|

||||||

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||||

Balance, March 31, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

Net loss and total comprehensive loss for the period |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Cumulative translation adjustment |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Stock based compensation |

|

10 |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Balance at June 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Net loss and total comprehensive loss for the period |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||

Cumulative translation adjustment |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Stock based compensation |

|

10 |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Common shares issued in relation to merger with Grade via share-for-share |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||||

Balance at September 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

11

ACASTI PHARMA INC.

Condensed Consolidated Interim Statements of Cash Flows

(Unaudited)

Three and Six Months ended September 30, 2022 and 2021

|

|

|

|

Six Months ended |

|

|||||

|

|

|

|

September 30, |

|

|

September 30, |

|

||

(thousands of U.S. dollars) |

|

Notes |

|

$ |

|

|

$ |

|

||

Cash flows used in operating activities: |

|

|

|

|

|

|

|

|

||

Net loss for the period |

|

|

|

|

( |

) |

|

|

( |

) |

Adjustments: |

|

|

|

|

|

|

|

|

||

Depreciation of equipment |

|

|

|

|

|

|

|

|

||

Stock-based compensation |

|

10 |

|

|

|

|

|

|

||

Change in fair value of warrant liabilities |

|

|

|

|

( |

) |

|

|

( |

) |

Income tax recovery |

|

|

|

|

( |

) |

|

|

|

|

Unrealized foreign exchange (gain) loss |

|

|

|

|

( |

) |

|

|

( |

) |

Write off of equipment |

|

|

|

|

|

|

|

|

||

Changes in non-cash working capital items |

|

11 |

|

|

( |

) |

|

|

( |

) |

Net cash used in operating activities |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

||

Cash flows from (used in) investing activities: |

|

|

|

|

|

|

|

|

||

Acquisition of equipment |

|

|

|

|

( |

) |

|

|

|

|

Acquisition of short-term investments |

|

|

|

|

( |

) |

|

|

( |

) |

Maturity of short-term investment |

|

|

|

|

|

|

|

|

||

Net cash from (used in) investing activities |

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

||

Cash flows from (used in) financing activities: |

|

|

|

|

|

|

|

|

||

Net proceeds from issuance of common shares under the at-the-market (ATM) |

|

(7a) |

|

|

|

|

|

|

||

Net cash from (used in) financing activities |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Effect of exchange rate fluctuations on cash and cash equivalents |

|

|

|

|

|

|

|

( |

) |

|

Translations effects on cash and cash equivalents related to reporting currency |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

||

Net increase (decrease) in cash and cash equivalents |

|

|

|

|

|

|

|

( |

) |

|

Cash and cash equivalents, beginning of period |

|

|

|

|

|

|

|

|

||

Cash and cash equivalents, end of period |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Cash and cash equivalents are comprised of: |

|

|

|

|

|

|

|

|

||

Cash |

|

|

|

|

|

|

|

|

||

Cash equivalents |

|

|

|

|

|

|

|

|

||

See accompanying notes to unaudited interim financial statements.

12

ACASTI PHARMA INC.

Notes to Condensed Consolidated Interim Financial Statements

(Unaudited)

(Expressed in thousands of U.S. dollars except share data)

Three and Six Months ended September 30, 2022 and 2021

1. Nature of operation

Acasti Pharma Inc. (“Acasti” or the “Corporation”) is incorporated under the Business Corporations Act (Québec) (formerly Part 1A of the Companies Act (Québec)). The Corporation is domiciled in Canada and its registered office is located at 3009 boul. de la Concorde East, Suite 102, Laval, Québec, Canada H7E 2B5.

In August 2021, the Corporation completed the acquisition via a share-for-share merger of Grace Therapeutics, Inc. (“Grace”), a privately held emerging biopharmaceutical company focused on developing innovative drug delivery technologies for the treatment of rare and orphan diseases. The post-merger Corporation is focused on building a late-stage specialty pharmaceutical company specializing in rare and orphan diseases and developing and commercializing products that improve clinical outcomes using our novel drug delivery technologies. The Corporation seeks to apply new proprietary formulations to existing pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, more convenient delivery and increased patient compliance; all of which could result in improved patient outcomes. The active pharmaceutical ingredients chosen by the Corporation for further development may be already approved in the target indication or could be repurposed for use in new indications.

The Corporation has incurred operating losses and negative cash flows from operations in each year since its inception. The Corporation expects to incur significant expenses and continued operating losses for the foreseeable future. The Corporation expects its expenses will increase substantially in connection with its ongoing activities, particularly as it advances clinical development for the first three drug candidates in the Corporation’s pipeline; continues to engage contract manufacturing organizations (“CMOs”) to manufacture its clinical study materials and to ultimately develop large-scale manufacturing capabilities in preparation for commercial launch; seeks regulatory approval for its drug candidates; and adds personnel to support its drug product development and future drug product launch and commercialization.

The Corporation does not expect to generate revenue from product sales unless and until it successfully completes drug development and obtains regulatory approval, which the Corporation expects will take several years and is subject to significant uncertainty. To date, the Corporation has financed its operations primarily through public offerings and private placements of its common shares, warrants and convertible debt and the proceeds from research tax credits. Until such time that the Corporation can generate significant revenue from drug product sales, if ever, it will require additional financing, which is expected to be sourced from a combination of public or private equity or debt financings or other non-dilutive sources, which may include fees, milestone payments and royalties from collaborations with third parties. Arrangements with collaborators or others may require the Corporation to relinquish certain rights related to its technologies or drug product candidates. Adequate additional financing may not be available to the Corporation on acceptable terms, or at all. The Corporation’s inability to raise capital as and when needed could have a negative impact on its financial condition and its ability to pursue its business strategy.

The Corporation remains subject to risks similar to other development stage companies in the biopharmaceutical industry, including compliance with government regulations, protection of proprietary technology, dependence on third party contractors and consultants and potential product liability, among others.

