10-K: Annual report pursuant to Section 13 and 15(d)

Published on June 21, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

or

For the transition period from |

|

to |

|

Commission file number:

(Exact name of registrant as specified in its charter)

Québec, |

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Name of each exchange on which registered |

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

☒ |

Smaller reporting company |

||

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

The aggregate market value of the voting and non-voting common shares held by non-affiliates of the registrant, based on the closing sale price of the registrant’s common shares on the last business day of its most recently completed second fiscal quarter, as reported on the NASDAQ Stock Market, was approximately $110,720,458.

The number of outstanding common shares of the registrant, no par value per share, as of June 21, 2022, was

Auditor Firm Id:

Documents Incorporated by Reference

Portions of the registrant’s Definitive Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 2022 Annual Meeting of Shareholders, to be filed subsequent to the date hereof, are incorporated by reference into Part III of this annual report. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission not later than 120 days after the conclusion of the registrant’s fiscal year ended March 31, 2022.

ACASTI PHARMA INC.

FORM 10-K

For the Fiscal Year Ended March 31, 2022

Table of Contents

|

|

|

|

|

Item 1. |

8 |

|

|

Item 1A. |

19 |

|

|

Item 1B. |

39 |

|

|

Item 2. |

39 |

|

|

Item 3. |

39 |

|

|

Item 4. |

39 |

|

|

|

|

|

|

Item 5. |

40 |

|

|

Item 6. |

43 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operation |

44 |

|

Item 7A. |

54 |

|

|

Item 8. |

54 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

54 |

|

Item 9A. |

54 |

|

|

Item 9B. |

54 |

|

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

|

|

|

|

|

Item 10. |

55 |

|

|

Item 11. |

55 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

55 |

|

Item 13. |

Certain Relationships and Related Transactions and Director Independence |

55 |

|

Item 14. |

55 |

|

|

|

|

|

|

Item 15. |

56 |

|

|

Item 16. |

56 |

|

|

|

||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains information that may be forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of U.S. federal securities laws, both of which we refer to in this annual report as forward-looking information. Forward- looking information can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not statements about the present or historical facts. Forward-looking information in this annual report includes, among other things, information or statements about:

Although the forward-looking statements in this annual report are based upon what we believe are reasonable assumptions, you should not place undue reliance on those forward-looking statements since actual results may vary materially from them. Important assumptions made by us when making forward-looking statements include, among other things, assumptions by us that:

In addition, the forward-looking statements in this annual report are subject to a number of known and unknown risks, uncertainties and other factors many of which are beyond our control, that could cause our actual results and developments to differ materially from those that are disclosed in or implied by the forward-looking statements, including, among others:

All of the forward-looking statements in this annual report are qualified by this cautionary statement. There can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the consequences or effects on our business, financial condition, or results of operations that we anticipate. As a result, you should not place undue reliance on the forward-looking statements. Except as required by applicable law, we do not undertake to update or amend any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are made as of the date of this annual report.

We express all amounts in this annual report in U.S. dollars, except where otherwise indicated. References to “$” and “U.S.$” are to U.S. dollars and references to “C$” or “CAD$” are to Canadian dollars.

Except as otherwise indicated, references in this annual report to “Acasti,” “the Corporation,” “we,” “us” and “our” refer to Acasti Pharma Inc. and its consolidated subsidiaries, including Acasti Pharma U.S., which is formerly Grace.

PART I

Item 1. Business

Overview

On August 27, 2021, we completed our acquisition of Grace via a merger following the approval of Acasti’s shareholders and Grace’s stockholders. Following completion of the merger, Grace became a wholly owned subsidiary of Acasti and was renamed Acasti Pharma U.S. Inc.

The successful completion of the merger positions Acasti to build a premier, late-stage specialty pharmaceutical company focused on developing and commercializing products for rare and orphan diseases that have the potential to improve clinical outcomes by using the Company’s novel drug delivery technologies. We seek to apply new proprietary formulations to approved and marketed pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, and more convenient drug delivery and increased patient compliance; all of which could result in improved patient outcomes. The active ingredients chosen by Acasti for further development may be already approved in a target indication or could be repurposed for use in new indications.

The existing well understood efficacy and safety profiles of these marketed compounds provides the opportunity for us to utilize the Section 505(b)(2) regulatory pathway under the Federal Food, Drug and Cosmetic Act (the “FFDCA”) for our reformulated versions of these drugs, and therefore may provide a potentially shorter path to regulatory approval. Under Section 505(b)(2), if sufficient support of a product’s safety and efficacy either through previous FDA experience or sufficiently within the scientific literature can be established, it may eliminate the need to conduct some of the early studies that new drug candidates might otherwise require.

In connection with the merger, we acquired Grace’s entire therapeutic pipeline, which has the potential to address critical unmet medical needs for the treatment of rare and orphan diseases. The pipeline consists of three unique clinical stage and multiple pre-clinical stage assets supported by an intellectual property portfolio of more than 40 granted and pending patents in various jurisdictions worldwide. These drug candidates aim to improve clinical outcomes by applying proprietary formulation and drug delivery technologies to existing pharmaceutical compounds to achieve improvements over the current standard of care, or to provide treatment for diseases with no currently approved therapies.

Rare disorders represent an attractive area for drug development, and there remains an opportunity for Acasti to utilize already approved drugs that have established safety profiles and clinical experience to potentially address significant unmet medical needs. A key advantage of pursuing therapies for rare disorders is the potential to receive orphan drug designation (“ODD”) from the FDA. ODD provides for seven years of marketing exclusivity in the United States post-launch, provided certain conditions are met. Rare diseases also allow for more manageably scaled clinical trials and provide market opportunities that may require a smaller, more targeted commercial infrastructure.

The specific diseases targeted for drug development by Acasti are well understood although these patient populations may remain poorly served by available therapies or in some cases approved therapies do not yet exist. We aim to effectively treat debilitating symptoms that result from these underlying diseases.

Our three most advanced programs are:

Our management team possesses significant experience in drug delivery research and evaluation, clinical and pharmaceutical development and manufacturing, regulatory affairs, and business development, as well as being well-versed in late-stage drug development and commercialization. The Acasti team has been collectively involved in the development and approval of several successful marketed drugs, including TORADOL, NAPROSYN, ANDROGEL, SUBSYS, MARINOL and KEPPRA XR, Claritin®, Euflex®, Effexor®, Sonata®, Ativan®, RD-Heparin®, Rapamune®, Etodolac Aricept®, Cardizem®, Deflazacort®, Macimorelin®

8

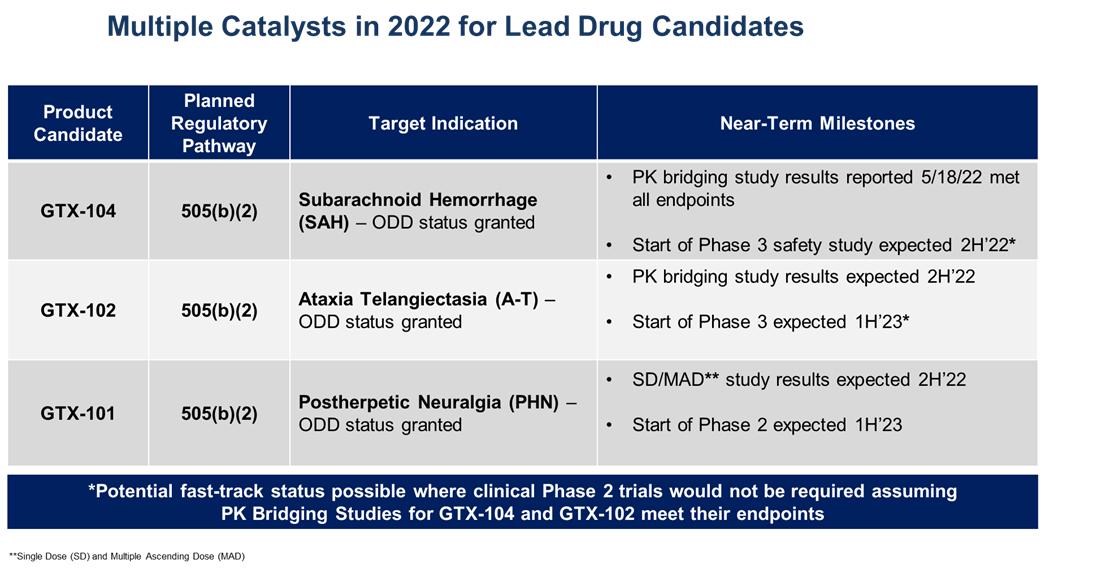

The table below summarizes planned key 2022 calendar year milestones for our three clinical drug candidates:

GTX-104 Overview

Nimodipine was granted FDA approval in 1988, and is the only drug approved to improve neurological outcomes in SAH. It is only available in the United States as a generic oral capsule and as a branded oral liquid solution called NYMALIZE, which is manufactured and sold by Arbor Pharmaceuticals. Nimodipine has poor water solubility and high permeability characteristics as a result of its high lipophilicity. Additionally, orally administered nimodipine has dose-limiting side-effects such as hypotension, poor absorption and low bioavailability resulting from high first-pass metabolism, and a narrow administration window as food effects lower bioavailability significantly. Due to these issues, blood levels of orally administered nimodipine can be highly variable, making it difficult to manage blood pressure in SAH patients. Nimodipine capsules are also difficult to administer, particularly to unconscious patients or those with impaired ability to swallow. Concomitant use with CYP3A inhibitors is contraindicated (NIMODIPINE Capsule PI).

