10-Q: Quarterly report [Sections 13 or 15(d)]

Published on August 12, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2025

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-35776

(Exact name of registrant as specified in its charter)

| State of | | |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

(Address of principal executive offices, including zip code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | Accelerated filer | ☐ | |

| | ☒ | | Smaller reporting company | | |

| Emerging growth company | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of outstanding shares of common stock of the registrant, par value per share of $0.0001, as of August 11, 2025, was 13,828,562 .

GRACE THERAPEUTICS, INC.

QUARTERLY REPORT ON FORM 10-Q

For the Quarter Ended June 30, 2025

| Table of Contents | ||

| Page | ||

| PART I. FINANCIAL INFORMATION | ||

|

Item 1.

|

5 | |

|

Item 2.

|

20 | |

|

Item 3.

|

37 | |

|

Item 4.

|

37 | |

| PART II. OTHER INFORMATION | ||

|

Item 1.

|

37 | |

|

Item 1A.

|

38 | |

|

Item 2.

|

38 | |

|

Item 3.

|

38 | |

|

Item 4.

|

38 | |

|

Item 5.

|

38 | |

|

Item 6.

|

38 | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report contains

information that may be forward-looking statements within the meaning of U.S.

federal securities laws and forward-looking information

within the meaning of Canadian securities laws, both of which we

refer to in this quarterly report as forward-looking information. Forward-

looking statements can be identified by the use of terms such as “may,”

“will,”

“should,”

“expect,”

“plan,”

“anticipate,”

“believe,”

“intend,”

“estimate,”

“predict,”

“potential,”

“continue” or other similar expressions concerning matters that are not

statements about historical facts. Forward-looking statements in this quarterly

report include, among other things, information, or statements about:

●

our ability to build a late-stage pharmaceutical company focused in rare and orphan diseases and on developing and commercializing products that improve clinical outcomes using our novel drug delivery technologies;

●

our ability to apply new proprietary formulations to existing pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, and more convenient drug delivery that can result in increased patient compliance;

●

the potential for our drug candidates to receive orphan drug designation and exclusivity from the U.S. Food and Drug Administration (“FDA”) or regulatory approval under the Section 505(b)(2) regulatory pathway under the Federal Food, Drug and Cosmetic Act (“FDCA”);

●

the future prospects of our GTx-104 drug candidate, including but not limited to GTx-104’s potential to be administered to improve the management of hypotension in patients with aneurysmal subarachnoid hemorrhage (“aSAH”); the ability of GTx-104 to achieve a pharmacokinetic (“PK”) and safety profile similar to the oral form of nimodipine; GTx-104’s potential to provide improved bioavailability; GTx-104’s potential to achieve pharmacoeconomic benefit over the oral form of nimodipine; our ability to ultimately file a new drug application (“NDA”) for GTx-104 under Section 505(b)(2) of the FDCA; the acceptance of the NDA by the FDA; and the timing and ability to receive FDA approval for marketing GTx-104;

●

our plan to prioritize the development of GTx-104;

●

our plan to maximize the value of our de-prioritized drug candidates, GTx-102 and GTx-101, including through potential development, licensing, or sale of those drug candidates;

●

the future prospects of our GTx-102 drug candidate, including but not limited to GTx-102’s potential to provide clinical benefits to decrease symptoms associated with Ataxia Telangiectasia; GTx-102’s potential ease of drug administration; the timing and outcomes of a Phase 3 efficacy and safety study for GTx-102; the timing of an NDA filing for GTx-102 under Section 505(b)(2) of the FDCA; and the timing and ability to receive FDA approval for marketing GTx-102;

●

the future prospects of our GTx-101 drug candidate, including but not limited to GTx-101’s potential to be administered to postherpetic neuralgia (“PHN”) patients to treat the severe nerve pain associated with the disease; assumptions about the biphasic delivery mechanism of GTx-101, including its potential for rapid onset and continuous pain relief for up to eight hours; and the timing and outcomes of single ascending dose/multiple ascending dose and PK bridging studies, and a Phase 2 and Phase 3 efficacy and safety study; the timing of an NDA filing for GTx-101 under Section 505 (b)(2) of the FDCA; and the timing and ability to receive FDA approval for marketing GTx-101;

●

the quality of our clinical data, the cost and size of our development programs, expectations and forecasts related to our target markets and the size of our target markets; the cost and size of our commercial infrastructure and manufacturing needs in the United States, European Union, and the rest of the world; and our expected use of a range of third-party contract research organizations (“CROs”) and contract manufacturing organizations (“CMOs”) at multiple locations;

●

expectations and forecasts related to our intellectual property portfolio, including but not limited to the probability of receiving orphan drug exclusivity from the FDA for our leading pipeline drug candidates; our patent portfolio strategy; and outcomes of our patent filings and extent of patent protection;

●

our strategy, future operations, prospects, and the plans of our management with a goal to enhance shareholder value;

●

our need for additional financing, and our estimates regarding our operating runway and timing for future financing and capital requirements;

●

our expectations regarding our financial performance, including our costs and expenses, liquidity, and capital resources;

●

our projected capital requirements to fund our anticipated expenses;

●

our ability to commercialize GTx-104 in the United States or establish strategic partnerships or commercial collaborations or obtain non-dilutive funding.

Although the forward-looking statements in this quarterly report are based upon what we believe are reasonable assumptions, you should not place undue reliance on those forward-looking statements since actual results may vary materially from them.

In addition, the forward-looking statements in this quarterly report are subject to a number of known and unknown risks, uncertainties and other factors, many of which are beyond our control, that could cause our actual results and developments to differ materially from those that are disclosed in or implied by the forward-looking statements, including, among others:

●

We are heavily dependent on the success of our lead drug candidate, GTx-104.

●

Clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results. Failure can occur at any stage of clinical development.

●

We are subject to uncertainty relating to healthcare reform measures and reimbursement policies that, if not favorable to our drug candidates, could hinder or prevent our drug candidates’ commercial success.

●

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell our drug products, if approved, we may be unable to generate any revenue.

●

If we are unable to differentiate our drug products from branded reference drugs or existing generic therapies for similar treatments, or if the FDA or other applicable regulatory authorities approve products that compete with any of our drug products, our ability to successfully commercialize our drug products would be adversely affected.

●

Our success depends in part upon our ability to protect our intellectual property for our drug candidates.

●

Intellectual property rights do not necessarily address all potential threats to our competitive advantage.

●

We do not have internal manufacturing capabilities, and if we fail to develop and maintain supply relationships with various third-party manufacturers, or if such third parties fail to provide us with sufficient quantities of active pharmaceutical ingredients, excipients, or drug products, or fail to do so at acceptable quality levels or prices or fail to maintain or achieve satisfactory regulatory compliance, we may be unable to develop or commercialize our drug candidates.

●

Our contract manufacturers may encounter difficulties involving, among other things, production yields, regulatory compliance, quality control and quality assurance, as well as shortages of qualified personnel. Approval of our drug candidates could be delayed, limited, or denied if the FDA does not approve and maintain the approval of our contract manufacturer’s processes or facilities.

●

The design, development, manufacture, supply, and distribution of our drug candidates are highly regulated and technically complex.

●

The other risks and uncertainties identified in Item 1A. Risk Factors and Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the year ended March 31, 2025.

All of the forward-looking statements in this quarterly report are qualified by this cautionary statement. There can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the consequences or effects on our business, financial condition, or results of operations that we anticipate. As a result, you should not place undue reliance on forward-looking statements. Except as required by applicable law, we do not undertake to update or amend any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are made as of the date of this quarterly report.