Reverse stock split

On August 26, 2021, the shareholders of the Corporation approved a resolution to undertake a reverse split of the common stock within a range of 1-6 to 1-8 with such specific ratio to be approved by the Acasti Board. All references in these financial statements to number of common shares, warrants and options, price per share and weighted average number of shares outstanding prior to the reverse split have been adjusted to reflect the approved reverse stock split of 1-

2. Summary of significant accounting policies:

Basis of presentation

These unaudited Consolidated Interim Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and on a basis consistent with those accounting principles followed by the Corporation and disclosed in note 2 of its most recent Annual Consolidated Financial Statements, except as disclosed in note 3 – Recent accounting pronouncements and policies and should be read in conjunction with such statements and notes thereto.

13

Functional currency

On April 1, 2022, the Corporation’s functional currency was changed from the Canadian dollar to the US dollar. This change is reflected prospectively in the Corporation’s financial statements.

FASB ASC Topic 830, “Functional Currency Matters,” requires a change in functional currency to be reported as of the date it is determined there has been a change, and it is generally accepted practice that the change is made at the start of the most recent period that approximates the date of the change. Management determined it would enact this change effective on April 1, 2022. While the change was based on a factual assessment, the determination of the date of the change required management’s judgement given the change in the Corporations primary economic and business environment, which has evolved over time. As part of management’s functional currency assessment, changes in economic facts and circumstances were considered. This included analysis of changes in: impact of the merger with Grace Therapeutics, management of operations, and in the composition of cash and short term investment balances. Additionally, budgeting is in USD, whereas this was previously performed in CAD. The Corporations cash outflows consist primarily of USD cash balances and less of CAD, as also reflected in the budget.

Use of estimates

The preparation of these financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, income, and expenses. Actual results may differ from these estimates.

Estimates are based on management’s best knowledge of current events and actions that management may undertake in the future. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

Estimates and assumptions include the measurement of derivative warrant liabilities (note 7), stock-based compensation (note 10), assets held for sale (note 6), supply agreement (note 12), valuation of intangibles (note 4) and goodwill. Estimates and assumptions are also involved in measuring the accrual of services rendered with respect to research and development expenditures at each reporting date, including whether contingencies should be accrued for, as well as in determining which research and development expenses qualify for investment tax credits and in what amounts. The Corporation recognizes the tax credits once it has reasonable assurance that they will be realized. Recorded tax credits are subject to review and approval by tax authorities and, therefore, could be different from the amounts recorded.

3. Recent accounting pronouncements

The Corporation has considered recent accounting pronouncements and concluded that they are either not applicable to the business or that the effect is not expected to be material to the consolidated financial statements as a result of future adoption.

4. Intangible assets

On August 27, 2021, the Corporation completed its acquisition of all outstanding equity interests in Grace Therapeutics Inc, via a merger. Grace, based in New Jersey and organized under the laws of Delaware, was a rare and orphan disease specialty pharmaceutical company.

In connection with the share-for-share noncash transaction, Grace was merged with a new wholly owned subsidiary of Acasti and became a subsidiary of Acasti. As a result, Acasti acquired Grace’s entire therapeutic pipeline consisting of three unique clinical stage and multiple pre-clinical stage assets supported by an intellectual property portfolio consisting of various granted and pending patents in various jurisdictions worldwide. Under the terms of the acquisition, each issued and outstanding share of Grace common stock was automatically converted into the right to receive Acasti common shares equal to the equity exchange ratio set forth in the merger agreement.

Intangible assets of $

|

|

$ |

|

|

Intangible assets – in-process research and development |

|

|

|

|

GTX-104 |

|

|

|

|

GTX-102 |

|

|

|

|

GTX-101 |

|

|

|

|

Total |

|

|

|

|

The Corporation performed an impairment test as at August 27, 2022 for each of our IPR&D technologies as well as for goodwill. The Corporation has one reporting unit which we have determined to be the Company. The estimated fair values of identifiable intangible assets and the reporting unit were determined using the multi-period excess earnings method. As a result of this quantitative assessment, we did not identify an impairment loss.

The projected discounted cash flow models used to estimate the fair value of assets of our IPR&D reflect significant assumptions and are level 3 unobservable data regarding the estimates a market participant would make in order to evaluate a drug development asset, including the following:

14

All IPR&D projects have risks and uncertainties associated with the timely and successful completion of the development and commercialization of product candidates, including our ability to confirm safety and efficacy based on data from clinical trials, our ability to obtain necessary regulatory approvals and our ability to successfully complete these tasks within budgeted costs. It is not permitted to market a human therapeutic without obtaining regulatory approvals, and such approvals require the completion of clinical trials that demonstrate that a product candidate is safe and effective. In addition, the availability and extent of coverage and reimbursement from third-party payers, including government healthcare programs and private insurance plans as well as competitive product launches, affect the revenues a product can generate. Consequently, the eventual realized values, if any, of acquired IPR&D projects may vary from their estimated fair values. The Corporation reviews individual IPR&D projects for impairment annually on the anniversary of acquisition, whenever events or changes in circumstances indicate that the carrying amounts may not be recoverable and upon establishment of technological feasibility or regulatory approval.

5. Short-term investments

The Corporation holds various marketable securities, with maturities greater than 3 months at the time of purchase, as follows:

|

|

September 30, |

|

|

March 31, |

|

||

|

|

$ |

|

|

$ |

|

||

Term deposits issued in US currency earning interest at |

|

|

|

|

|

|

||

Term deposits issued in CAD currency earning interest at ranges between |

|

|

|

|

|

|

||

Total short-term investments |

|

|

|

|

|

|

||

6. Assets held for sale

During the period, the Corporation determined to actively market for sale Other assets and Production equipment and has met the criteria for classification of assets held for sale:

|

|

September 30, |

|

|

March 31, |

|

||

|

|

|

|

|

Reclassed as explained below |

|

||

|

|

$ |

|

|

$ |

|

||

Other assets (a) |

|

|

|

|

|

|

||

Production equipment (b) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

a. Other assets

Other assets represent krill oil (“RKO”) held by the Corporation that was expected to be used in commercial inventory scale up related to the development and commercialization of the CaPre drug candidate. Given that the development of CaPre will no longer be pursued by Acasti, the Corporation is expected to sell this reserve. The other asset is being recorded at the fair value less cost to sell. Management’s estimate of the fair value of the RKO less cost to sell is based primarily on estimated market prices obtained from an appraiser specializing in the krill oil market. These projections are based on Level 3 inputs of the fair value hierarchy and reflect management’s best estimate of market participants’ pricing of the assets as well as the general condition of the asset.