NIMOTOP is an injectable form of nimodipine that is manufactured by Bayer Healthcare. It is approved in Europe and in other regulated markets (but not in the United States), but it has limited utility for SAH patients because of its high organic solvent content, namely 23.7% ethanol and 17% polyethylene glycol 400 (NIMOTOP SmPC).

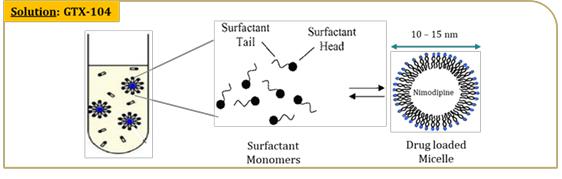

GTX-104 is a clinical stage, novel formulation of nimodipine for IV infusion in SAH patients. It uses surfactant micelles as the drug carrier to solubilize nimodipine. This unique nimodipine injectable formulation is composed of a nimodipine base, an effective amount of polysorbate 80, a non-ionic hydrophilic surfactant, and a pharmaceutically acceptable carrier for injection. GTX-104 is an aqueous solution substantially free of organic solvents, such that the nimodipine is contained in a concentrated injection solution, suspension, emulsion or complex as a micelle, a colloidal particle or an inclusion complex, and the formulation is stable and clear.

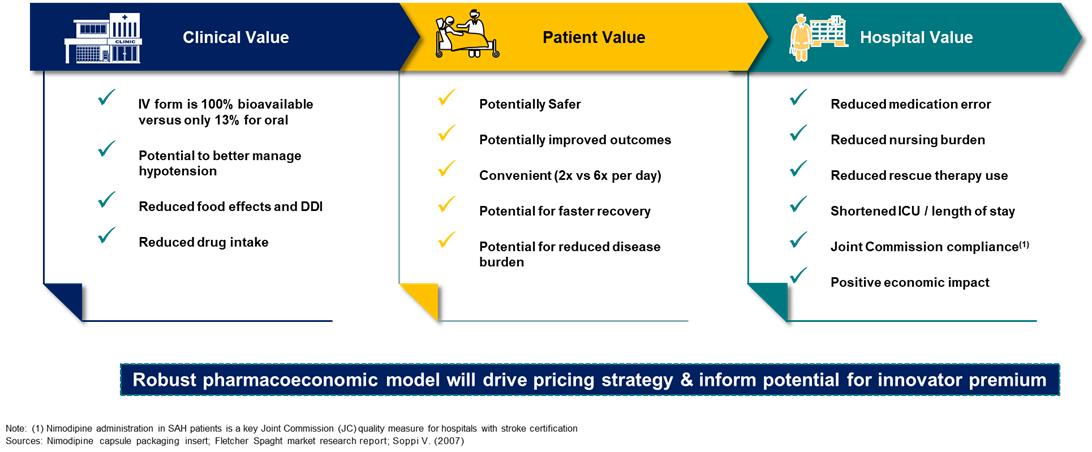

Key Benefits: Novel nanoparticle technology facilitates aqueous formulation of insoluble nimodipine and enables a safe, standard peripheral IV infusion:

9

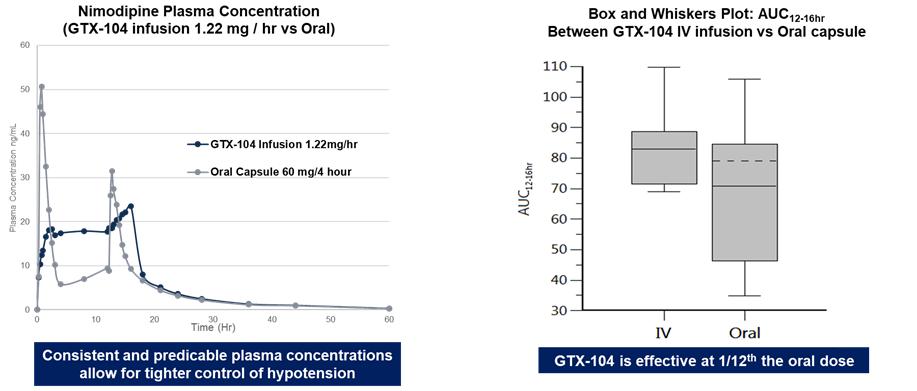

GTX-104 could provide a more convenient mode of administration as compared to generic nimodipine capsules or NYMALIZE GTX-104 is peripherally infused every four hours as compared to administration via a nasogastric tube in unconscious patients every two to four hours for both NYMALIZE oral solution and nimodipine oral capsules. Therefore, GTX-104 could be considered as a major contribution to patient care by potentially reducing the dosing frequency, and the associated nursing burden. More convenient and less frequent dosing can also reduce the risk of medication errors. In addition, two PK studies conducted with GTX-104 has shown that it has the potential to provide improved bioavailability and lower intra-subject variability compared to oral administration. Because of its IV formulation, we also expect it to reduce certain drug-drug interactions and food effects.

Despite the positive impact it has on recovery, physicians often must discontinue their patients on oral nimodipine, primarily as a result of hypotensive episodes that cannot be controlled by titrating the oral form of drug. Such discontinuation could potentially be avoided by administering GTX-104, which because of its IV administration, may obviate the complexity that results from the need for careful attention to the timing of nimodipine administration at least one hour before or two hours after a meal. Administration of GTX-104 via a peripheral vein is often much more comfortable for the patients compared to administration by central venous access, which can often be a difficult and invasive procedure. Also, unconscious patients will likely receive more consistent concentrations of nimodipine when delivered by the IV route as compared to oral gavage or a nasogastric tube. More consistent dosing is expected to result in a reduction of vasospasm and a better, more consistent management of hypotension. As summarized in the table below, we anticipate reduced use of rescue therapies, such as vasopressors, and expensive hospital resources, such as the angiography suite, are possible by more effectively managing blood pressure with GTX-104. Reduced incidences of vasospasm could result in shorter length of stay and better outcomes.

About Subarachnoid Hemorrhage (SAH)

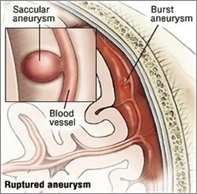

SAH is bleeding over the surface of the brain in the subarachnoid space between the brain and the skull, which contains blood vessels that supply the brain. A primary cause of such bleeding is rupture of an aneurysm. The result is a relatively uncommon type of stroke that accounts for about 5% of all strokes and has an incidence of six per 100,000 person years (Becske, 2018).

In contrast to more common types of stroke in elderly individuals, an SAH often occurs at a relatively young age, with approximately half the affected patients younger than 60 years old (Becske, 2018). Particularly devastating for patients younger than 45, around 10% to 15% of aneurysmal SAH (“aSAH”) patients die before reaching the hospital (Rinkel, 2016), and those who survive the initial hours post hemorrhage are admitted or transferred to tertiary care centers with high risk of complications, including rebleeding and delayed cerebral ischemia (“DCI”). Systemic manifestations affecting cardiovascular, pulmonary, and renal function are common and often complicate management of DCI. Approximately 70% of aSAH patients experience death or a permanent dependence on family members, and half die within one month after the hemorrhage. Of those who survive the initial month, half remain permanently dependent on a caregiver to maintain daily living (Becske, 2018).

Treatment offerings currently include sustained hypervolemia, hemodilution, and/or induced hypertension (Triple-H therapy), calcium antagonists and angioplasty. Because vasospasm may result from an increase of calcium in the vascular smooth-muscle cell, a medical rationale has emerged for the use of calcium antagonists. The addition of calcium antagonists like nimodipine to the treatment arsenal for the prevention of cerebral vasospasm after aSAH is based on the notion that these drugs can counteract the influx of calcium into the vascular smooth-muscle cell (Rinkel, 2002).

10

The incidence of SAH in the United States is approximately 10 in every 100,000 persons per year (Becske, 2016; NINDS, 2016; Ingall, 1989; Schievink, 1995; Schievink, 1997; Zacharia, 2010), based on multiple analyses of the population of Rochester, Minnesota. Ingall (1989) studied the incidence of SAH in this population over the 40-year period from 1945 through 1984. At that time, the population of Rochester lent itself well to epidemiological studies because medical care was provided primarily by the Mayo Clinic. Over this period, the average annual incidence rate of aSAH remained constant at approximately 11 per 100,000 population. More recently, the American Heart Association/American Stroke Association Guidelines for the Management of Aneurysmal Subarachnoid Hemorrhage (Connolly, 2012) refer to the 2003 Nationwide Inpatient Sample as providing an annual estimate of 14.5 discharges for aSAH per 100,000 adults, although, because death resulting from aSAH often occurs before hospital admission (in an estimated 10% to 15% of cases), the true incidence may be higher. According to the U.S. Census Bureau, Population Estimates for 2015, the U.S. population was estimated at 321,418,820. Therefore, we estimate that approximately 53,596 individuals experience aSAH each year. The total addressable market for SAH is approximately $300 million in the U.S., and an estimated 50,000 patients in the European Union based on annual inpatient admissions and the average length-of-stay.