We express all amounts in this quarterly report in thousands of U.S. dollars, except share and per share amounts or otherwise indicated. References to “$” are to U.S. dollars and references to “CAD$” are to Canadian dollars.

Except as otherwise indicated, references in this quarterly report to “Grace,” “Grace Therapeutics,” “Acasti,” “the Company,” “we,” “us,” and “our” refer to Grace Therapeutics, Inc. (formerly known as Acasti Pharma Inc.) and its consolidated subsidiary.

PART I. FINANCIAL INFORMATION

Item 1.

Financial Information

| 6 | |

| 7 | |

| 8 | |

| 9 | |

| 10 |

GRACE THERAPEUTICS, INC.

(Unaudited)

|

June 30,2025

|

March 31,2025

|

|||||

|

(Expressed in thousands except share data)

|

$ | $ | ||||

|

Assets

|

||||||

|

Current assets:

|

||||||

|

Cash and cash equivalents

|

||||||

|

Receivables

|

||||||

|

Prepaid expenses

|

||||||

|

Total current assets

|

||||||

|

Equipment, net

|

||||||

|

Intangible assets

|

||||||

|

Goodwill

|

||||||

|

Total assets

|

||||||

|

Liabilities and Stockholders’ equity

|

||||||

|

Current liabilities:

|

||||||

|

Trade and other payables

|

||||||

|

Total current liabilities

|

||||||

|

Derivative warrant liabilities

|

||||||

|

Deferred tax liability

|

||||||

|

Total liabilities

|

||||||

|

Commitments and contingencies (Note 11)

|

||||||

|

Stockholders’ equity:

|

||||||

| Preferred stock, $ |

|

|||||

| Common stock, $ |

||||||

|

Additional paid-in capital

|

||||||

|

Accumulated other comprehensive loss

|

( |

) | ( |

) | ||

|

Accumulated deficit

|

( |

) | ( |

) | ||

|

Total stockholders' equity

|

||||||

|

Total liabilities and stockholders’ equity

|

See accompanying notes to unaudited condensed consolidated financial statements.

GRACE THERAPEUTICS, INC.

(Unaudited)

| Three months ended | |||||||

| June 30, 2025 | June 30, 2024 | ||||||

|

(Expressed in thousands, except share and per share data)

|

$ | $ | |||||

|

Operating expenses

|

|||||||

|

Research and development expenses

|

( |

) | ( |

) | |||

|

General and administrative expenses

|

( |

) | ( |

) | |||

|

Loss from operating activities

|

( |

) | ( |

) | |||

|

Foreign exchange gain (loss)

|

( |

) | |||||

|

Change in fair value of derivative warrant liabilities

|

( |

) | |||||

|

Interest and other income, net

|

|||||||

|

Other (expense) income, net

|

( |

) | |||||

|

Loss before income tax benefit

|

( |

) | ( |

) | |||

|

Income tax benefit

|

|||||||

|

Net loss and total comprehensive loss

|

( |

) | ( |

) | |||

|

Basic and diluted loss per share

|

( |

) | ( |

) | |||

|

Weighted-average number of shares outstanding

|

|||||||

See accompanying notes to unaudited condensed consolidated financial statements.

GRACE THERAPEUTICS, INC.

(Unaudited)

|

Common stock

|

||||||||||||||||||

|

(Expressed

in thousands except share data)

|

Number

|

Amount

|

Additional

paid-in capital

|

Accumulated

other comprehensive

loss |

Accumulated deficit

|

Total

stockholders' equity |

||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||

|

Balance, March 31, 2025

|

( |

) | ( |

) | ||||||||||||||

| Issuance of common stock upon cashless exercise of pre-funded warrants | ||||||||||||||||||

|

Net loss

|

— | ( |

) | ( |

) | |||||||||||||

|

Stock-based compensation

|

— | |||||||||||||||||

|

Balance at June 30, 2025

|

( |

) | ( |

) | ||||||||||||||

|

Common stock

|

||||||||||||||||||

|

(Expressed

in thousands except share data)

|

Number

|

Amount

|

Additional

paid-in capital |

Accumulated

other comprehensive loss |

Accumulated deficit

|

Total

stockholders' equity |

||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||

|

Balance, March 31, 2024

|

( |

) | ( |

) | ||||||||||||||

|

Issuance of common stock upon cashless

exercise of pre-funded warrants

|

||||||||||||||||||

|

Net loss

|

— | ( |

) | ( |

) | |||||||||||||

|

Stock-based compensation

|

— | |||||||||||||||||

|

Balance at June 30, 2024

|

( |

) | ( |

) | ||||||||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

GRACE THERAPEUTICS, INC.

(Unaudited)

| Three months ended | ||||||

|

June 30, 2025

|

June 30, 2024

|

|||||

|

(Expressed in thousands)

|

$ | $ | ||||

|

Cash flows from operating activities:

|

||||||

|

Net loss

|

( |

) | ( |

) | ||

|

Adjustments:

|

||||||

|

Depreciation expense

|

||||||

|

Stock-based compensation

|

||||||

|

Change in fair value of derivative warrant liabilities

|

( |

) | ||||

|

Deferred income tax benefit

|

( |

) | ||||

|

Changes in operating assets and liabilities:

|

||||||

|

Receivables

|

||||||

|

Prepaid expenses

|

( |

) | ( |

) | ||

|

Trade and other payables

|

||||||

|

Net cash used in operating activities

|

( |

) | ( |

) | ||

|

Cash flows from investing activities:

|

||||||

|

Purchase of short-term investments

|

( |

) | ||||

|

Net cash used in investing activities

|

( |

) | ||||

|

Cash flows from financing activities:

|

||||||

| Payment of stock issuance costs | ( |

) | ||||

|

Net cash used in financing activities

|

( |

) | ||||

|

Net decrease in cash and cash equivalents

|

( |

) | ( |

) | ||

|

Cash and cash equivalents, beginning of period

|

||||||

|

Cash and cash equivalents, end of period

|

||||||

|

Cash and cash equivalents are comprised of:

|

||||||

|

Cash

|

||||||

|

Cash equivalents

|

||||||

See accompanying notes to unaudited condensed consolidated financial statements.

GRACE THERAPEUTICS, INC.

(Unaudited)

(Expressed in thousands except share and per share data)

1. Nature of operations

General

Grace Therapeutics, Inc. (formerly

known as Acasti Pharma Inc.) (“Acasti Delaware” or “the Company”), is a

Delaware corporation that, as further described below, previously existed under

the laws of the Province of Québec, Canada (“Acasti Québec”), before changing

its jurisdiction on October 1, 2024 to the Province of British Columbia, Canada

(“Acasti British Columbia”). On October 7, 2024, Acasti British Columbia

changed its jurisdiction to the State of Delaware in the United States of

America. Effective October 28, 2024, the Company changed its corporate name to

Grace Therapeutics, Inc.

Continuance and Domestication

On October 1, 2024, Acasti Québec changed its jurisdiction of incorporation from the Province of Québec in Canada to the Province of British Columbia in Canada pursuant to a “continuance” effected in accordance with Chapter XII of the Business Corporations Act (Québec) (the “Continuance”). Subsequently on October 7, 2024 (the “Effective Date”), Acasti British Columbia changed its jurisdiction of incorporation from the Province of British Columbia in Canada to the State of Delaware in the United States of America pursuant to a “continuance” effected in accordance with Section 308 of the Business Corporations Act (British Columbia) and a “domestication” (the “Domestication”) under Section 388 of the General Corporation Law of the State of Delaware. Both the Continuance and the Domestication were approved by the Company’s shareholders at the Company’s Annual and Special Meeting of Shareholders held on September 30, 2024.