b. Production equipment

September 30, 2022 |

|

Cost, net of |

|

|

Accumulated |

|

|

Net book |

|

|||

|

|

$ |

|

|

$ |

|

|

$ |

|

|||

Production equipment |

|

|

|

|

|

( |

) |

|

|

|

||

|

|

|

|

|

|

( |

) |

|

|

|

||

During the three months ended June 30, 2022, the Corporation reclassed the following assets from assets held for sale as they no longer met the criteria of such classification.

|

|

Cost, net of |

|

|

Accumulated |

|

|

Net |

|

|||

|

|

$ |

|

|

$ |

|

|

$ |

|

|||

Furniture and office equipment |

|

|

|

|

|

( |

) |

|

|

|

||

Computer equipment |

|

|

|

|

|

( |

) |

|

|

|

||

Laboratory equipment |

|

|

|

|

|

( |

) |

|

|

|

||

|

|

|

|

|

|

( |

) |

|

|

|

||

Furthermore, depreciation expense of $

15

7. Capital and other components of equity

On February 14, 2019, the Corporation entered into an ATM sales agreement with B. Riley FBR, Inc. (“B. Riley”) pursuant to which common shares may be sold from time to time for aggregate gross proceeds of up to $

On June 29, 2020, the Corporation entered into an amended and restated sales agreement (the “Sales Agreement”) with B. Riley, Oppenheimer & Co. Inc. and H.C. Wainwright & Co., LLC (collectively, the “Agents”) to amend the existing ATM program. Under the terms of the Sales Agreement, which has a three-year term, the Corporation may issue and sell from time-to-time common shares having an aggregate offering price of up to $

On November 10, 2021, the Corporation filed a prospectus supplement relating to its at-the-market program with B. Riley, Oppenheimer& Co. Inc. and H.C. Wainwright & Co., LLC acting as agents. Under the terms of the ATM Sales Agreement and the prospectus supplement, the Corporation may issue and sell from time-to-time common shares having an aggregate offering price of up to $

During the six months ended September 30, 2022

The outstanding warrants of the Corporation are composed of the following as at September 30, 2022, and March 31, 2022:

|

|

September 30, 2022 |

|

|

March 31, 2022 |

|

||||||||||

|

|

Number |

|

|

Amount |

|

|

Number |

|

|

Amount |

|

||||

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

||||

Liability |

|

|

|

|

|

|

|

|

|

|

|

|

||||

May 2018 Canadian public offering warrants (i) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

December 2017 U.S. public offering warrants (ii) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

||||

December 2017 US public offering broker warrants (iii) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

(i)

(ii)

(iii)

8. Government assistance

Government assistance is comprised of a government grant from the Canadian federal government and research and development investment tax credits receivable from the Québec provincial government, which relate to qualifiable research and development expenditures under the applicable tax laws. The amounts recorded as receivables are subject to a government tax audit and the final amounts received may differ from those recorded. For the six months ended September 30, 2022 and 2021, the Corporation recorded $

9. Net financial income

16

|

|

Three months ended |

|

|

Six Months ended |

|

||||||||||

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

||||

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Foreign exchange gain (loss) |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||

Change in fair value of warrant liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest income and bank charges |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Financial income (expenses) |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

At September 30, 2022, the Corporation has in place a stock option plan for directors, officers, employees, and consultants of the Corporation (“Stock Option Plan”). An amendment of the Stock Option Plan was approved by shareholders on September 28, 2022. The amendment provides for an increase to the existing limits for common shares reserved for issuance under the Stock Option Plan.

The Stock Option Plan continues to provide for the granting of options to purchase common shares. The exercise price of the stock options granted under this amended plan is not lower than the closing price of the common shares on the TSXV at the close of markets the day preceding the grant. The maximum number of common shares that may be issued upon exercise of options granted under the amended Stock Option Plan shall not exceed 20% of the aggregate number of issued and outstanding shares of the Corporation as of July 28, 2022. The terms and conditions for acquiring and exercising options are set by the Corporation’s Board of Directors, subject among others, to the following limitations: the term of the options cannot exceed

The total number of shares issued to any one consultant within any twelve-month period cannot exceed

The following table summarizes information about activities within the Stock Option Plan for the six month period ended:

|

|

September 30, 2022 |

|

|

September 30, 2021 |

|

||||||||||

|

|

Weighted average |

|

|

Number of |

|

|

Weighted average |

|

|

Number of |

|

||||

|

|

CAD $ |

|

|

|

|

|

CAD $ |

|

|

|

|

||||

Outstanding at beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Granted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Exercised |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Forfeited |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

Expired |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|||

Outstanding at end of period |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Exercisable at end of period |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

The fair value of options granted was estimated using the Black-Scholes option pricing model, resulting in the following weighted average assumptions for the options granted:

|

|

Three months ended |

|

|

Six Months ended |

|

||||

|

|

September 30, |

|

|

September 30, |

|

||||

|

|

|

$ |

|

|

|

$ |

|

||

Exercise price |

|

CAD $ |

|

|

|

CAD $ |

|

|

||

Share price |

|

CAD $ |

|

|

|

CAD $ |

|

|

||

Weighted average grant-date fair value per award |

|

CAD $ |

|

|

|

CAD $ |

|

|

||

Volatility |

|

|

|

% |

|

|

|

% |

||

Risk-free interest rate |

|

|

|

% |

|

|

|

% |

||

Expected life |

|

|

|

|

|

|

|

|

||

Dividend |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Stock-based compensation payment transactions

17

The fair value of stock-based compensation transactions is measured using the Black-Scholes option pricing model. Measurement inputs include share price on measurement date, exercise price of the instrument, expected volatility (based on weighted average historic volatility for a duration equal to the estimated weighted average life of the instruments, life based on the average of the vesting and contractual periods for employee awards as minimal prior exercises of options in which to establish historical exercise experience; and contractual life for broker warrants), and the risk-free interest rate (based on government bonds). Service and performance conditions attached to the transactions, if any, are not taken into account in determining fair value. The expected life of the stock options is not necessarily indicative of exercise patterns that may occur. The expected volatility reflects the assumption that the historical volatility over a period similar to the life of the options is indicative of future trends, which may also not necessarily be the actual outcome.