GTX-104—R&D History and Clinical Studies to Date

During 2017 and 2018, Acasti Pharma U.S. (formerly Grace) evaluated GTX-104 in a four-part, single center, randomized, safety and dose-escalation and crossover study in over 80 healthy male and female subjects designed to assess the PK, bioavailability (“BA”), and the safety of GTX-104 administered via IV infusion compared to nimodipine oral capsules.

Details of the four-part PK study follow below:

Part One: |

|

|

|

|

|

|

|

|

Primary Objective: |

|

Evaluate the preliminary cardiovascular safety and tolerability of incremental doses of IV GTX-104 in healthy male and female subjects |

|

|

|

Method: |

|

Evaluate incremental dose-escalation of GTX-104 administered at dose levels of 0.3 mg/h to 1.22 mg/h over 16 hours, with dose-escalation occurring every 4 hours (0.3, 0.6, 0.9, and 1.22 mg/h) |

|

|

|

Adverse Events: |

|

Arthralgia, constipation, flatulence, headache, infusion site irritation, peripheral edema, and vomiting—all adverse events (“AEs”) were rated as mild in severity |

Part Two: |

|

|

|

|

|

|

|

|

Primary Objective: |

|

Evaluate the PK and BA of GTX-104 administered via IV infusion compared to the reference product of oral nimodipine capsules and to select the dose of IV GTX-104 with an exposure profile most closely matching that of oral nimodipine capsules |

|

|

|

Method: |

|

Two-period, crossover BA study. Pilot study that evaluated GTX-104 administered open-label as 1.22 mg/h continuous IV infusion for 16 hours compared to oral nimodipine (60 mg every 4 hours for 12 hours) in 12 subjects |

|

|

|

Adverse Events: |

|

No serious adverse events ("SAEs") in any subjects. 20.0% of subjects reported non-serious AEs following administration of GTX-104 compared to 50.0% of subjects reporting AEs following administration of oral nimodipine |

Part Three: |

|

|

|

|

|

|

|

|

Primary Objective: |

|

Determine the comparative bioavailability of IV GTX-104 versus oral nimodipine capsules and to evaluate the safety and tolerability of IV GTX 104 compared to oral nimodipine capsules in healthy male and female subjects |

|

|

|

Method: |

|

BA study, with GTX-104 administered as 1.1 mg/h continuous IV infusion for 28 hours compared to oral nimodipine capsules administered every four hours for 24 hours at a dose level of 60 mg in approximately 32 subjects |

|

|

|

Adverse Events: |

|

No SAEs; 20.0% of the subjects reported non-serious AEs following administration of GTX-104 whereas 8 (50.0%) subjects reported AEs following administration of oral nimodipine. Fourteen (34.1%) subjects reported AEs following administration of GTX-104 whereas 18 (43.9%) subjects reported AEs following administration of oral nimodipine |

Part Four: |

|

|

|

|

|

|

|

|

Primary Objective: |

|

Determine the comparative BA of IV GTX-104 versus oral nimodipine capsules and to evaluate the safety and tolerability of IV GTX 104 compared to oral nimodipine capsules in healthy male and female subjects |

|

|

|

Method: |

|

BA study: extension study with the same study design as Part Three, where only GTX-104 was administered open-label as a continuous IV infusion of 1.4 mg/h for 36 hours with oral nimodipine administered for 20 hours (approximately 24 subjects) |

|

|

|

Adverse Events: |

|

No SAEs: 10 (41.7%) subjects reported AEs following administration of GTX-104 whereas eight (36.4%) subjects reported AEs following administration of oral nimodipine |

11

GTX-104 Near Term Milestones: - Conduct PK Bridging and Phase 3 Safety Studies

In September 2021, we initiated our pivotal PK bridging study to evaluate the relative bioavailability of GTX-104 compared to currently marketed oral nimodipine capsules in approximately 50 healthy subjects. The PK study was the next required step in our proposed 505(b)(2) regulatory pathway for GTX-104.

Interim results were reported on December 2, 2021, and we believed at the time and it turned out to be correct, that the tight correlation of the primary endpoint data for the first 20 patients was a strong indication that GTX-104 could achieve comparable bioavailability with oral nimodipine in the full study cohort of 50 subjects. As observed in a previous PK study, the inter- and intra-subject variability in the interim analysis was much lower for GTX-104 as compared with oral nimodipine. There were no serious adverse events observed in the first 20 subjects, and only mild adverse events were reported in both groups such as headaches, that were resolved with common medications.

Final results from this pivotal PK study were reported on May 18, 2022, and showed that the bioavailability of IV GTX-104 compared favorably with the oral formulation of nimodipine in all subjects, and no serious adverse events were observed for GTX-104.

The PK study was completed at a single center in Canada and followed a 2-period crossover design where each subject received IV GTX-104 first, followed by oral nimodipine; or oral nimodipine first, followed by IV GTX-104. Fifty-eight subjects were randomized in a ratio of 1:1 between IV GTX-104 first or oral nimodipine first. IV GTX-104 and oral nimodipine was administered to all subjects over a period of 72 hours. A total of 56 and 55 subjects were included in the PK analysis at Day 1 and Day 3, respectively, as two subjects did not complete one of the two periods and one subject was excluded due to a protocol deviation, as prospectively defined in the statistical analysis plan.

The primary PK endpoints were maximum concentration (expressed as Cmax) during the first 4 hours on Day 1 and the total amount of nimodipine in the blood (expressed as the area under the curve (AUCDay 3, 0-24hr)) on Day 3. The secondary endpoint was Cmax measured over 24 hours on Day 3. The ratio of IV/oral is presented below for each endpoint with the corresponding 90% confidence interval (CI). A ratio of 1 indicates no absolute difference between IV GTX-104 and oral nimodipine.

The IV/oral ratio (%) and its corresponding 90% CI (range) for the primary and secondary endpoints in the subjects who completed each treatment period were as follows:

Day 1 Cmax, 0-4hr: 92% (82 – 104)

AUCDay 3, 0-24hr: 106% (99 – 114)

Day 3 Cmax, 0-24hr: 92% (85 – 101)

All three endpoints indicated that statistically there was no difference in exposures between IV GTX-104 and oral nimodipine over the defined time periods for both maximum exposure and total exposure. Plasma concentrations obtained following IV administration showed significantly less variability between subjects as compared to oral administration of capsules, since IV administration is not as sensitive to some of the physiological processes that affect oral administration, such as taking the drug with and without meals, variable gastrointestinal transit time, variable drug uptake from the gastrointestinal tract into the systemic circulation, and variable hepatic blood flow and hepatic first pass metabolism. Previous studies have shown these processes significantly affect the oral bioavailability of nimodipine, and therefore cause oral administration to be prone to larger within and between-subject variability.

The bioavailability of oral nimodipine capsules observed was only 8% compared to IV GTX-104. Consequently, less than one-tenth the amount of nimodipine is delivered with GTX-104 to achieve the same blood levels as with the oral capsules. In addition, the diurnal variation associated with IV GTX-104 was approximately half of that seen with the oral nimodipine capsules. Diurnal variation takes into consideration variation in body functions (blood flow, renal function and hepatic metabolism) over the course of a day.

No serious adverse events and no adverse events leading to withdrawal were reported during the study. More gastro-intestinal disorders were observed with oral nimodipine (16% vs 7% for IV GTX-104), and as expected in the context of a phase I trial conducted in healthy volunteers, more administration and sampling site related events were observed with IV GTX-104 (41% vs 11% for oral nimodipine). The other most frequently observed adverse events (IV/oral) were headache (36%/36%), somnolence (9%/13%) and hot flashes/flushing (10%/11%).

We plan to submit these results to the FDA, along with our proposed study design for the Phase 3 safety study which continues on track to start in the second half of 2022. We expect the safety study to be the final step required to seek approval under the 505(b)(2) regulatory pathway before submitting a New Drug Application to the FDA.

12

GTX-102 Overview

GTX-102 is a novel, concentrated oral-mucosal spray of betamethasone intended to improve neurological symptoms of Ataxia Telangiectasia (“A-T”) for which there are currently no FDA-approved therapies. GTX-102 is a stable, concentrated oral spray formulation comprised of the glucocorticoid betamethasone, that together with other excipients can be sprayed conveniently over the tongue of the A-T patient.