Prior to the Continuance and Domestication, the Company’s Class A common shares, without par value per share (“Common Shares”), were listed on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “ACST.” Upon the effectiveness of the Continuance, each outstanding Class A common share of Acasti Québec at the time of the Continuance remained issued and outstanding as a common share, without par value per share, of Acasti British Columbia. Upon effectiveness of the Domestication, each outstanding common share of Acasti British Columbia at the time of the Domestication automatically became one outstanding share of common stock, par value $0.0001 per share, of Acasti Delaware (“Common Stock”). The Common Stock continues to be listed for trading on Nasdaq and in connection with its corporate name change to Grace Therapeutics, Inc., commenced trading under the symbol “GRCE” on October 28, 2024.

The Continuance and Domestication has

been accounted for as an exchange of equity interest among entities under

common control resulting in a change in reporting entity, and has been

retroactively reflected in the accompanying unaudited condensed consolidated

financial statements and notes thereto. All assets and liabilities of Acasti

British Columbia were deemed assumed by the Company at the Effective Date,

resulting in the retention of the historical basis of accounting as if they had

always been combined for accounting and financial reporting purposes. Any

excess resulting from the automatic conversion of each outstanding Common Share

of Acasti British Columbia into one outstanding share of Common Stock of Acasti

Delaware, is presented as Additional Paid-in Capital in the equity section of

the accompanying unaudited condensed consolidated financial statements and

notes thereto. All per share amounts for all periods presented in the

accompanying unaudited condensed consolidated financial statements and notes

thereto have been adjusted retroactively, where applicable, to reflect the

effect of the change in par value.

Liquidity and Financial Condition

The Company has incurred operating losses and negative cash flows from operations in each period since its inception. The Company expects to incur significant expenses and continued operating losses for the foreseeable future.

In May 2023, the Company implemented a strategic realignment plan to enhance shareholder value that resulted in the Company engaging a new management team, streamlining its research and development activities, and greatly reducing its workforce. Following the realignment, the Company is a smaller, more focused organization, based in the United States, and concentrated on its development of its lead product candidate GTx-104. Further development of GTx-102 and GTx-101 will occur at such a time when the Company is able to secure additional funding or enters into strategic partnerships for license or sale with third parties.

In February 2025, the Company completed a private placement of Company securities with certain institutional and accredited investors. Net proceeds to the Company were $13,705 . Refer to Note 6, Stockholder’s Equity - 2025 Private Placement, for additional information.

The Company plans to use its current cash to further the regulatory review process for GTx-104, pre-commercial planning, commercial team buildout, and product launch if GTx-104 is approved, working capital and other general corporate purposes. The Company believes its existing cash and cash equivalents will be sufficient to sustain planned operations through at least 12 months from the issuance date of these unaudited condensed consolidated financial statements.

The Company will require additional capital to fund its daily operating needs. The Company does not expect to generate revenue from product sales unless and until it obtains regulatory approval for GTx-104, which is subject to significant uncertainty. To date, the Company has financed its operations primarily through public offerings and private placements of its common equity, warrants and convertible debt and the proceeds from research tax credits. Until such time that the Company can generate significant revenue from drug product sales, if ever, it will require additional financing, which is expected to be sourced from a combination of public or private equity or debt financing or other non-dilutive sources, which may include fees, milestone payments and royalties from collaborations with third parties. Arrangements with collaborators or others may require the Company to relinquish certain rights related to its technologies or drug product candidates. Adequate additional financing may not be available to the Company on acceptable terms, or at all. The Company’s inability to raise capital as and when needed could have a negative impact on its financial condition and its ability to pursue its business strategy. The Company plans to raise additional capital in order to maintain adequate liquidity. Negative results from studies or trials, if any, the timing and ability to receive FDA approval for marketing our drug candidates or depressed prices of the Company’s stock could impact the Company’s ability to raise additional financing. Raising additional equity capital is subject to market conditions that are not within the Company’s control. If the Company is unable to raise additional funds, the Company may not be able to realize its assets and discharge its liabilities in the normal course of business.

The Company remains subject to risks similar to other development stage companies in the biopharmaceutical industry, including compliance with government regulations, protection of proprietary technology, dependence on third-party contractors and consultants and potential product liability, among others. Please refer to the risk factors included in Part 1, Item 1A of the Company’s Annual Report on Form 10-K for the year ended March 31, 2025, filed with the SEC on June 23, 2025 (the “Annual Report”).

2. Summary of significant accounting policies:

Basis of presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X under the Securities Exchange Act of 1934. Any reference in these notes to applicable guidance is meant to refer to the authoritative U.S. GAAP as found in the Accounting Standards Codification (“ASC”) and as amended by Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”).

The unaudited condensed consolidated financial statements have been prepared on the same basis as the audited annual consolidated financial statements as of and for the year ended March 31, 2025, and, in the opinion of management, reflect all adjustments, consisting of normal recurring adjustments, necessary for the fair presentation of the Company’s consolidated financial position as of June 30, 2025, the consolidated results of its operations for the three months ended June 30, 2025 and 2024, its statements of stockholders’ equity for the three months ended June 30, 2025 and 2024, and its consolidated cash flows for the three months ended June 30, 2025 and 2024.

These unaudited condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements and the accompanying notes for the year ended March 31, 2025 included in the Company’s Annual Report. The condensed consolidated balance sheet data as of March 31, 2025 presented for comparative purposes was derived from the Company’s audited consolidated financial statements. The results for the three months ended June 30, 2025 are not necessarily indicative of the operating results to be expected for the full year or for any other subsequent interim period.

The Company’s significant accounting policies are disclosed in the audited consolidated financial statements for the year ended March 31, 2025 included in the Annual Report. There have been no changes to the Company’s significant accounting policies since the date of the audited consolidated financial statements for the year ended March 31, 2025 included in the Annual Report.

Use of estimates

The preparation of these unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, income, and expenses. Actual results may differ from these estimates.

Estimates are based on management’s best knowledge of current events and actions that management may undertake in the future. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

Estimates and assumptions include the measurement of stock-based compensation, derivative warrant liabilities, accruals for research and development contracts and contract organization agreements, and valuation of intangibles and goodwill. Estimates and assumptions are also involved in determining the extent to which research and development expenses qualify for research and development tax credits. The Company recognizes tax credits once it has reasonable assurance that they will be realized.

Recent accounting pronouncements

In November 2024, the FASB issued ASU 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40) (“ASU 2024-03”), to improve the disclosures about a public business entity’s expenses and address requests from investors for more detailed information about the types of expenses (including purchases of inventory, employee compensation, depreciation, amortization and depletion) in commonly presented expense captions (such as cost of sales, SG&A and research and development).

ASU 2024-03 applies to all public business entities and is effective for annual reporting periods beginning after December 15, 2026 and interim reporting periods within annual reporting periods beginning after December 15, 2027. The requirements will be applied prospectively with the option for retrospective application. Early adoption is permitted. The Company is currently evaluating the effect of adopting this new guidance on its consolidated financial statements and disclosures. The Company does not expect that the adoption of ASU 2024-03 will have a material impact on its consolidated financial statements and disclosures.