Compensation expense recognized under the Stock Option Plan for the six months ended September 30, 2022 and 2021 was as follows:

|

|

Three months ended |

|

|

Six Months ended |

|

||||||||||

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

||||

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Research and development expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

General and administrative expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sales and marketing expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

11. Supplemental cash flow disclosure

(a) Changes in non-cash operating items

|

|

|

|

|

|

|

||

|

|

Six Months ended |

|

|||||

|

|

September 30, |

|

|

September 30, |

|

||

|

|

$ |

|

|

$ |

|

||

Receivables |

|

|

( |

) |

|

|

( |

) |

Prepaid expenses |

|

|

( |

) |

|

|

( |

) |

Trade and other payables |

|

|

|

|

|

( |

) |

|

|

|

|

( |

) |

|

|

( |

) |

12. Commitments and contingencies

Research and development contracts and contract research organizations agreements

We utilize contract manufacturing organizations, for the development and production of clinical materials and contract research organizations to perform services related to our clinical trials. Pursuant to the agreements with these contract manufacturing organizations and contract research organizations, we have either the right to terminate the agreements without penalties or under certain penalty conditions.

Supply contract

On October 25, 2019, the Corporation signed a supply agreement with Aker Biomarine Antartic. (“Aker”) to purchase raw krill oil product for a committed volume of commercial starting material for CaPre for a total fixed value of $

18

Legal proceedings and disputes

In the ordinary course of business, the Corporation is at times subject to various legal proceedings and disputes. The Corporation assesses its liabilities and contingencies in connection with outstanding legal proceedings utilizing the latest information available. Where it is probable that the Corporation will incur a loss and the amount of the loss can be reasonably estimated, the Corporation records a liability in its consolidated financial statements. These legal contingencies may be adjusted to reflect any relevant developments. Where a loss is not probable or the amount of loss is not estimable, the Corporation does not accrue legal contingencies. While the outcome of legal proceedings is inherently uncertain, based on information currently available, management believes that it has established appropriate legal reserves. Any incremental liabilities arising from pending legal proceedings are not expected to have a material adverse effect on the Corporation’s financial position, results of operations, or cash flows. However, it is possible that the ultimate resolution of these matters, if unfavorable, may be material to the Corporation’s financial position, results of operations, or cash flows. No reserves or liabilities have been accrued as at September 30, 2022.

19

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation

This management’s discussion and analysis (“MD&A”) is presented in order to provide the reader with an overview of the financial results and changes to our balance sheet as at September 30, 2022, and for the three and six month period then ended. This MD&A also explains the material variations in our results of operations, balance sheet and cash flows for the three and six months ended September 30, 2022 and 2021.

Market data, and certain industry data and forecasts included in this MD&A were obtained from internal corporation surveys and market research and those conducted by third parties hired by us, publicly available information, reports of governmental agencies and industry publications, and independent third-party surveys. We have relied upon industry publications as our primary sources for third-party industry data and forecasts. Industry surveys, publications and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. We have not independently verified any of the data from third-party sources or the underlying economic assumptions they have made. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based upon our management’s or contracted third parties’ knowledge of our industry, have not been independently verified. Our estimates involve risks and uncertainties, including assumptions that may prove not to be accurate, and these estimates and certain industry data are subject to change based on various factors, including those discussed in this quarterly report and in our most recently filed annual report on Form 10-K.

This MD&A, approved by the Board of Directors on November 14, 2022, should be read in conjunction with our unaudited condensed consolidated interim financial statements for the Three and Six Months ended September 30, 2022 and 2021 included elsewhere in this quarterly report. Our interim financial statements were prepared in accordance with U.S. GAAP.

All amounts appearing in this MD&A for the period-by-period discussions are in thousands of U.S. dollars, except share and per share amounts or unless otherwise indicated.

Business Overview

On August 27, 2021, we completed our acquisition of Grace via a merger following the approval of Acasti’s shareholders and Grace’s stockholders. Following completion of the merger, Grace became a wholly owned subsidiary of Acasti and was renamed Acasti Pharma U.S. Inc.

The successful completion of the merger positions Acasti as a premier, late-stage specialty pharmaceutical company focused on developing and commercializing products for rare and orphan diseases that have the potential to improve clinical outcomes by using the Company’s novel drug delivery technologies. We seek to apply new proprietary formulations to approved and marketed pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, and more convenient drug delivery and increased patient compliance; all of which could result in improved patient outcomes. The active pharmaceutical ingredients used in the drug candidates under development by Acasti may be already approved in a target indication or could be repurposed for use in new indications.

The existing well understood efficacy and safety profiles of these marketed compounds provides the opportunity for us to utilize the Section 505(b)(2) regulatory pathway under the Federal Food, Drug and Cosmetic Act (the “FFDCA”) for the development of our reformulated versions of these drugs, and therefore may provide a potentially shorter path to regulatory approval. Under Section 505(b)(2), if sufficient support of a product’s safety and efficacy either through previous FDA experience or sufficiently within the scientific literature can be established, it may eliminate the need to conduct some of the preclinical and clinical studies that new drug candidates might otherwise require.

In connection with the merger, we acquired Grace’s entire therapeutic pipeline, which has the potential to address critical unmet medical needs for the treatment of rare and orphan diseases. The pipeline consists of three unique clinical stage and multiple pre-clinical stage assets supported by an intellectual property portfolio of more than 40 granted and pending patents in various jurisdictions worldwide. These drug candidates aim to improve clinical outcomes by applying proprietary formulation and drug delivery technologies to existing pharmaceutical compounds to achieve improvements over the current standard of care, or to provide treatment for diseases with no currently approved therapies.