About Ataxia Telangiectasia

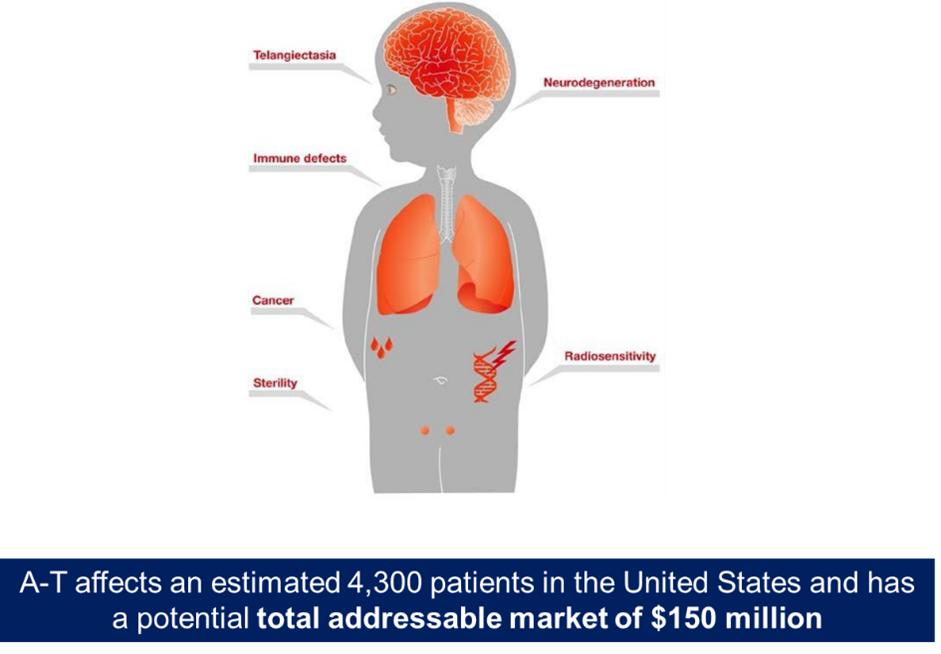

A-T is a rare genetic progressive autosomal recessive neurodegenerative disorder that affects children, with the hallmark symptoms of cerebellar ataxia and other motor dysfunction, and dilated blood vessels (telangiectasia) that occur in the sclera of the eyes. A-T is caused by mutations in the ataxia telangiectasia gene, which is responsible for modulating cellular response to stress, including breaks in the double strands of DNA.

Children with A-T begin to experience balance and coordination problems when they begin to walk (toddler age), and ultimately become wheelchair-bound in their second decade of life. In pre-adolescence (between ages 5 and 8), patients experience oculomotor apraxia, dysarthria, and dysphagia. They also often develop compromised immune systems and are at increased risk of developing respiratory tract infections and cancer (typically lymphomas and leukemia) (U.S. National Cancer Institute A-T, 2015).

A-T is diagnosed through a combination of clinical assessment (especially neurologic and oculomotor deficits), laboratory analysis, and genetic testing. There is no known treatment to slow disease progression, and treatments that are used are strictly aimed at controlling the symptoms (e.g., physical, occupational or speech therapy for neurologic issues), or conditions secondary to the disease (e.g., antibiotics for lung infections, chemotherapy for cancer, etc.) (U.S. National Cancer Institute A-T, 2015). There are no FDA-approved therapeutic options currently available. Patients typically die by age 25 from complications of lung disease or cancer. According to a third-party report commissioned by Acasti Pharma US, A-T affects approximately 4,300 patients per year in the United States and has a potential total addressable market of $150 million, based on the number of treatable patients in the United States.

The U.S. National Institutes of Health (NIH) Genetics Home Reference, the U.S. National Organization for Rare Disorders (NORD), the U.S. National Cancer Institute, and the United States National Ataxia Foundation, all estimate the incidence of A-T worldwide to be between 1:40,000 and 1:100,000 live births. It has been reported in all races throughout the world and is represented equally in males and females (Lavin, 2007; Sedgwick and Boder, 1972).

For the purposes of estimating prevalence, the maximum survival age observed by Crawford et al., 40 years, has been used. Assuming a maximum survival of 40 years, the total number of A-T cases has been calculated from 1975 to 2015. The highest incidence rate reported in the United States of 1:40,000 has been used to obtain an estimate of A-T prevalence today. Between 1975 and 2015, the highest number of births in one year was 4,316,233 in 2007 (Martin, 2010; Martin, 2015) and so for the purposes of this prevalence calculation, this has been taken as the number of births per year.

Total A-T cases/year = 25 A-T births/million live births x 4.32 million live births/year = 108 new A-T cases/year. Assuming that all 108 people possibly born with A-T are still alive today, the total number of individuals with A-T today in the United States, at the very outside estimate = 108 births/year x 40 years = 4320 cases. With a U.S. population of 321,251,852 (United States Census Bureau) the highest estimated prevalence of A-T is 4320:321,251,852 or 1:74,364.

GTX-102—R&D and Clinical Studies to Date

In a multicenter, double-blind, randomized, placebo-controlled crossover trial conducted in Italy, Zannolli et al. studied the effect of an oral liquid solution of betamethasone on the reduction of ataxia symptoms in 13 children (between ages 2 to 8 years) with A-T. Patients were randomly assigned to first receive either betamethasone or placebo at a dose of 0.1 mg/kg/day for 30 days: at full dose for the first 10 days, at a tapered dose on days 11–20 (i.e., for 4 days, 0.075 mg/kg/day; for 4 days, 0.050 mg/kg/day; and for 2 days, 0.025 mg/kg/day); and at full dose for the last 10 days (the full dose was tapered in the middle of the treatment phase to reduce risk from potential functional suppression of the hypothalamus-hypophysis-adrenal axis). Each phase of the trial was followed by a washout period of 30 days. The primary outcome measure was the reduction in ataxia symptoms as assessed by the International Cooperative Ataxia Rating Scale (“ICARS”).

In the trial, oral liquid betamethasone reduced the ICARS total score by a median of 13 points in the intent-to-treat (“ITT”) population and 16 points in the per-protocol (“PP”) population (the median percent decreases of ataxia symptoms of 28% and 31%, respectively). In the ITT population, significant improvements were observed in the posture and gait disturbance (p = 0.02), kinetic function (p = 0.02), and speech disorders ICARS subscales (p = 0.02), but not in the oculomotor disorders subscale (p > 0.05). Similar results were found in the PP population. Adverse events in the trial were minimal, with no compulsory withdrawals and only minor side effects that did not require medical intervention. Small increases in body weight were observed in 12 patients on betamethasone and in 4 patients on placebo. Moon face was present in 8 patients on betamethasone. Clinical study results in A-T patients administered oral betamethasone indicated that betamethasone significantly reduced ICARS total score relative to placebo (P = 0.01). The median ICARS change score (change in score with betamethasone minus change in score with placebo) was -13 points (95% confidence interval for the difference in medians was -19 to -5.5 points).

13

|

|

Clinical Study Results in A-T Patients Administered Oral Betamethasone |

|

|||||||||||||

|

|

Placebo |

|

Betamethasone |

|

Efficacy |

|

|||||||||

ICARS |

|

Day -1 |

|

Day 31 |

|

Day -1 |

|

Day 31 |

|

Db |

|

95% Cl for the |

|

P valuec |

|

|

Total score |

|

46 (14-69) |

|

41.5 (26-68) |

|

50 (20-68) |

|

33 (19-55) |

|

-13 (-28 to 14) |

|

-19 to -5.5 |

|

|

0.01 |

|

I. Posture and gait disturbance |

|

13.5 (3-30) |

|

14.5 (7-30) |

|

18 (7-29) |

|

9 (4-26) |

|

-5 (-15 to 5) |

|

-9.5 to -1.5 |

|

|

0.02 |

|

II. Kinetic function |

|

22 (6-32) |

|

20.5 (13-31) |

|

23 (10-33) |

|

18 (8-28) |

|

-8 (-15 to 10) |

|

-10 to -0.5 |

|

|

0.02 |

|

III. Speech disorder |

|

3 (1-5) |

|

2.5 (2-5) |

|

3 (2-5) |

|

2 (1-5) |

|

-1 (-3 to 1) |

|

-2.5 to -0.5 |

|

|

0.02 |

|

IV. Oculomotor disorders |

|

3 (2-5) |

|

3.5 (1·5) |

|

3 (1-5) |

|

3 (1-5) |

|

0 (-2 to 2) |

|

-2 to 1 |

|

|

0.43 |

|

Betamethasone significantly reduced ICARS total score relative to placebo (P = .01). The median ICARS change score (change in score with Betamethasone minus change in score with placebo) was -13 points (95% CI for the difference in medians was -19 to -5.5 points).

Based on the Zannolli data, we believe GTX-102 concentrated oral spray has the potential to provide clinical benefits in decreasing A-T symptoms, including assessments of posture and gait disturbance and kinetic, speech and oculomotor functions. In addition, GTX-102 may ease drug administration for patients experiencing A-T given its application of 1-3x/day of 140µL of concentrated betamethasone liquid spray onto the tongue using a more convenient metered dose spray, as these A-T patients typically have difficulty swallowing (lefton-greif 2000).

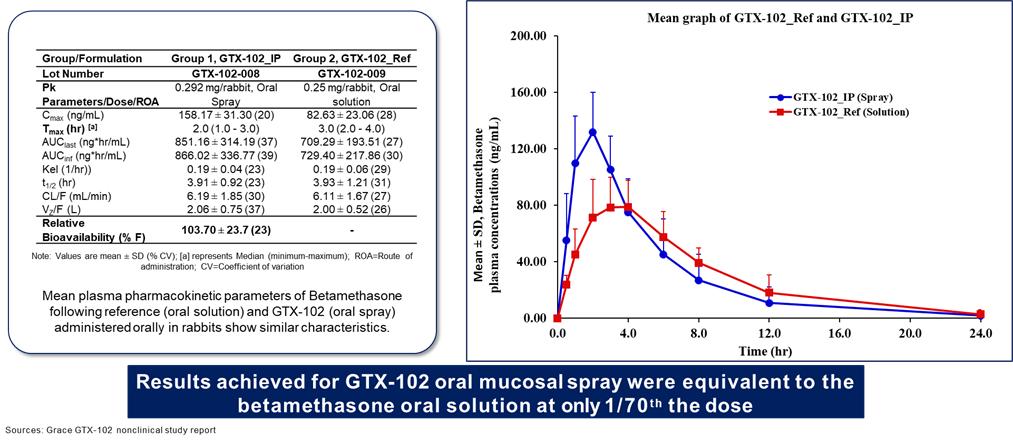

GTX-102 PK Data to Date:

GTX-102 administered as a concentrated oral spray achieves similar blood levels at only 1/70th the volume of an oral solution of betamethasone. This is important for A-T patients who have difficulties swallowing large volumes of liquids, and it could help to reduce the side effects common with chronic use of a glucocorticosteroid drug.