The Company has considered all other recent accounting pronouncements and concluded that they are either not applicable to the Company’s business or that the effect is not expected to be material to the consolidated financial statements as a result of future adoption.

3. Fair value measurements

Assets and liabilities measured at fair value on a recurring basis as of June 30, 2025 are as follows:

|

Total

|

Quoted prices

in active markets

(Level 1)

|

Significant other

observable inputs

(Level 2)

|

Significant

unobservable inputs

(Level 3)

|

|||||||||

| $ | $ | $ | $ | |||||||||

|

Assets

|

||||||||||||

|

Treasury bills classified as cash equivalents

|

||||||||||||

|

Total assets

|

||||||||||||

|

Liabilities

|

||||||||||||

|

Derivative warrant liabilities

|

||||||||||||

|

Total liabilities

|

Assets and liabilities measured at fair value on a recurring basis as of March 31, 2025 are as follows:

|

Total

|

Quoted

prices

in

active markets

(Level

1)

|

Significant

other

observable

inputs

(Level

2)

|

Significant

unobservable

inputs

(Level

3)

|

|||||||||

| $ | $ | $ | $ | |||||||||

|

Assets

|

||||||||||||

|

Treasury bills classified as cash

equivalents

|

||||||||||||

|

Total assets

|

||||||||||||

|

Liabilities

|

||||||||||||

|

Derivative warrant liabilities

|

||||||||||||

|

Total liabilities

|

There were no changes in valuation techniques or transfers between Levels 1, 2 or 3 during the three months ended June 30, 2025. The Company’s derivative warrant liabilities are measured at fair value on a recurring basis using unobservable inputs that are classified as Level 3 inputs. Refer to Note 6, Stockholders’ Equity, for the valuation techniques and assumptions used in estimating the fair value of the derivative warrant liabilities.

4. Receivables

|

June 30, 2025

|

March 31, 2025

|

|||||

| $ | $ | |||||

|

Sales tax receivables

|

||||||

|

Other receivables

|

||||||

|

Total receivables

|

5. Trade and other payables

|

June 30, 2025

|

March 31, 2025

|

|||||

| $ | $ | |||||

|

Trade

payables

|

||||||

|

Accrued

research and development expenses

|

||||||

|

Employee salaries and benefits

payable

|

||||||

|

Accrued

liabilities and payables

|

||||||

|

Total

trade and other payables

|

6. Stockholders’ equity

Preferred Stock

The Company is authorized to issue up to 10,000,000 shares of preferred stock, par value $0.0001 per share. No

Common Stock

In connection with the consummation of the Domestication, on October 7, 2024, the Company adopted a Certificate of Incorporation (as amended, the “Charter”) and Bylaws (as amended, the “Bylaws”). The rights of holders of the Company’s Common Stock, par value $0.0001 per share (“Common Stock”) are governed by the Charter, the Bylaws, and the General Corporation Law of the State of Delaware. The Company is authorized to issue up to 100,000,000 shares of Common Stock.

2025 Private Placement

In February 2025, the Company agreed to offer and sell in a private placement (the “2025 Private Placement”) an aggregate of 3,252,132 shares of Common Stock at a purchase price of $3.395 per share of Common Stock (the “Shares”) and pre-funded warrants (the “2025 Pre-Funded Warrants”) to purchase up to 1,166,160 shares of Common Stock at a purchase price equal to the purchase price per Share less $0.0001 (the “2025 Pre-Funded Warrant Shares”). Each 2025 Pre-Funded Warrant is exercisable for one share of Common Stock at an exercise price of $0.0001 per share, exercisable immediately and will expire once exercised in full.

Pursuant to the securities purchase agreement with certain institutional and accredited investors in connection with the 2025 Private Placement (the “2025 Purchase Agreement”) for each Share and each 2025 Pre-Funded Warrant issued, the Company agreed to issue to each purchaser an accompanying common warrant (the “2025 Common Warrants” and, together with the 2025 Pre-Funded Warrants, the “2025 Warrants”) to purchase shares of Common Stock (or 2025 Pre-Funded Warrants in lieu thereof), exercisable for an aggregate of 4,418,292 shares of Common Stock (or 2025 Pre-Funded Warrants in lieu thereof). Each 2025 Common Warrant is exercisable for one share of Common Stock at an exercise price of $3.395 per share (or one 2025 Pre-Funded Warrant at an exercise price of $3.3949 per share in lieu thereof), is immediately exercisable and will expire on the earlier of (i) the 60th day after the date the FDA approves the NDA for GTx-104 and (ii) September 25, 2028. The 2025 Common Warrants were offered and sold at a purchase price of $0.125 per 2025 Common Warrant, which purchase price is included in the offering price per Share and 2025 Pre-Funded Warrant issued in the 2025 Private Placement.

The 2025 Private Placement included the issuance of Common Stock, 2025 Pre-Funded Warrants, and 2025 Common Warrants to related parties namely (i) Shore Pharma LLC, an entity held in a trust for the benefit of immediate family members of Vimal Kavuru, the Chair of the Company’s Board of Directors, (ii) ADAR1 Partners, LP, (iii) AIGH Investment Partners, LP, and (iv) SS Pharma LLC, each a beneficial owner of more than 5 5,694 in the year ended March 31, 2025.

The Company paid TD Securities (USA) LLC, the placement agent, customary placement fees in its capacity as placement agent for the sale of the Company’s securities to certain of the investors in the 2025 Private Placement.

The 2025 Private Placement closed on February 11, 2025 (the “Closing Date”). The net proceeds to the Company were $13,705 , after deducting fees and expenses.

Both 2025 Pre-funded Warrants and 2025 Common Warrants are presented under additional paid-in capital in the equity section of the unaudited condensed consolidated balance sheet as of June 30, 2025.

During the three months ended June 30, 2025, 110,460 of the 2025 Pre-Funded Warrants were exercised for 110,456 shares of Common Stock.

2023 Private Placement

In September 2023, the Company entered into a securities

purchase agreement (the “2023 Purchase Agreement”) with certain institutional

and accredited investors in connection with a private placement offering of the

Company’s securities (the “2023 Private Placement”). Pursuant to the 2023

Purchase Agreement, the Company offered and sold 1,951,371 Common Shares, at a

purchase price of $1.848 per Common Share and pre-funded warrants (“2023

Pre-Funded Warrants”) to purchase up to 2,106,853 Common Shares at a purchase

price equal to the purchase price per Common Share less $0.0001 . Each 2023

Pre-Funded Warrant is exercisable for one Common Share at an exercise price of

$0.0001 per Common Share, is immediately exercisable, and will expire once

exercised in full. Pursuant to the 2023 Purchase Agreement, the Company also

issued, to such institutional and accredited investors, common warrants (the

“2023 Common Warrants” and, together with the 2023 Pre-Funded Warrants, the

“2023 Warrants”) to purchase Common Shares exercisable for an aggregate of

2,536,391 Common Shares. Under the terms of the 2023 Purchase Agreement, for

each Common Share and each 2023 Pre-Funded Warrant issued in the 2023 Private

Placement, an accompanying five-eighths (0.625 ) of a 2023 Common Warrant was

issued to the purchaser thereof. Each whole 2023 Common Warrant is exercisable

for one Common Share at an exercise price of $3.003 per Common Share, is

immediately exercisable, and will expire on the earlier of (i) the 60th day

after the date of the acceptance by the FDA of an NDA for the Company’s product

candidate GTx-104 or (ii) five years from the date of issuance. The 2023

Private Placement closed on September 25, 2023. The net proceeds to the Company

from the 2023 Private Placement were $7,338 , after deducting fees and expenses.