Rare disorders represent an attractive area for drug development, and there remains an opportunity for Acasti to utilize already approved drugs that have established safety profiles and clinical experience to potentially address significant unmet medical needs. A key advantage of pursuing therapies for rare disorders is the potential to receive orphan drug designation (“ODD”) from the FDA. ODD provides for seven years of marketing exclusivity in the United States post-launch, provided certain conditions are met, and the potential for faster regulatory review. ODD status can also result in tax credits of up to 50% of clinical development costs conducted in the United States upon market approval and a waiver of the new drug application (NDA) fees, which can range between $1 - $2 million. Developing drugs for rare diseases can often allow for clinical trials that are more manageably scaled and may require a smaller, more targeted commercial infrastructure.

The specific diseases targeted for drug development by Acasti are well understood although these patient populations may remain poorly served by available therapies or in some cases approved therapies do not yet exist. We aim to effectively treat debilitating symptoms that result from these underlying diseases.

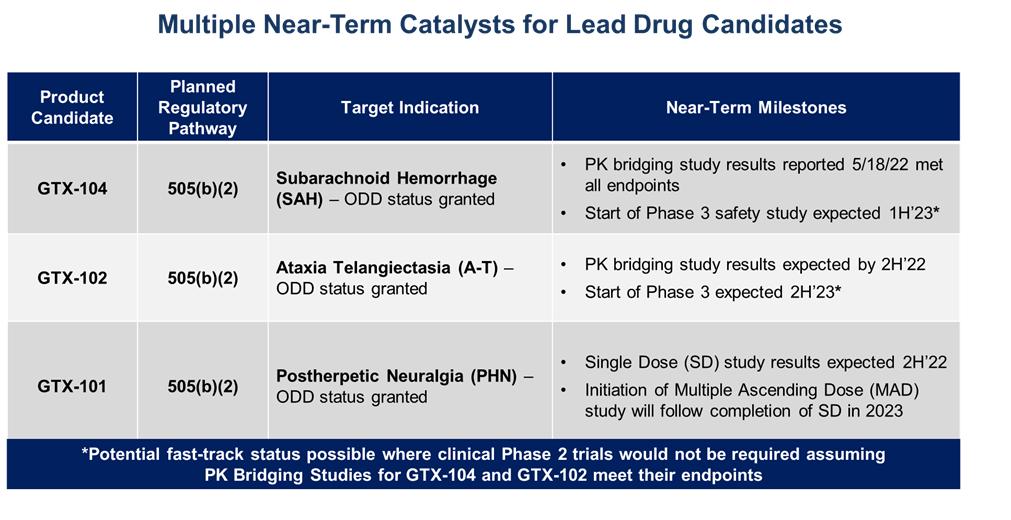

Our three most advanced programs are:

20

Our management team possesses significant experience in drug formulation and drug delivery research and development, clinical and pharmaceutical development and manufacturing, regulatory affairs, and business development, as well as being well-versed in late-stage drug development and commercialization. The Acasti team has been collectively involved in the development and approval of numerous successfully marketed drugs, including TORADOL, NAPROSYN, ANDROGEL, SUBSYS, MARINOL, KEPPRA XR, CLARITIN®, EUFLEX®, EFFEXOR®, SONATA®, ATIVAN®, RD-HEPARIN®, RAPAMUNE®, ETODOLAC, ARICEPT®, CARDIZEM®, DEFLAZACORT®, AND MACIMORELIN®.

The table below summarizes planned key fiscal 2023 milestones for our three clinical drug candidates:

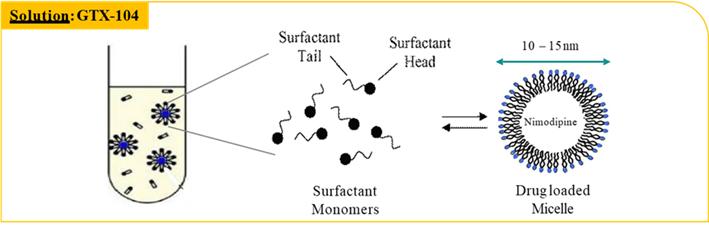

GTX-104 Overview

Nimodipine was granted FDA approval in 1988, and is the only approved drug that has been clinically shown to improve neurological outcomes in SAH. It is only available in the United States as a generic oral capsule and as a branded oral liquid solution called NYMALIZE, which is manufactured and sold by Arbor Pharmaceuticals (acquired in September 2021 by Azurity Pharmaceuticals). Nimodipine has poor water solubility and high permeability characteristics as a result of its high lipophilicity. Additionally, orally administered nimodipine has dose-limiting side-effects such as hypotension, poor absorption and low bioavailability resulting from high first-pass metabolism, and a narrow administration window as food effects lower bioavailability significantly. Due to these issues, blood levels of orally administered nimodipine can be highly variable, making it difficult to manage blood pressure in SAH patients. Nimodipine capsules are also difficult to administer, particularly to unconscious patients or those with impaired ability to swallow. Concomitant use with CYP3A inhibitors is contraindicated (NIMODIPINE Capsule PI).

NIMOTOP is an injectable form of nimodipine that is manufactured by Bayer Healthcare. It is approved in Europe and in other regulated markets (but not in the United States). It has limited utility for SAH patients because of its high organic solvent content, namely 23.7% ethanol and 17% polyethylene glycol 400 (NIMOTOP SmPC).