GTX-102 Near-Term Milestones: Conduct PK Bridging and Confirmatory Phase 3 Clinical Trials

Acasti Pharma US has licensed the data from the multicenter, double-blinded, randomized, placebo-controlled crossover trial from Azienda Ospedaliera Universitaria Senese, Siena, Italy, where Dr. Zannolli et. al. studied the effect of oral liquid solution of betamethasone to reduce ataxia symptoms in patients with A-T. Note that this oral liquid solution is not approved in the United States, and therefore is not available for clinical use. Betamethasone is only available in the United States as an injectable or as a topical cream. However, this license gives Acasti Pharma US the right to reference the study’s data in its NDA filing. On November 12, 2015, Acasti Pharma US submitted the data from the Zannolli study to the FDA’s Division of Neurology at a pre-Investigational New Drug (“IND”) meeting and received guidance from the agency on the regulatory requirements to seek approval.

Based on such FDA guidance, we plan to initiate a PK bridging study of our proprietary concentrated oral spray as compared to the oral liquid solution of betamethasone used in the Zannolli study and against the injectable form of betamethasone that is approved in the U.S. in the second calendar quarter of 2022. We expect to report the results of this study before the end of 2022. Based on the FDA’s guidance and assuming the PK bridging study meets its primary endpoint, we plan to conduct a confirmatory Phase 3 safety and efficacy trial in A-T patients. The Phase 3 study is expected to be initiated in the first half of 2023. If both studies meet their primary endpoints, an NDA filing under Section 505(b)(2) would follow.

14

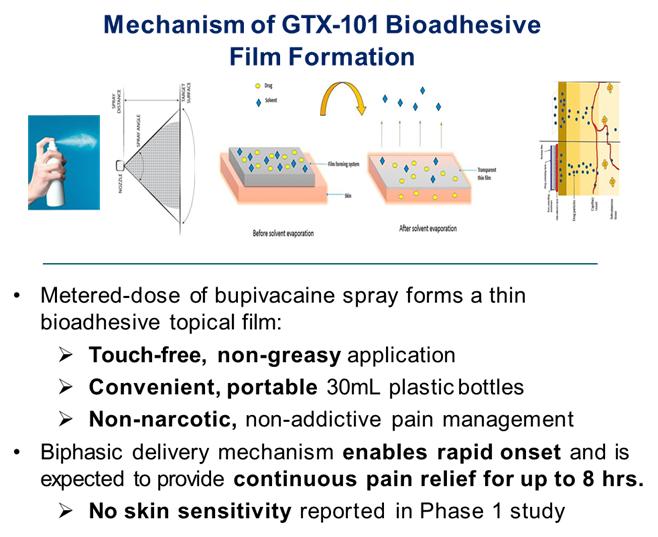

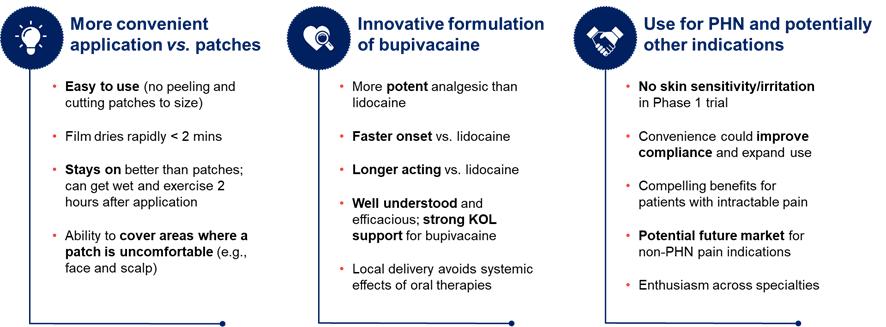

GTX-101 Overview

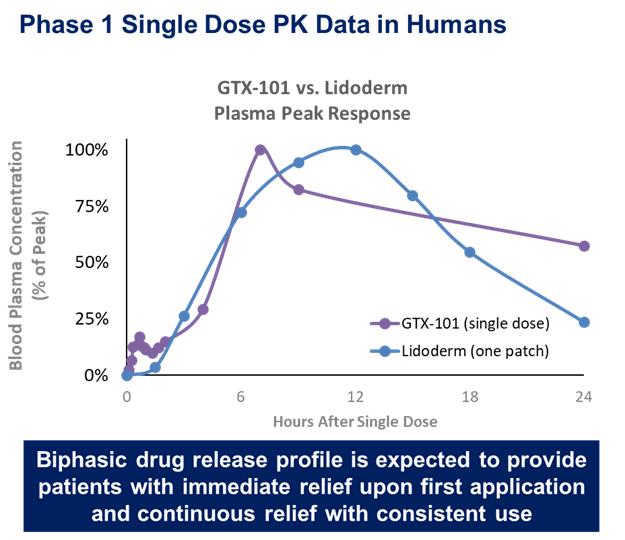

GTX-101 is a non-narcotic, topical bio-adhesive film-forming bupivacaine spray designed to ease the symptoms of patients suffering with postherpetic neuralgia (“PHN”). GTX-101’s metered-dose of bupivacaine spray forms a thin bio-adhesive topical film on the surface of the patient’s skin, which enables a touch-free, non-greasy application. It also comes in convenient, portable 30 ml plastic bottles. Unlike oral gabapentin and lidocaine patches, we believe that the biphasic delivery mechanism of GTX-101 has the potential for rapid onset and continuous pain relief for up to eight hours. No skin sensitivity was reported in a Phase 1 study.

Source: Third party primary market research (2022)

About Postherpetic Neuralgia (PHN)

PHN is neuropathic pain due to damage caused by the varicella zoster virus (“VZV”). Infection with the VZV causes two distinct clinical conditions. Primary VZV infection causes varicella (i.e., chickenpox), a contagious rash illness that typically occurs among young children. Secondary VZV can reactivate clinically, decades after initial infection, to cause herpes zoster (“HZ”), otherwise known as shingles. Acute HZ arises when dormant virus particles, persisting within an affected sensory ganglion from the earlier, primary infection with VZV become reactivated when cellular immunity to varicella decreases. Viral particles replicate and may spread to the dorsal root, into the dorsal horn of the spinal cord, and through peripheral sensory nerve fibers down to the level of the skin. Viral particles also may circulate in the blood. This reactivation is accompanied by inflammation of the skin, immune response, hemorrhage, and destruction of peripheral and central neurons and their fibers. Following such neural degeneration, distinct types of pathophysiological mechanisms involving both the central and peripheral nervous systems may give rise to the severe nerve pain associated with PHN.

While the rash associated with HZ typically heals within two to four weeks, the pain may persist for months or even years, and this PHN manifestation is the most common and debilitating complication of HZ. There is currently no consensus definition for PHN, but it has been suggested by the Centers for Disease Control and Prevention (“CDC”) that PHN is best defined as pain lasting at least three months after resolution of the rash.

PHN is associated with significant loss of function and reduced quality of life, particularly in the elderly. It has a detrimental effect on all aspects of a patients’ quality of life. The nature of PHN pain varies from mild to excruciating in severity, constant, intermittent, or triggered by trivial stimuli. Approximately half of patients with PHN describe their pain as “horrible” or “excruciating,” ranging in duration from a few minutes to constant on a daily or almost daily basis (Katz, 2004). The pain can disrupt sleep, mood, work, and activities of daily living, adversely impacting the quality of life and leading to social withdrawal and depression. PHN is the number-one cause of intractable, debilitating pain in the elderly, and has been cited as the leading cause of suicide in chronic pain patients over the age of 70 (Hess, 1990).