The 2023 Private Placement included the issuance of Common Shares, 2023 Pre-Funded Warrants, and 2023 Common Warrants to related parties namely (i) Shore Pharma LLC, an entity that was controlled by Vimal Kavuru, the Chair of the Company’s Board of Directors, at the time of the 2023 Private Placement and (ii) SS Pharma LLC, the beneficial owner of 5.5 % of Common Shares outstanding prior to the 2023 Private Placement, resulting in proceeds of $2,500 in 2023.

There were no

The following table summarizes the Company’s

outstanding warrants as at June 30, 2025, all of which are exercisable for

shares of Common Stock:

|

June 30, 2025

|

|||||||||||

|

No. of warrants |

Exercise Price ($) |

Expiration Date |

|||||||||

|

Liability classified warrants (Derivative Warrant Liabilities)

|

|||||||||||

|

Common warrants issued in connection with 2023 Private Placement (2023 Common Warrants)

|

1 | ||||||||||

|

Equity classified warrants

|

|||||||||||

|

Pre-funded warrants issued in connection with 2023 Private Placement (2023 Pre-Funded Warrants)

|

No expiration | ||||||||||

|

Common warrants issued in connection with 2025 Private Placement (2025 Common Warrants)

|

2 | ||||||||||

|

Pre-funded warrants issued in connection with 2025 Private Placement (2025 Pre-Funded Warrants)

|

No expiration | ||||||||||

1.

2.

In connection with the Continuance and the Domestication, the Company continues its obligations under the 2023 Purchase Agreement and the 2023 Warrants. At effectiveness of the Continuance, each outstanding 2023 Warrant exercisable for Common Shares remained exercisable for an equivalent number of common shares of Acasti British Columbia for the equivalent exercise price per share without any action by the holder. At effectiveness of the Domestication, each outstanding 2023 Warrant exercisable for common shares of Acasti British Columbia remained exercisable for an equivalent number of shares of Common Stock for the equivalent exercise price per share without any action by the holder.

Derivative Warrant Liabilities

The 2023 Common Warrants issued as a part of the 2023 Private Placement are derivative warrant liabilities given that the 2023 Common Warrants did not meet the fixed-for-fixed criteria and that the 2023 Common Warrants are not indexed to the Company’s own stock. Proceeds were allocated amongst Common Shares, 2023 Pre-Funded Warrants, and 2023 Common Warrants by applying the residual method, with fair value of the 2023 Common Warrants determined using the Black-Scholes model, resulting in initial derivative warrant liabilities of $1,631 and issuance costs of $45 allocated to 2023 Common Warrants.

The derivative warrant liabilities are measured at fair value at each reporting period and the reconciliation of changes in fair value is presented in the following table:

| Three months ended | ||||||

| June 30, 2025 | June 30, 2024 | |||||

| $ | $ | |||||

|

Beginning balance

|

||||||

|

Issued during the year

|

||||||

|

Change in fair value

|

) | |||||

|

Ending balance

|

||||||

The warrant liability was determined based on the fair value of 2023 Common Warrants at the issue date and the reporting dates using the Black-Scholes model with the following weighted-average assumptions will expire on the earlier of (i) the 60th day after the date of the acceptance by the FDA of an NDA for the Company's product candidate GTx-104 and (ii) five years from the date on issuance.

| June 30, 2025 |

March 31, 2025 |

||||||

| Risk-free interest rate | % | % | |||||

| Share price | $ | $ | |||||

| Expected warrant life | |||||||

| Dividend yield | % | % | |||||

| Expected volatility | % | % |

The weighted average fair values of the 2023 Common Warrants were determined to be $0.64 and $0.45 per 2023 Common Warrant as of June 30, 2025, and March 31, 2025, respectively. The risk-free interest rate at the issue date and on the reporting date of June 30, 2025 was based on the interest rate corresponding to the U.S. Treasury rate issue with a remaining term equal to the expected term of the 2023 Common Warrants. The expected volatility was based on the historical volatility for the Company.

As of June 30, 2025 and March 31, 2025, the balance of derivative warrant liabilities from related parties was $1,357 and $952 , respectively.

7. Stock-based compensation

2024 Equity Incentive Plan

At the Annual and Special Meeting of Shareholders on September 30, 2024, the Company’s shareholders approved the Acasti Pharma Inc. 2024 Equity Incentive Plan (the “2024 Plan”) which became effective on the date of the Domestication. The 2024 Plan replaced the Acasti Pharma Inc. Stock Option Plan and the Acasti Pharma Inc. Equity Incentive Plan (the “Prior Plans”). The 2024 Plan provides for the grant of awards of stock options, stock appreciation rights, restricted stock, restricted stock units, deferred stock units, unrestricted stock, dividend equivalent rights, performance-based awards and other equity-based awards to eligible persons as defined under the 2024 Plan. Any of these awards may, but need not, be made as performance incentives to reward the holders of such awards for the achievement of performance goals in accordance with the terms of the 2024 Plan. Stock options granted under the 2024 Plan may be non-qualified stock options or incentive stock options, as provided in the 2024 Plan.

In connection with the Continuance and the Domestication, the Company continues its obligations under the Prior Plans and all of the outstanding equity awards under the Prior Plans. Upon effectiveness of the Continuance, each outstanding option exercisable for and restricted share unit settleable into Common Shares remained exercisable for or able to be settled into an equivalent number of common shares of Acasti British Columbia for the equivalent exercise price per share (if applicable), without any action by the holder. Upon effectiveness of the Domestication, each outstanding option exercisable for and restricted share unit settleable into common shares of Acasti British Columbia remained exercisable for or able to be settled into an equivalent number of shares of Common Stock for the equivalent exercise price per share (if applicable), without any action by the holder.

Following the Effective Date of the 2024 Plan, no awards shall be made under the Prior Plans. However, Common Shares reserved under the Prior Plans to settle awards which were made under the Prior Plans may be issued and delivered following the Effective Date to settle such awards.

The 2024 Plan is administered by a committee designated from time to time, by resolution of the Company’s Board of Directors. The committee will also be responsible for determining, among others, the key terms of the awards including their grant dates, pricing, basis for fair value determination, vesting terms, restrictions, and terminations. The Board has designated its Compensation Committee to administer the 2024 Plan. As of June 30, 2025, there were 1,350,000 shares of Common Stock authorized for issuance under the 2024 Plan and 943,470 shares available for future issuance under the 2024 Plan.

The 2024 Plan will terminate automatically ten years after the Effective Date and may be terminated on any earlier date as provided by the 2024 Plan.