21

Key Potential Benefits:

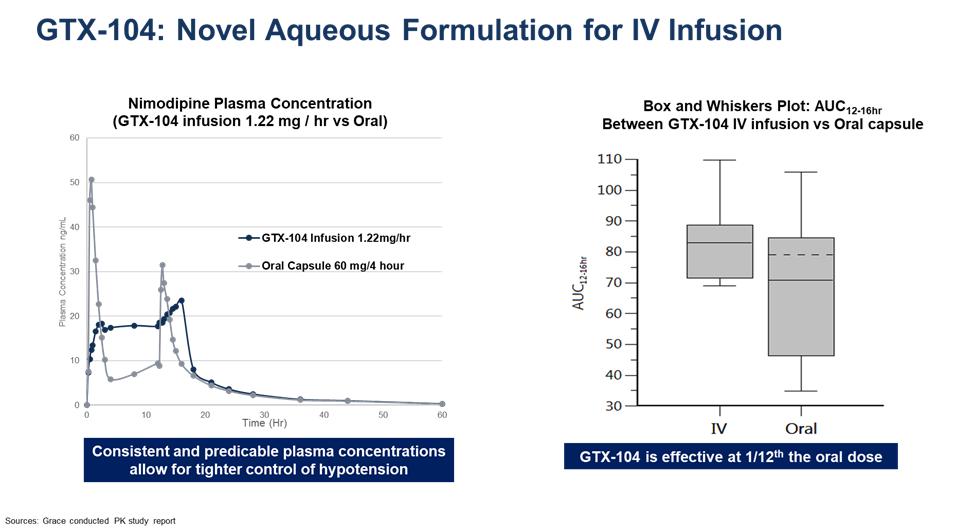

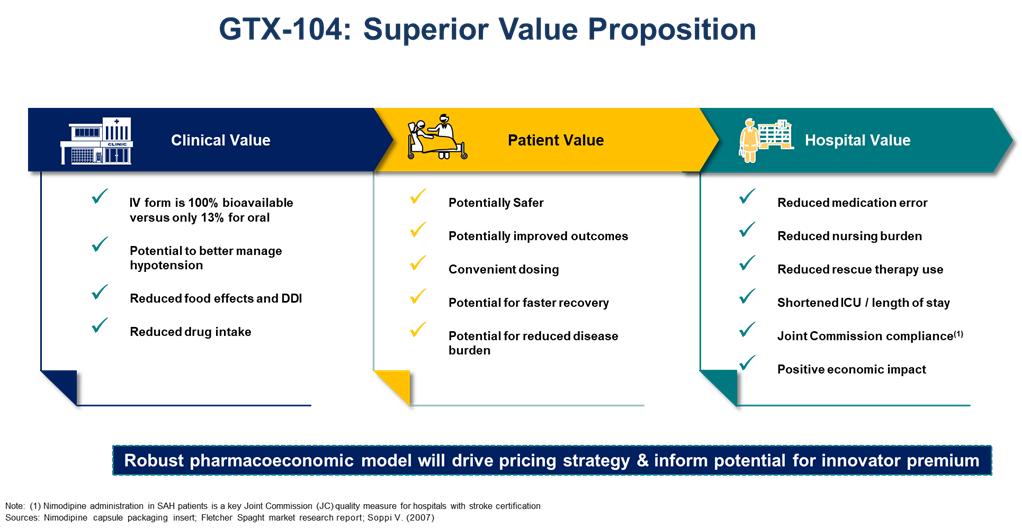

GTX-104 could provide a more convenient mode of administration as compared to generic nimodipine capsules or NYMALIZE GTX-104 is administered as an initial bolus followed by a continuous infusion as compared to oral administration via a nasogastric tube in unconscious patients every two to four hours for both nimodipine capsules and NYMALIZE solution. Therefore, GTX-104 could be considered as a major contribution to patient care by potentially reducing the dosing frequency, and the associated nursing burden. More convenient and continuous, more consistent dosing can also reduce the risk of medication errors. In addition, two PK studies have shown that GTX-104 has the potential to provide improved bioavailability and lower intra-subject variability compared to oral administration (see chart below). Because of its IV formulation, we also expect GTX-104 to reduce certain drug-drug interactions and food effects.

Despite the positive impact it has on recovery, physicians often must discontinue their patients on oral nimodipine, primarily as a result of hypotensive episodes that cannot be controlled by titrating the oral form of drug. Such discontinuation could potentially be avoided by administering GTX-104, which because of its IV administration, may obviate the complexity that results from the need for careful attention to the timing of nimodipine administration at least one hour before or two hours after a meal. Administration of GTX-104 via a peripheral vein is often much more comfortable for the patients compared to administration by central venous access (as is the case for NIMOTOPTM), which can often be a difficult, invasive and more risky procedure. Also, unconscious patients will likely receive more consistent concentrations of nimodipine when delivered via the IV route as compared to oral gavage or a nasogastric tube. More consistent dosing is expected to result in a reduction of vasospasm and a better, more consistent management of hypotension. As summarized in the table below, we anticipate reduced use of rescue therapies, such as vasopressors, and expensive hospital resources, such as the angiography suite, are possible by more effectively managing blood pressure with GTX-104. Reduced incidences of vasospasm could result in shorter length of stay and better outcomes.

22

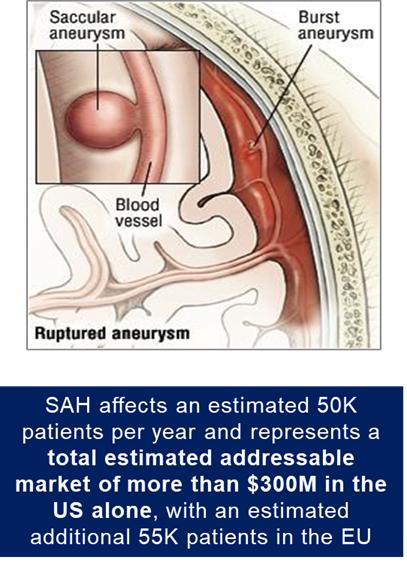

About Subarachnoid Hemorrhage (SAH)

SAH is bleeding over the surface of the brain in the subarachnoid space between the brain and the skull, which contains blood vessels that supply the brain. A primary cause of such bleeding is rupture of an aneurysm. The result is a relatively uncommon type of stroke that accounts for about 5% of all strokes and has an incidence of six per 100,000 person years (Becske, 2018).