15

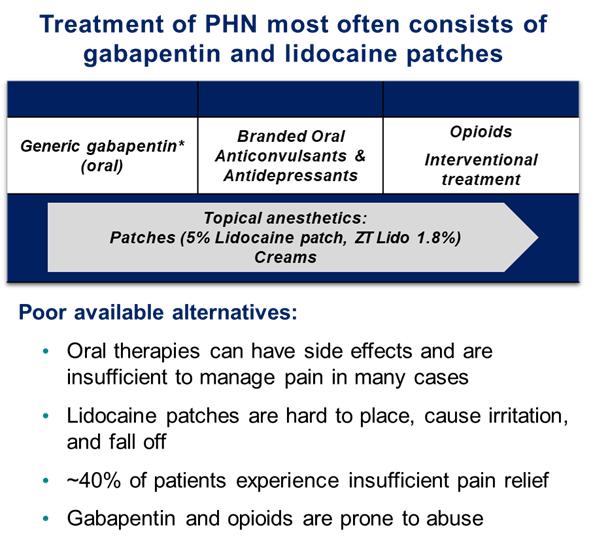

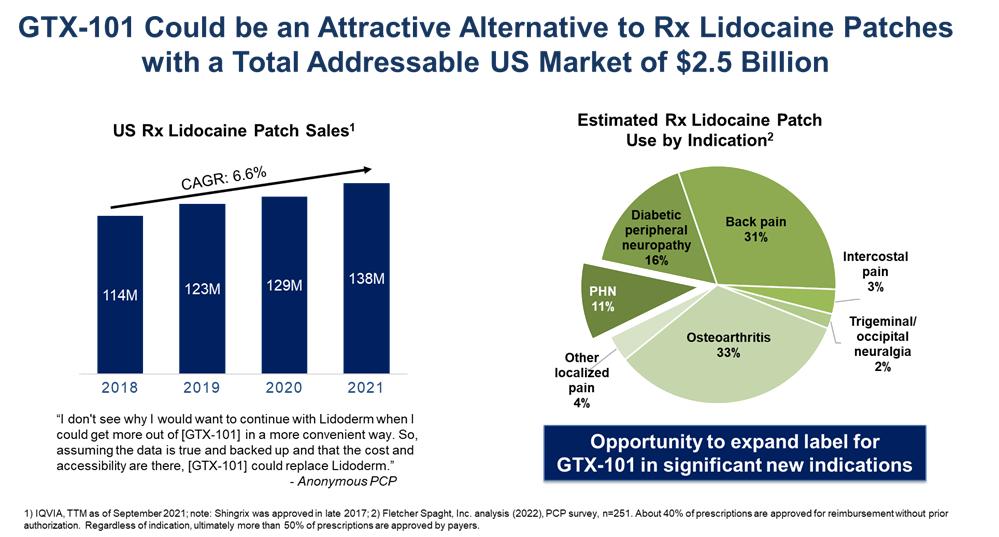

Current treatment of PHN most often consists of oral gabapentin (first line) and prescription lidocaine patches (second line), and refractory cases may be prescribed opioids to address persistent pain. Gabapentin and opioid abuse have continued to proliferate, and lidocaine patches are suboptimal for many reasons. An independent third party market research firm commissioned by Acasti interviewed more than 250 physicians who regularly treat PHN patients, and found that approximately 40% of patients using lidocaine patches experience insufficient pain relief. Lidocaine patches are difficult to use, fall off, and look unsightly with possible skin sensitivity and irritation. Additionally, it can take up to two weeks for an optimal analgesic effect to be achieved. Prescription lidocaine patches are only approved for PHN, and the market is currently made up of both branded and generic offerings. It is estimated that PHN affects approximately 120,000 patients per year in the United States. According to the third-party report commissioned by Acasti, the total addressable market for GTX-101 could be as large as $2.5 billion, consisting of approximately $200 million for PHN pain and $2.3 billion for non-PHN pain.

GTX-101 R&D History and Clinical Studies Completed to Date

To date, Acasti Pharma US has conducted three Phase I studies in healthy volunteers to assess the PK, safety and tolerability of GTX-101 and to determine the plasma levels of bupivacaine HCl administered as a single dose in various concentrations, namely 30 mg (three sprays), 50 mg (five sprays), 70 mg (seven sprays) or 100 mg (ten sprays).

The initial study was conducted to determine the PK levels of GTX-101 following a single dose of either 30 mg, 50 mg or 70 mg, and to compare the plasma levels to those produced by a single 30 mg dose of injectable bupivacaine (SENSORCAINETM). In this study, the plasma levels of bupivacaine were below the limit of quantitation (limit of quantitation (“LOQ”) was 1.00 ng/mL) for almost all subjects administered GTX-101, and at almost all time points. Mean Cmax and AUC0-T for injectable bupivacaine were 129.3 ng/mL and 517.7 ng/mL, respectively. Bupivacaine was not detected due to assay sensitivity limited to 1ng/ml.

The second study investigated the PK, safety, and tolerability of a single 100 mg dose (ten sprays) of GTX-101. The mean bupivacaine Cmax in this study was 1.249 ng/mL for the first set of samples and 1.067 ng/mL for the second set of samples; the two mean values differing from each other by less than 20%. The LOQ of the bioanalytical method used for this study was 5 pg/mL. This study confirmed the Cmax values as being similar from two sets of samples collected from the same patients at the same time points.

In the third study, the PK, safety, and tolerability of a single 100 mg dose (ten sprays) of GTX-101 were again investigated. This study was a single-center, non-randomized, single dose, open-label, 1-period, 1-treatment design in 10 healthy male and female subjects. The PK results show the maximum observed plasma concentration of bupivacaine was reached within 20 to 48 hours for all subjects. The maximum concentration reached was 19.59 ng/mL. This study confirmed that bupivacaine delivered as a spray (GTX-101) is well absorbed through the skin, as demonstrated in the graph below, while very little is absorbed systemically.

16

In all three studies, the administration of GTX-101 to healthy volunteers was safe and well tolerated. In addition, no evidence of skin irritation was observed at the application site following the spray administrations.

GTX-101 Near-Term Milestones: Conduct Dose Ranging Phase 1 Clinical Trials of GTX-101

We believe that the PHN pain market will continue to grow, and non-opioid products like GTX-101 that can relieve PHN pain more quickly and in a sustained manner by means of a more efficient delivery system, will be an attractive therapy option for patients and physicians. GTX-101 is administered by spraying a proprietary bupivacaine formulation over the affected area, which we believe has the potential to provide several advantages over currently marketed products such as the lidocaine patch, including faster onset of action, sustained pain relief, possibly lower dosing requirements and improved dosing convenience, all which could lead to increased patient compliance.

The data from the single dose Phase 1 clinical trial for topical bupivacaine spray along with regulatory guidance from the FDA’s Division of Anesthesiology that was received at a pre-IND meeting on April 18, 2018 has informed the design of additional preclinical toxicology studies and a clinical and regulatory pathway to approval. We expect to report the results of a minipig skin sensitivity study in the third calendar quarter of 2022. We also plan to initiate a single dose and a multiple ascending dose study in healthy human volunteers in the third calendar quarter of 2022. We expect to report both of these results for these studies before the end of 2022. Results from these pre-clinical and clinical studies are required before we can initiate our program in PHN patients, which we expect will start in early 2023.

Overall Commercialization Strategy

We plan to retain our worldwide commercialization rights for some of our key drug candidates, while for other drug candidates we might consider collaboration opportunities to maximize market penetration and returns. If we receive regulatory approval, we expect to build a small and focused commercial organization in the United States to market and sell GTX-104 and GTX-102. We believe the patient populations and medical specialists for these indications are sufficiently concentrated to allow us to cost-effectively promote these drug products following approval for commercial sale. Given that GTX-101 will be targeted to a larger primary care and pain specialist market, if GTX-101 receives regulatory approval, it is likely we will seek commercial partnerships to fully exploit the market potential of this drug product.

As product candidates advance through the pipeline, our commercial plans may change. Clinical data, the size of the development programs, the size of the target market, the size of a commercial infrastructure and manufacturing needs may all have influence on U.S., European Union, and rest-of-world strategies.

Manufacturing and Supply

We currently do not own any manufacturing facilities. The manufacture of our pipeline of drug candidates is highly reliant on complex techniques and personnel aseptic techniques, which present significant challenges and require specialized expertise. Further, these processes undergo a high level of scrutiny by regulatory agencies. Consequently, we utilize a network of third-party contract manufacturers (“CMOs”) for manufacturing of our drug candidates. All CMOs are monitored and evaluated by us to assess compliance with regulatory requirements.

We work with and regularly inspect our manufacturers to review the manufacturing process for our drug candidates and to provide input on quality issues. We have addressed the risk of supply chain disruptions through risk management strategies designed to mitigate the effects of any disruptions. While this strategy creates additional effort and requires maintaining dialogue and traveling to and overseeing production at multiple facilities, we believe our manufacturing risks are better managed by utilizing a range of specialized third-party manufacturers at diverse locations.

17

Intellectual Property Portfolio

We have a strong and multi-layered intellectual property protection strategy, which we believe will create barriers to entry and solidify our position in the market. All of our leading pipeline products have received orphan status designation from the FDA, which could result in 7 years of marketing exclusivity in the United States and 10 years in Europe, provided they receive the final marketing authorizations from the applicable government agencies, and they can meet the conditions for receiving such marketing exclusivity. In addition, we protect our drug candidates through a well-defined patent filing strategy. Our patent estate includes more than 40 granted and pending patents in various global jurisdictions, including 4 U.S. issued patents and 7 filed U.S. patent applications. We believe that our intellectual property portfolio, consisting primarily of composition and method-of-use patents, will protect the market value of our products by extending exclusivity beyond what is granted through the orphan designation. We intend to continue to build our patent portfolio by filing for patent protection on new developments with respect to our product candidates. We expect that these patents will, if and when issued, allow us to list our own patents in the Orange Book: Approved Drug Products with Therapeutic Equivalence issued by the FDA, to which potential competitors will be required to certify upon submission of their applications referencing our drug products, if approved.