The following table summarizes information about activities within the 2024 Plan and Prior Plans for the three months ended June 30, 2025:

| Number of Options |

Weighted-average Exercise Price |

Remaining Contractual Term (years) |

Aggregate Intrinsic Value (in thousands) |

|||||||||

| $ | $ | |||||||||||

| Outstanding, March 31, 2025 | ||||||||||||

| Granted | ||||||||||||

| Outstanding, June 30, 2025 | ||||||||||||

| Exercisable, June 30, 2025 |

The weighted-average grant date fair value of awards for options granted during the three months ended June 30, 2025 was $1.78 . The fair value of options granted was estimated using the Black-Scholes option pricing model, resulting in the following weighted-average assumptions for the options granted:

| Three months ended June 30, 2025 |

Three months ended June 30, 2024 |

||||||

| Weighted-average |

Weighted-average |

||||||

| Exercise price | $ | $ | |||||

| Share price | $ | $ | |||||

| Dividend | |||||||

| Risk-free interest | % | % | |||||

| Estimated life (years) | |||||||

| Expected volatility | % | % |

Compensation expense recognized under the 2024 Plan and the Prior Plan is summarized as follows:

| Three months ended | ||||||

|

June 30, 2025

|

June 30, 2024

|

|||||

| $ | $ | |||||

|

Research and development expenses

|

||||||

|

General and administrative expenses

|

||||||

As of June 30, 2025, there was $710 of total unrecognized compensation cost, related to non-vested stock options, which is expected to be recognized over a remaining weighted-average vesting period of 1.42 years.

8. Loss per share

The Company has generated a net loss for all periods presented. Therefore, diluted loss per share is the same as basic loss per share since the inclusion of potentially dilutive securities would have had an anti-dilutive effect. All currently outstanding options and warrants could potentially be dilutive in the future.

The Company excluded the following potential shares of Common Stock, presented based on amounts outstanding at each period end, from the computation of diluted net loss per share attributable to stockholders for the periods indicated because including them would have had an anti-dilutive effect:

|

Three months ended

|

||||||

|

June 30, 2025

|

June 30, 2024

|

|||||

|

Options outstanding

|

||||||

|

September 2023 Common Warrants

|

||||||

|

February 2025 Common Warrants

|

||||||

Basic and diluted net loss per share is calculated based upon the weighted-average number of shares of Common Stock outstanding during the year. Common Stock underlying the 2025 Pre-Funded Warrants and 2023 Pre-Funded Warrants are included in the calculation of basic and diluted earnings per share.

9. Segment Information

An operating segment is a component of an entity whose operating results are regularly reviewed by its chief operating decision maker (“CODM”) to make decisions about resources to be allocated to the segment and assess its performance. Factors used by the Company in determining the reportable segment include the nature of the Company's operating activities, the organizational and reporting structure and the type of information reviewed by the CODM to allocate resources and evaluate financial performance.

The Company has one reportable operating segment: the development and commercialization of pharmaceutical applications of its patents and licensed rights. The Company’s CODM is its Chief Executive Officer. The accounting policies of the segment are those described in the summary of significant accounting policies.

The CODM assesses the performance of the segment based on net loss, which is reported on the unaudited condensed consolidated statement of

net loss and comprehensive loss as Net loss and total comprehensive loss. The measure of segment assets is reported on the unaudited condensed consolidated balance sheet as Total assets.

The Company has not generated any revenue and expects to continue to incur significant expenses and operating losses as it advances product candidates through all stages of development, and ultimately, receive regulatory approval. Accordingly, the CODM utilizes the cash budget and forecasts in assessing the entity-wide operating results and performance, and in deciding how to allocate resources across the organization and its segment. Net loss and total comprehensive loss is used to monitor budgets against actual results, which then is used in assessing the performance of the segment.

The table below summarizes the significant expenses, by category regularly reviewed by the CODM, for the three months ended June 30, 2025 and 2024:

|

June 30, 2025

$

|

June 30, 2024

$

|

|||||

|

Clinical development programs

|

( |

) | ( |

) | ||

|

Professional fees

|

( |

) | ( |

) | ||

|

Salaries and benefits

|

( |

) | ( |

) | ||

|

Stock-based compensation

|

( |

) | ( |

) | ||

|

Other general and administrative

expenses (1)

|

( |

) | ( |

) | ||

|

Other segment expense (income) (2)

|

( |

) | ||||

|

Interest income, net

|

||||||

|

Income tax benefit

|

||||||

|

Segment and consolidated loss

|

( |

) | ( |

) |

1)

2)

10. Income taxes

The provision for income taxes and the effective income tax rates were as follows:

| Three months ended | ||||||||

| June 30, 2025 | June 30, 2024 | |||||||

| $ | $ | |||||||

|

Provision for income taxes

|

( |

) | ||||||

| Effective income tax rate | % | % | ||||||

The variance in effective tax rates for the three months ended June 30, 2025 and 2024 is primarily attributable to the Company’s partial valuation allowance applied to its net domestic deferred tax assets.

As of June 30, 2025, the Company had a partial valuation allowance against its net domestic deferred tax assets, for which realization cannot be considered more likely than not at this time. Management assesses the need for the valuation allowance on a quarterly basis. In assessing the need for a valuation allowance, the Company considers all positive and negative evidence, including scheduled reversals of deferred tax liabilities, projected future taxable income, tax planning strategies, and past financial performance.

On July 4, 2025, the One Big Beautiful Bill Act (“OBBBA”) was enacted in the U.S. The OBBBA includes significant provisions, such as the permanent extension of certain expiring provision of the Tax Cuts and Jobs Act, modification to the international tax framework and the restoration of favorable tax treatment for certain business provisions. The legislation has multiple effective dates, with certain provisions effective in 2025 and other implemented through 2027. We are currently assessing the impact of this legislation on our unaudited condensed consolidated financial statements.

11. Commitments and contingencies

Research and development contracts and contract research organizations agreements

The Company utilizes CMOs for the development and production of clinical materials and CROs to perform services related to its clinical trials. Pursuant to the agreements with these CMOs and CROs, the Company has either the right to terminate the agreements without penalties or under certain penalty conditions. As of June 30, 2025, the Company has $185 of commitments to CMOs for the next twelve months.

Legal proceedings and disputes

In the ordinary course of business, the Company is at times subject to various legal proceedings and disputes. The Company assesses its liabilities and contingencies in connection with outstanding legal proceedings utilizing the latest information available. Where it is probable that the Company will incur a loss and the amount of the loss can be reasonably estimated, the Company records a liability in its unaudited condensed consolidated financial statements. These legal contingencies may be adjusted to reflect any relevant developments on a quarterly basis. Where a loss is not probable or the amount of loss is not estimable, the Company does not accrue legal contingencies. While the outcome of legal proceedings is inherently uncertain, based on information currently available, management believes that it has established appropriate legal reserves. No reserves or liabilities have been accrued at June 30, 2025.

Item 2.

This management’s discussion and analysis (“MD&A”) is presented in order to provide the reader with an overview of the financial results and changes to our financial position as at June 30, 2025 and for the three months then ended. This MD&A also explains the material variations in our operations, financial positions and cash flows for the three months ended June 30, 2025 and 2024.

Market data, and certain industry data

and forecasts included in this MD&A were obtained from internal Company

surveys and market research conducted by third parties hired by us, publicly

available information, reports of governmental agencies and industry

publications, and independent third-party surveys. We have relied upon industry

publications as our primary sources for third-party industry data and

forecasts. Industry surveys, publications, and forecasts generally state that

the information they contain has been obtained from sources believed to be

reliable, but that the accuracy and completeness of that information are not

guaranteed. We have not independently verified any of the data from third-party

sources or the underlying economic assumptions they have made. Similarly,

internal surveys, industry forecasts and market research, which we believe to

be reliable based upon our management’s or contracted third parties’ knowledge

of our industry, have not been independently verified. Our estimates involve

risks and uncertainties, including assumptions that may prove not to be

accurate, and these estimates and certain industry data are subject to change

based on various factors, including those discussed in this quarterly report

and in our most recently filed Annual Report on Form 10-K, filed with the

Securities and Exchange Commission (the “SEC”) on June 23, 2025 (the “Annual

Report”). This MD&A contains forward-looking information. You should review

our Special Note Regarding Forward-Looking Statements presented at the

beginning of this quarterly report.