In contrast to more common types of stroke in elderly individuals, SAH often occurs at a relatively young age, with approximately half the affected patients younger than 60 years old (Becske, 2018). Approximately 10% to 15% of aneurysmal SAH (“aSAH”) patients die before reaching the hospital (Rinkel, 2016), and those who survive the initial hours post hemorrhage are admitted or transferred to tertiary care centers with high risk of complications, including rebleeding and delayed cerebral ischemia (“DCI”). Systemic manifestations affecting cardiovascular, pulmonary, and renal function are common and often complicate management of DCI. Approximately 70% of aSAH patients experience death or a permanent dependence on family members, and half die within one month after the hemorrhage. Of those who survive the initial month, half remain permanently dependent on a caregiver to maintain daily living (Becske, 2018).

23

We estimate that approximately 50,000 individuals experience aSAH each year in the US. The total addressable market for SAH is approximately $300 million in the U.S., and an estimated 50,000 patients in the European Union based on annual inpatient admissions and the average length-of-stay.

GTX-104 Near Term Milestones: Conduct Phase 3 Safety Study

In September 2021, we initiated our pivotal PK bridging study to evaluate the relative bioavailability of GTX-104 compared to currently marketed oral nimodipine capsules in approximately 50 healthy subjects. The PK study was the next required step in our proposed 505(b)(2) regulatory pathway for GTX-104.

Final results from this pivotal PK study were reported on May 18, 2022, and showed that the bioavailability of GTX-104 compared favorably with the oral formulation of nimodipine in all subjects, and no serious adverse events were observed for GTX-104.

All three endpoints indicated that statistically there was no difference in exposures between GTX-104 and oral nimodipine over the defined time periods for both maximum exposure and total exposure. Plasma concentrations obtained following IV administration showed significantly less variability between subjects as compared to oral administration of capsules, since IV administration is not as sensitive to some of the physiological processes that affect oral administration, such as taking the drug with and without meals, variable gastrointestinal transit time, variable drug uptake from the gastrointestinal tract into the systemic circulation, and variable hepatic blood flow and hepatic first pass metabolism. Previous studies have shown these processes significantly affect the oral bioavailability of nimodipine, and therefore cause oral administration to be prone to larger inter- and intra-subject variability.

The bioavailability of oral nimodipine capsules observed was only 8% compared to 100% for GTX-104. Consequently, about one-twelfth the amount of nimodipine is delivered with GTX-104 to achieve the same blood levels as with the oral capsules.

No serious adverse events and no adverse events leading to withdrawal were reported during the study.

Next Step – Initiate Phase 3 Safety Study for GTX-104

We plan to submit the final PK bridging study report to the FDA and to request a Type C meeting with the FDA to get the agency’s guidance on our proposed phase 3 study design. We expect to receive that guidance by the end of 2022 or early in the first calendar quarter of 2023. We anticipate that this feedback should allow us to initiate the Phase 3 Safety Study and enroll the first patient in the first half of 2023. The study is expected to take about 18 months to complete, and we expect this safety study to be the final clinical step required to seek approval under the 505(b)(2) regulatory pathway. Before submitting a New Drug Application to the FDA, Acasti plans to hold a pre-NDA meeting to enhance the likelihood of market approval.

GTX-102 Overview

GTX-102 is a novel, concentrated oral-mucosal spray of betamethasone intended to improve neurological symptoms of Ataxia Telangiectasia (“A-T”) for which there are currently no FDA-approved therapies. GTX-102 is a stable, concentrated oral spray formulation comprised of glucocorticoid betamethasone that together with other excipients can be sprayed conveniently over the tongue of the A-T patient and is rapidly absorbed.

About Ataxia Telangiectasia

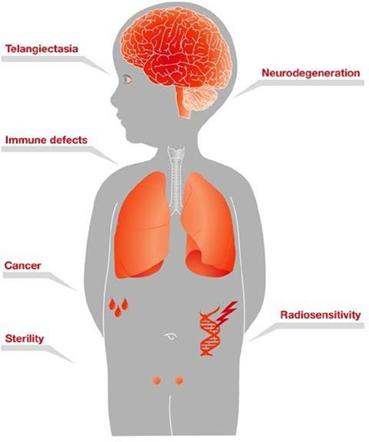

A-T is a rare genetic progressive autosomal recessive neurodegenerative disorder that affects children, with the hallmark symptoms of cerebellar ataxia and other motor dysfunction, and dilated blood vessels (telangiectasia) that occur in the sclera of the eyes. A-T is caused by mutations in the ataxia telangiectasia gene, which is responsible for modulating cellular response to stress, including breaks in the double strands of DNA.

Children with A-T begin to experience balance and coordination problems when they begin to walk (toddler age), and ultimately become wheelchair-bound in their second decade of life. In pre-adolescence (between ages 5 and 8), patients experience oculomotor apraxia, dysarthria, and dysphagia. They also often develop compromised immune systems and are at increased risk of developing respiratory tract infections and cancer (typically lymphomas and leukemia) (U.S. National Cancer Institute A-T, 2015).

24

A-T is diagnosed through a combination of clinical assessment (especially neurologic and oculomotor deficits), laboratory analysis, and genetic testing. There is no known treatment to slow disease progression, and treatments that are used are strictly aimed at controlling the symptoms (e.g., physical, occupational or speech therapy for neurologic issues), or conditions secondary to the disease (e.g., antibiotics for lung infections, chemotherapy for cancer, etc.) (U.S. National Cancer Institute A-T, 2015). There are no FDA-approved therapeutic options currently available. Patients typically die by age 25 from complications of lung disease or cancer. According to a third-party report commissioned by Acasti Pharma US, A-T affects approximately 4,300 patients per year in the United States and has a potential total addressable market of $150 million, based on the number of treatable patients in the United States.

GTX-102 - R&D and Clinical Studies to Date

In a multicenter, double-blind, randomized, placebo-controlled crossover trial conducted in Italy, Zannolli et al. studied the effect of an oral liquid solution of betamethasone on the reduction of ataxia symptoms in 13 children (between ages 2 to 8 years) with A-T. The primary outcome measure was the reduction in ataxia symptoms as assessed by the International Cooperative Ataxia Rating Scale (“ICARS”).