We strive to protect and enhance the proprietary technology, inventions, and improvements that are commercially important to the development of our business, including seeking, maintaining, and defending patent rights, whether developed internally or licensed from third parties. We also rely on trade secrets relating to manufacturing know-how, continuing technological innovation and in-licensing opportunities to develop, strengthen, and maintain our proprietary position. We may also rely on regulatory protections afforded through orphan drug status, data exclusivity, market exclusivity, and patent term extensions, where available.

We are actively seeking U.S. and international patent protection for a variety of technologies and intend to seek patent protection or rely upon trade secret rights to protect other technologies that may be used to discover and validate targets and that may be used to identify and develop novel pharmaceutical products. We seek these protections, in part, through confidentiality and proprietary information agreements.

Individual patents extend for varying periods depending on the date of filing or the date of issuance, and the legal term of patents in the countries in which they are obtained. Generally, utility patents issued for applications filed in the United States are granted a term of 20 years from the earliest effective filing date of a non-provisional patent application. In addition, in certain instances, a patent term can be extended to recapture a portion of the U.S. Patent and Trademark Office delay in issuing the patent as well as a portion of the term effectively lost as a result of the FDA regulatory review period. However, as to the FDA component, the restoration period cannot be longer than 5 years and the total patent term including the restoration period must not exceed 14 years following FDA approval. The duration of foreign patents varies in accordance with provisions of applicable local law, but typically is also 20 years from the earliest effective filing date. The actual protection afforded by a patent may vary on a product-by-product basis from country to country and can depend upon many factors, including the type of patent, the scope of its coverage, the availability of regulatory-related extensions, the availability of legal remedies in a particular country and the validity and enforceability of the patent.

Acasti Pharma US has several issued U.S. patents and patent applications as well as patents and patent applications in other jurisdictions. Four patents for GTX-104 have been granted in the United States. One patent for GTX-101 has been granted in Europe, China, Mexico, Japan and South Africa. One patent for GTX-102 has been granted in Japan.

Recent Developments

On March 22, 2022 we announced the awards of several patents relating to our three lead drug candidates. The European Patent Office provided notice of intention to grant the Company’s composition of matter patent for GTX-104. The patent is expected to be valid until 2037. The United States Patent and Trademark Office also issued a notice of allowance for our composition of matter patent for GTX-102. The patent is expected to be valid until 2037. Finally, the Japanese Patent Office granted a composition of matter patent for our GTX 101 topical spray. The granted patent is valid until 2036.

On March 25, 2022 we announced the appointment of Michael L. Derby to our board of directors, filling the remaining seat on our board of directors recommended by the former Grace stockholders as contemplated by the merger agreement for the Grace transaction.

On May 18, 2022, we announced that the top line results of the PK bridging study with IV GTX-104, our lead drug candidate for the treatment of SAH, met all its planned study endpoints. The primary objective of the study was to evaluate the relative bioavailability of IV GTX-104 compared to oral nimodipine in healthy adult male and female subjects, while the secondary objective was to assess its safety and tolerability.

On May 23, 2022 we announced that we have retained one of the industry's leading investor relations firms, Lytham Partners, LLC, to lead a strategic investor relations and shareholder communication program for the Company.

On June 14, 2022 we announced the issuance of additional patents for GTX-104 and GTX-101. Three composition of matter patents were issued for GTX-104 by The United States Patent and Trademark Office, the Japanese Patent Office, and the Australian Patent Office. Additionally, one new patent for GTX-104 was awarded by the Indian Patent Office. These granted patents are all valid until 2037.

COVID-19 Update

To date, the ongoing COVID-19 pandemic has not caused significant disruptions to our business operations and research and development activities.

The extent to which the COVID-19 pandemic impacts our business and prospects and the timing and completion of future clinical trials for our new drug candidates will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the COVID-19 pandemic and the actions to contain the COVID-19 pandemic or treat its impact, among others.

Corporate Structure

Acasti was incorporated on February 1, 2002 under Part 1A of the Companies Act (Québec) under the name “9113-0310 Québec Inc.” On February 14, 2011, the Business Corporations Act (Québec), or QBCA, came into effect and replaced the Companies Act (Québec). We are now governed by the QBCA. On August 7, 2008, pursuant to a Certificate of Amendment, we changed our name to “Acasti Pharma Inc.”, our share capital description, the provisions regarding the restriction on securities transfers and our borrowing powers. On November 7, 2008, pursuant to a Certificate of Amendment, we changed the provisions regarding our borrowing powers. We became a reporting issuer in the Province of Québec on November 17, 2008. On December 18, 2019, we incorporated a new wholly owned subsidiary named Acasti Innovation AG, or AIAG, under the laws of Switzerland for the purpose of future development of our intellectual property and for global distribution of our products. AIAG currently does not have any operations. On August 27, 2021, Acasti completed its acquisition of Grace via a merger following the approval of Acasti’s shareholders and Grace’s stockholders. Following completion of the merger, Grace became a wholly owned subsidiary of Acasti and was renamed Acasti Pharma U.S. Inc.

18

Available Information

This annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and any amendments to these reports are filed, or will be filed, as applicable, with the SEC, and the Canadian Securities Administrators, or CSA. These reports are available free of charge on our website, www.acastipharma.com, as soon as reasonably practicable after we electronically file such reports with or furnish such reports to the SEC and the CSA. Information contained on, or accessible through, our website is not a part of this annual report, and the inclusion of our website address in this document is an inactive textual reference.

Additionally, our filings with the SEC may be accessed through the SEC’s website at www.sec.gov and our filings with the CSA may be accessed through the CSA’s System for Electronic Document Analysis and Retrieval at www.sedar.com.

Item 1A. Risk Factors

Summary of Risk Factors

We are providing the following summary of the risk factors contained in this Annual Report on Form 10-K to enhance the readability and accessibility of our risk factor disclosures. This summary does not address all of the risks that we face. We encourage you to carefully review the full risk factors contained in this Annual Report on Form 10-K in their entirety for additional information regarding the material factors that make an investment in our securities speculative or risky. The primary categories by which we classify risks include: (i) general risks related to our company; (ii) risks relating to our business; (iii) risks relating to the development, testing and commercialization of our products; (iv) risks relating to our intellectual property; (v) risks relating to our dependence on third parties; and (vi) risks relating to ownership of our common shares. Set forth below within each of these categories is a summary of the principal factors that make an investment in our common shares speculative or risky.

General Risks Related to the Company

Risk Factors Relating to our Business

Risks Related to Development, Testing and Commercialization of Our Products

19

Risks Relating to our Intellectual Property

20

Risks Related to Our Dependence on Third Parties

Risks related to Tax

Risks Relating to Ownership of our Common Shares

Any investment in our common shares involves a high degree of risk. The following risk factors and other information included in this annual report on Form 10-K should be carefully considered. If any of these risks actually occur, our business, financial condition, prospects, results of operations or cash flow could be materially and adversely affected, and you could lose all or a part of the value of your investment. Additional risks or uncertainties not currently known to us, or that we deem immaterial, may also negatively affect our business operations.

General Risks Related to the Company

We may not achieve our publicly announced milestones on time, or at all.

From time to time, we may publicly announce the timing of certain events that we expect to occur, such as the anticipated timing of results from our clinical trials and the timing of an upcoming NDA filing. These statements are forward-looking and are based on the best estimate of management at the time relating to the occurrence of the events. However, the actual timing of these events may differ from what has been publicly disclosed. The timing of events such as completion of a clinical trial, discovery of a new product candidate, filing of an application to obtain regulatory approval, beginning of commercialization of products, completion of a strategic partnership, or announcement of additional clinical trials for a product candidate may ultimately vary from what is publicly disclosed. These variations in timing may occur as a result

21

of different events, including the nature of the results obtained during a clinical trial or during a research phase, problems with a supplier or a distribution partner or any other event having the effect of delaying the publicly announced timeline. We undertake no obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as otherwise required by law. Any variation in the timing of previously announced milestones could have a material adverse effect on our business, financial condition or operating results and the trading price of our common shares.

We are heavily dependent on the success of our lead drug candidates, GTX-104, GTX-102 and GTX-101.

Our business and future success are substantially dependent on our ability to successfully and timely develop, obtain regulatory approval for, and commercialize our lead product candidate, GTX-104. Any delay or setback in the development of GTX-104 could adversely affect our business. Our planned development, approval and commercialization of GTX-104 may fail to be completed in a timely manner or at all. Our other product candidates, GTX-102 and GTX-101, are at an earlier development stage and we will require additional time and resources to develop and seek regulatory approval for such drug candidates and, if we are successful, to proceed with commercialization. We cannot provide assurance that we will be able to obtain approval for any of our drug candidates from the FDA or any foreign regulatory authority or that we will obtain such approval in a timely manner.

We may not be able to maintain our operations and advance our research and development and commercialization of our lead drug candidates without additional funding.

We have incurred operating losses and negative cash flows from operations since our inception. To date, we have financed our operations through public offerings and private placements of securities, proceeds from exercises of warrants, rights and options, and receipt of research tax credits and research grant programs. Our cash and cash equivalents and short-term investments (including restricted investments) were $43.7 million as of March 31, 2022 and $60.7 million as of March 31, 2021.