This MD&A should be read in conjunction with our unaudited condensed consolidated interim financial statements for the three months ended June 30, 2025 and 2024 included elsewhere in this quarterly report. Our unaudited condensed consolidated financial statements were prepared in accordance with U.S. GAAP.

All amounts appearing in this MD&A for the period-by-period discussions are in thousands of U.S. dollars, except share and per share amounts or unless otherwise indicated.

Business Overview

We are focused on developing and commercializing products for rare and orphan diseases that have the potential to improve clinical outcomes by using our novel drug delivery technologies. We seek to apply new proprietary formulations to approved and marketed pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, more convenient drug delivery and increased patient compliance; all of which could result in improved patient outcomes. The active pharmaceutical ingredients used in the drug candidates under development by us may be already approved in a target indication or could be repurposed for use in new indications.

Our therapeutic pipeline consists of three unique clinical-stage drug candidates supported by an intellectual property portfolio of more than 40 granted and pending patents in various jurisdictions worldwide. These drug candidates aim to improve clinical outcomes in the treatment of rare and orphan diseases by applying proprietary formulation and drug delivery technologies to existing pharmaceutical compounds to achieve improvements over the current standard of care, or to provide treatment for diseases with no currently approved therapies.

The existing well understood efficacy

and safety profiles of these marketed compounds provide the opportunity for us

to utilize the Section 505(b)(2) regulatory pathway under the Federal Food,

Drug and Cosmetic Act (“FDCA”) for the development of our reformulated versions

of these drugs, and therefore may provide a potentially shorter path to

regulatory approval. Under Section 505(b)(2), if sufficient support of a

product’s safety and efficacy either through previous U.S. Food and Drug

Administration (“FDA”) experience or sufficiently within the existing and

accepted scientific literature, can be established, it may eliminate the need

to conduct some of the pre-clinical studies and clinical trials that new drug

candidates might otherwise require.

We believe rare disorders represent an attractive area for drug development, and there remains an opportunity for us to utilize already approved drugs that have established safety profiles and clinical experience to potentially address significant unmet medical needs. A key advantage of pursuing therapies for rare disorders is the potential to receive orphan drug designation (“ODD”) from the FDA. Our three drug candidates have received ODD status and, provided certain conditions are met at new drug application approval, those candidates, if approved, will be entitled to orphan drug exclusivity (“ODE”), which blocks FDA from approving for seven years any other application for a product that is the same drug for the same orphan indication, except in limited circumstances, such as a showing of clinical superiority to the product with ODE. ODD status can also result in tax credits of up to 25% of clinical development costs conducted in the United States upon marketing approval and a waiver of the NDA fees, which we estimate can translate into savings of approximately $4.3 million for our lead drug candidate, GTx-104. Developing drugs for rare diseases can often allow for clinical trials that are more manageably scaled and may require a smaller, more targeted commercial infrastructure.

The specific diseases targeted for drug development by us are well understood, although the patient populations suffering from such diseases may remain poorly served by available therapies or, in some cases, approved therapies do not yet exist. We aim to effectively treat debilitating symptoms that result from these underlying diseases.

Our management team possesses significant experience in drug formulation, drug delivery research and development, clinical and pharmaceutical development, manufacturing, regulatory affairs, business development, as well as late-stage drug development and commercialization. Importantly, our team is comprised of industry professionals with deep expertise and knowledge, including a world-renowned practicing neurosurgeon-scientist and respected authority in aneurysmal subarachnoid hemorrhage, as well as product development, chemistry, manufacturing and controls (“CMC”), planning, implementation, management, and execution of global Phase 2 and Phase 3 trials for GTx-104, and drug commercialization.

Recent Developments

GTx-104

On June 25, 2025, we announced the

submission of a New Drug Application (“NDA”) to the FDA for GTx-104, a

clinical-stage, novel, injectable formulation of nimodipine being developed for

IV infusion to address significant unmet medical needs in aneurysmal

subarachnoid hemorrhage (“aSAH”) patients.

Our Pipeline

•

GTx-104 is a clinical stage, novel, injectable formulation of nimodipine being developed for IV infusion in aSAH patients to address significant unmet medical needs. The unique nanoparticle technology of GTx-104 facilitates aqueous formulation of insoluble nimodipine for a standard peripheral IV infusion. GTx-104 provides a convenient IV delivery of nimodipine in the Intensive Care Unit potentially eliminating the need for nasogastric tube administration in unconscious or dysphagic patients. Intravenous delivery of GTx-104 also has the potential to lower food effects, drug-to-drug interactions, and eliminate potential dosing errors. Further, GTx-104 has the potential to better manage hypotension in aSAH patients. GTx-104 has been administered in over 200 patients and healthy volunteers and was well tolerated with significantly lower inter- and intra-subject pharmacokinetic variability compared to oral nimodipine.

•

GTx-102 is targeted as the first potential therapy for the treatment of ataxia-telangiectasia (“A-T”) in a pediatric population. A-T is caused by mutations in the ataxia telangiectasia mutated gene. Children with A-T experience cerebellar ataxia and other motor dysfunctions, oculomotor apraxia, dysarthria, and dysphagia. A Phase-1 pharmacokinetic study was successfully completed and GTx-102 was well tolerated with no serious events reported.

•

GTx-101 is a topical bio adhesive film-forming bupivacaine spray for Postherpetic Neuralgia (“PHN”), which can be persistent and often causes debilitating pain following infection by the shingles virus. Four single-dose Phase 1 studies to evaluate the PK, safety, dose proportionality and

tolerability of GTx-101 have been performed. In these trials, no serious

adverse events were reported and GTx-101 was well tolerated. We believe that

GTx-101 could be administered to patients with PHN to treat pain associated

with the disease.

In May 2023, we implemented a strategic

realignment plan to enhance shareholder value that resulted in engaging a new

management team, streamlining our research and development activities, and

greatly reducing our workforce. Following the realignment, we are a smaller,

more focused organization, based in the United States, and concentrated on the development

of our lead product candidate GTx-104. Further development of GTx-102 and

GTx-101 will occur at such a time when we are able to secure additional funding

or enter strategic partnerships for license or sale with third parties.

GTx-104 Overview

About aneurysmal Subarachnoid Hemorrhage (aSAH)

aSAH is bleeding over the surface of the brain in the subarachnoid space between the brain and the skull, which contains blood vessels that supply the brain. A primary cause of such bleeding is the rupture of an aneurysm in the brain. The result is a relatively uncommon type of stroke that accounts for about 5% of all strokes and an estimated 42,500 U.S. hospital treated patients per year.

Unmet Needs with Oral Nimodipine

Nimodipine was granted FDA approval in 1988 and is the only approved drug that has been clinically shown to improve neurological outcomes in aSAH patients. It is only available in the United States as a generic oral capsule and as a branded oral liquid solution called NYMALIZE™, which is manufactured and sold by Arbor Pharmaceuticals (acquired in September 2021 by Azurity Pharmaceuticals). Nimodipine has poor water solubility and high permeability characteristics because of its high lipophilicity. Additionally, orally administered nimodipine has dose-limiting side-effects such as hypotension, poor absorption and low bioavailability resulting from high first-pass metabolism, and a narrow administration window as food effects lower bioavailability significantly. Due to these issues, blood levels of orally administered nimodipine can be highly variable, making it difficult to manage blood pressure in aSAH patients, often leading to frequent dose interruptions. Nimodipine capsules are also difficult to administer, particularly to unconscious patients or those with impaired ability to swallow, while the oral liquid solution has tolerability challenges due to solubility limitations of nimodipine.