In the trial, oral liquid betamethasone reduced the ICARS total score by a median of 13 points in the intent-to-treat (“ITT”) population and 16 points in the per-protocol (“PP”) population (the median percent decreases of ataxia symptoms of 28% and 31%, respectively). Adverse events in the trial were minimal, with no compulsory withdrawals and only minor side effects that did not require medical intervention. Clinical study results in A-T patients administered oral betamethasone indicated that betamethasone significantly reduced ICARS total score relative to placebo (P = 0.01). The median ICARS change score (change in score with betamethasone minus change in score with placebo) was -13 points (95% confidence interval for the difference in medians was -19 to -5.5 points).

Based on the Zannolli data, we believe that our GTX-102 concentrated oral spray has the potential to provide clinical benefits in decreasing A-T symptoms, including assessments of posture and gait disturbance and kinetic, speech and oculomotor functions. In addition, GTX-102 may ease drug administration for patients experiencing A-T given its application of 1-3x/day of 140µL of concentrated betamethasone liquid sprayed onto the tongue using a more convenient metered dose delivery system, as these A-T patients typically have difficulty swallowing (lefton-greif 2000).

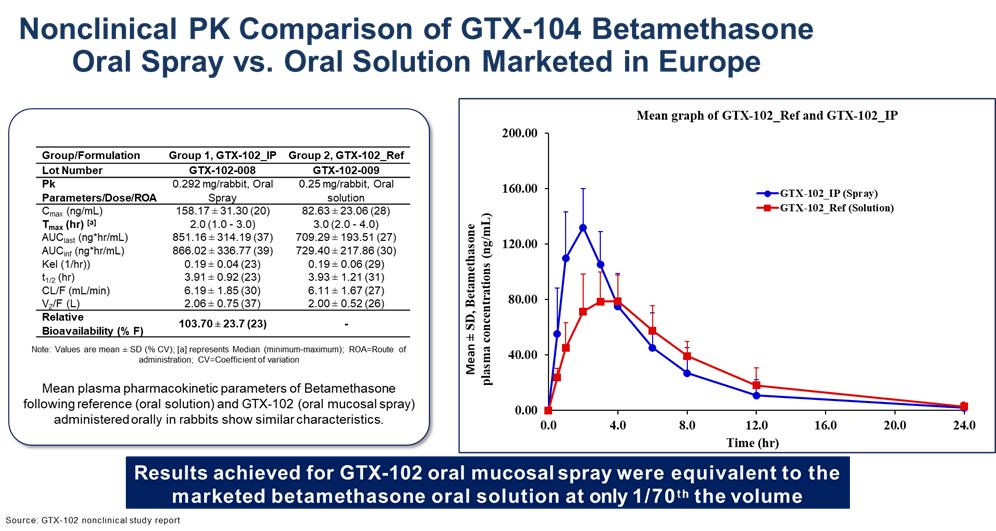

GTX-102 PK Data to Date:

GTX-102 administered as a concentrated oral spray achieves similar blood levels at only 1/70th the volume of an oral solution of betamethasone. This more convenient mode of administration will be important for A-T patients who have difficulties swallowing large volumes of liquids.

GTX-102 Near-Term Milestones: Conduct PK Bridging and Confirmatory Phase 3 Clinical Trials

Acasti Pharma US has licensed the data from the multicenter, double-blinded, randomized, placebo-controlled crossover trial from Azienda Ospedaliera Universitaria Senese, Siena, Italy, where Dr. Zannolli et. al. studied the effect of oral liquid solution of betamethasone to reduce ataxia symptoms in patients with A-T. Note that this oral liquid solution is not marketed in the United States, and therefore is not available for clinical use; currently, betamethasone is only available in the United States as an injectable or as a topical cream. This license gives Acasti Pharma US the right to reference the study’s data in its NDA filing. On November 12, 2015, Acasti Pharma US submitted the data from the Zannolli study to the FDA’s Division of Neurology at a pre-Investigational New Drug (“IND”) meeting and received guidance from the agency on the regulatory requirements to seek approval.

We plan to initiate a PK bridging study of our proprietary concentrated oral spray as compared to the oral liquid solution of betamethasone used in the Zannolli study and against the injectable form of betamethasone that is approved in the U.S. in the third calendar quarter of 2022. We expect to report the results of this study before the end of 2022. Assuming the PK bridging study meets its primary endpoint, we plan to conduct a confirmatory Phase 3 safety

25

and efficacy trial in A-T patients, and plan to seek guidance from the FDA on the study design at a Type B meeting. The Phase 3 study is expected to be initiated in the second half of 2023. If both studies meet their primary endpoints, a Pre-NDA meeting and an NDA filing under Section 505(b)(2) would follow.

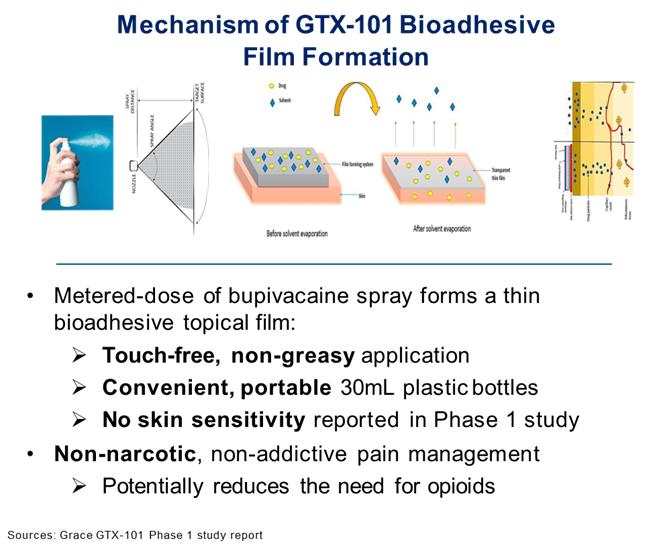

GTX-101 Overview