Our current assets, as of March 31, 2022, are projected to support our current liabilities as at that date when combined with the projected level of our expenses for the next twelve months, including fully funding the completion of our Phase 3 program for GTX-104. We expect that additional time and capital will be required by us to file an NDA to obtain FDA approval for GTX-104 in the United States, to further scale up our manufacturing capabilities, and to complete marketing and other pre-commercialization activities. Consequently, we expect to require additional capital to fund our daily operating needs beyond the next twelve months. Based on a conservative estimate, we believe that our existing cash and cash equivalents will enable us to fund our operating expenses and capital expenditure requirements beyond the completion of our Phase 3 trials for GTX-104. To fully execute our business plan, we plan to raise the necessary capital primarily through additional securities offerings and multiple sources of non-dilutive capital, such as grants or loans and strategic alliances. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may have to significantly delay the research and development and commercial launch of our lead drug candidates. Unexpected negative results in our clinical programs for our lead drug candidates may affect our ability to raise additional capital and/or complete strategic development and/or distribution partnerships to support the commercial launch of our drug candidates. Additional funding from third parties may not be available on acceptable terms or at all to enable us to continue with the research and development and commercialization of our lead drug candidates.

Our future results will suffer if we do not effectively manage our expanded operations.

As a result of the merger, we have become a larger company than either of Acasti or Grace prior to the merger, and our business has become more complex. There can be no assurance that we will effectively manage the increased complexity without experiencing operating inefficiencies or control deficiencies. Significant management time and effort is required to effectively manage the increased complexity of the larger organization and if we fail to successfully do so it could have a material adverse effect on our business, financial condition, results of operations and growth prospects. In addition, as a result of the merger, our financial statements and results of operations in prior years may not provide meaningful guidance to form an assessment of our prospects or the potential success of our future business operations.

Business disruptions could seriously harm our future revenue and financial condition and increase our costs and expenses.

Our operations, and those of our suppliers, third party manufacturers and other contractors and consultants could be subject to earthquakes, power shortages, telecommunications failures, water shortages, floods, hurricanes, typhoons, fires, extreme weather conditions, medical pandemics and other natural or man-made disasters or business interruptions, for which we are predominantly self-insured. The occurrence of any of these business disruptions could seriously harm our operations and financial condition and increase our costs and expenses. We rely on third-party manufacturers to manufacture our products. Our ability to obtain supplies of candidate products could be disrupted if the operations of our manufacturers and suppliers are affected by a man-made or natural disaster or other business interruption.

We may be subject to foreign exchange rate fluctuations.

Our reporting currency is the U.S. dollar. However, many of our expenses currently are and/or are expected to be, denominated in foreign currencies, including Canadian dollars. As we previously completed financings in both Canadian and U.S. dollars, both currencies are maintained and used to make required payments in the applicable currency. Though we plan to implement measures designed to reduce our foreign exchange rate exposure, the U.S. dollar/Canadian dollar and U.S. dollar /European euro exchange rates have fluctuated significantly in the recent past and may continue to do so, which could have a material adverse effect on our business, financial position and results of operations.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our share price and trading volume could decline.

The trading market for our common shares will depend in part on the research and reports that securities or industry analysts publish about us or our business. We do not currently have limited research coverage by securities and industry analysts. If few or no securities or industry analysts commence coverage of our company, the trading price for our common shares could be negatively impacted. If one or more of the analysts who covers us downgrades our common shares or publishes inaccurate or unfavorable research about our business, our share price would likely decline. If one or more of these analysts ceases coverage of us or fails to publish reports on us regularly, demand for our common shares could decrease, which could cause our share price and trading volume to decline.

Lawsuits have been filed, and other lawsuits may be filed, against us and members of our board of directors challenging the Grace merger, and an adverse ruling in any such lawsuit may result in an award of damages against us.

In connection with the Grace merger, four shareholder lawsuits were filed. Two of the lawsuits have been voluntarily dismissed without prejudice and the remaining two have been consolidated. The lawsuits generally allege that our public disclosures pertaining to the Grace merger omit material facts in purported violation of Section 14(a) of the Exchange Act and Rule 14a-9 promulgated thereunder, and that members of our board of directors are liable for those purported omissions under Section 20(a) of the Exchange Act. The relief sought in the lawsuits includes, among other things, to enjoin the consummation of the merger, to award damages purportedly caused by the alleged omissions, and to award plaintiffs’ attorneys’ fees and other costs. It is possible that additional lawsuits asserting similar claims could be filed. We strongly believe the allegations in the lawsuits are frivolous and without merit, and are vigorously defending against them. The results of complex legal proceedings are difficult to predict.

22

Moreover, the pending litigation is, and any future additional litigation could be, time consuming and expensive and could divert management’s attention away from its regular business.

Risk Factors Relating to our Business

Our future success depends on our ability to retain key executives and to attract, retain and motivate qualified personnel.

We are highly dependent on the principal members of our executive team. Any of our executive officers could leave our employment at any time, as all of our employees are “at will” employees. Recruiting and retaining other qualified employees for our business, including scientific and technical personnel, will also be critical to our success. There is currently a shortage of skilled executives and other personnel in our industry, which is likely to continue. As a result, competition for skilled personnel is intense and the turnover rate can be high. We may not be able to attract and retain personnel on acceptable terms given the competition among numerous pharmaceutical companies for individuals with similar skill sets. In addition, failure to succeed in clinical studies may make it more challenging to recruit and retain qualified personnel. The inability to recruit key executives or the loss of the services of any executive or key employee might impede the progress of our development and commercialization objectives.

We will need to expand our organization, and we may experience difficulties in managing this growth, which could disrupt our operations and our ability to compete.

As our company matures, we expect to expand our employee base to increase our managerial, scientific, engineering, operational, sales, marketing, financial and other resources and to hire more consultants and contractors. Future growth would impose significant additional responsibilities on our management, including the need to identify, recruit, maintain, motivate, and integrate additional employees, consultants and contractors. We may not be able to effectively manage the expansion of our operations, which may result in weaknesses in our infrastructure, give rise to operational mistakes, loss of business opportunities, loss of employees and reduced productivity among remaining employees. Future growth could require significant capital expenditures and may divert financial resources from other projects, such as the development of our existing or future product candidates. Our future financial performance and our ability to sell and commercialize our product candidates, if approved, and compete effectively will depend, in part, on our ability to effectively manage any future growth.

We face potential product liability, and if claims are brought against us, we may incur substantial liability.

The use of our product candidates in clinical trials, and the sale of any drug candidates for which we obtain marketing approval, exposes us to the risk of product liability claims. Product liability claims might be brought against us by consumers, healthcare providers, pharmaceutical companies or others selling or otherwise coming into contact with our product candidates. If we cannot successfully defend against product liability claims, we could incur substantial liability and costs. In addition, regardless of merit or eventual outcome, product liability claims may result in:

Our current product liability insurance coverage may not be sufficient to reimburse us for any expenses or losses we may suffer. Moreover, insurance coverage is becoming increasingly expensive, and, in the future, we may not be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect us against losses due to liability. A successful product liability claim or series of claims brought against us could cause our share price to decline and, if judgments exceed our insurance coverage, could adversely affect our results of operations and business.

We rely significantly on information technology and any failure, inadequacy, interruption, or security lapse of that technology, including any cybersecurity incidents, could harm our ability to operate our business effectively.

Despite the implementation of security measures, our internal computer systems, and those of third parties with which we contract are vulnerable to damage from cyber-attacks, computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures. System failures, accidents or security breaches could cause interruptions in our operations and could result in a material disruption of our drug product development and clinical activities and business operations, in addition to possibly requiring substantial expenditures of resources to remedy. The loss of drug product development or clinical trial data could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. To the extent that any disruption or security breach were to result in a loss of, or damage to, our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur liability and our development programs, and the development of our product candidates could be delayed.

Risks Related to Development, Testing and Commercialization of Our Products

Even if our drug candidates receive regulatory approval in the United States, we may never obtain regulatory approval or successfully commercialize our products outside of the United States.

Our business plan is highly dependent upon our ability to obtain regulatory approval to market and commercialize our lead drug candidates, GTX-104, GTX-102 and GTX-101 in the United States. The failure to do so would have a material adverse effect on our ability to execute on our business plan and generate revenue. In addition, even if we obtain U.S. regulatory approvals to commercialize GTX-104, GTX-102 and GTX-101, we may not be able to do so in other international jurisdictions.

We are subject to uncertainty relating to healthcare reform measures and reimbursement policies which, if not favorable to our drug candidates, could hinder or prevent our drug candidates’ commercial success.

Our ability to commercialize our drug candidates successfully will depend in part on the extent to which governmental authorities, private health insurers and other third-party payors establish appropriate coverage and reimbursement levels for our drug candidates and related treatments. As a threshold for coverage and reimbursement, third-party payors generally require that drug products have been approved for marketing by the FDA. Third-party payors are increasingly imposing additional

23

requirements and restrictions on coverage and limiting reimbursement levels for medical products. These restrictions and limitations influence the purchase of healthcare services and products. The cost containment measures that healthcare payors and providers are instituting and the effect of any healthcare reform could significantly reduce our revenues from the sale of any approved drug. We cannot provide any assurances that we will be able to obtain third-party coverage or reimbursement for our drug candidates in whole or in part.