GTx-104 Technology

Our lead drug candidate, GTx-104, is a

novel injectable formulation of nimodipine for the treatment of aSAH. This

formulation offers several potential advantages over oral administration of

nimodipine that is the current Standard of Care (SoC) in the United States.

•

Novel injectable formulation of nimodipine

•

Overcomes solubility limitations of nimodipine

•

A patented formulation that uses non-ionic surfactant micelles as the drug carrier to solubilize nimodipine

•

Simple to prepare in a pharmacy and stable at room temperature

Value Proposition

GTx-104 provides a convenient IV delivery of nimodipine in the Intensive Care Unit, potentially eliminating the need for nasogastric tube administration in unconscious or dysphagic patients. Intravenous delivery of GTx-104 also has the potential to lower food effects, drug-to-drug interactions, and eliminate potential dosing errors. Further, GTx-104 has the potential to better manage hypotension in aSAH patients. GTx-104 has been administered in over 200 patients and healthy volunteers and was well tolerated with significantly lower inter- and intra-subject pharmacokinetic variability compared to oral nimodipine.

GTx-104 is designed to address

significant unmet medical needs for patients with aSAH. We believe that our

novel nimodipine IV formulation may offer a potential value to physicians,

hospitals, and their patients.

GTx-104 Market Opportunity

Approximately 42,500 patients in the

United States are affected by aSAH per year. Company sponsored third party

market research including claims analysis suggests that aSAH incidence may be

as high as approximately 70,000 per year in the United States. Outside of the

United States, annual cases of aSAH are estimated at approximately 60,000 in

the European Union, and approximately 150,000 in China.

The unmet needs in the treatment of

aSAH patients and the potential of GTx-104 to address the limitations of the

current standard of care were the subject of a Key Opinion Leader event we

hosted in November 2024. In an independent market research survey we conducted

of hospital administrators and critical and neuro intensive care physicians at

institutions with Comprehensive or Advanced Stroke Center certification who are

involved in purchasing decisions for their institutions/units, respondents

reported 80% likelihood of adopting an IV formulation of nimodipine, assuming

100% bioavailability, better safety, no food effects, effective hypotension

management, potential hospital value and patient value.

Clinical Data

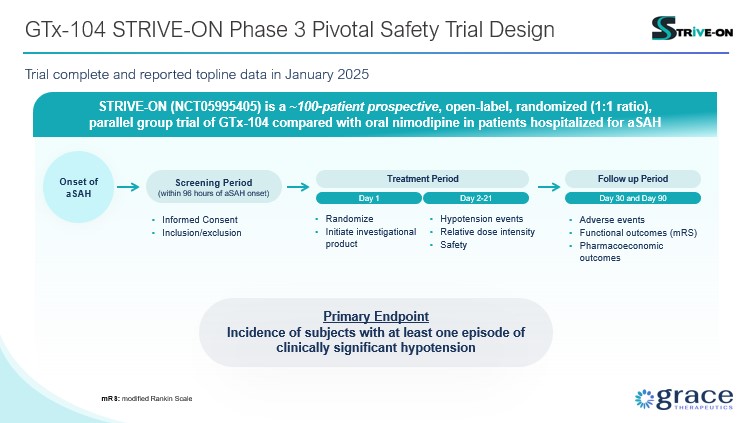

Pivotal Phase 3 STRIVE-ON Randomized Safety Trial

The STRIVE-ON trial was a prospective,

randomized open-label Phase 3 trial of GTx-104 compared with oral nimodipine in

patients hospitalized with aSAH. 50 patients were administered GTx-104 and 52

patients received oral nimodipine. The primary endpoint was the number of

patients with at least one episode of clinically significant hypotension

reasonably considered to be caused by the drug, and additional endpoints

included safety, clinical, and pharmacoeconomic outcomes. Each patient was

evaluated for up to 90 days inclusive of the 21-day treatment period. There was

a higher proportion of the most severe cases of aSAH (Hunt & Hess Grade V)

with the worst prognosis in the GTx-104 arm (8%) compared to the oral

nimodipine arm (2%).

On September 25, 2024, we announced the completion of enrollment in our Phase 3 STRIVE-ON trial for GTx-104. On February 10, 2025, we announced the trial met its primary endpoint and provided evidence of clinical benefit for GTx-104 compared to orally administered nimodipine. Patients receiving GTx-104 were observed to have a 19% reduction in at least one incidence of clinically significant hypotension compared to oral nimodipine (28% versus 35%). Other measures also favored or were comparable to GTx-104, including:

•

54% of patients who received GTx-104 had a relative dose intensity of 95% or higher of the prescribed dose compared to only 8% on oral nimodipine.

•

29% relative increase in the number of patients receiving GTx-104 compared to oral nimodipine with favorable outcomes at 90 days follow up on the modified Rankin scale. Quality of life as measured by EQ-5D-3L also favored patients receiving GTx-104 versus oral nimodipine.

•

Fewer intensive care unit (ICU) readmissions, ICU days, and ventilator days for patients receiving GTx-104 versus oral nimodipine.

•

Adverse events were comparable between the two arms and no new safety issues were identified with patients receiving GTx-104. All deaths in both arms of the trial were due to severity of the patient’s underlying disease. There were eight deaths on the GTx-104 arm compared to four deaths on the oral nimodipine arm. The survival status of one patient on the oral nimodipine arm was unknown. No deaths were determined to be related to GTx-104 or oral nimodipine.

Furthermore,

pharmacoeconomic measures favored the use of GTx-104 for patients with aSAH.

We believe these data validate the

GTx-104 value proposition. If approved, GTx-104 has the potential to address

significant challenges with oral nimodipine administration and may transform

the standard of care for patients with aSAH.

GTx-104 Phase 1 PK Trial

In September 2021, we initiated our pharmacokinetic

(“PK”) bridging trial to evaluate the relative bioavailability of GTx-104

compared to currently marketed oral nimodipine capsules in approximately 50

healthy subjects. This PK trial established the 505(b)(2) regulatory pathway

for GTx-104.

Final results from this PK trial were

reported in May 2022, and showed that the bioavailability of GTx-104 compared

favorably with the oral formulation of nimodipine in all subjects, and no

serious adverse events were observed for GTx-104.

In this trial, all endpoints indicated

that statistically there was no difference in exposures between GTx-104 and

oral nimodipine over the defined time periods for both maximum exposure and

total exposure. Plasma concentrations obtained following IV administration

showed significantly less variability between subjects as compared to oral

administration of capsules because IV administration is not as sensitive to

some of the physiological processes that affect oral administration, such as

taking the drug with and without meals, variable gastrointestinal transit time,

variable drug uptake from the gastrointestinal tract into the systemic

circulation, and variable hepatic blood flow and hepatic first pass metabolism.

Previous studies have shown these processes significantly affect the oral

bioavailability of nimodipine, and therefore cause oral administration to be

prone to larger inter- and intra-subject variability.

The bioavailability of oral nimodipine capsules observed was only approximately 7% compared to 100% for GTx-104. Consequently, about one-twelfth the amount of nimodipine is delivered with GTx-104 to achieve comparable PKs as with the oral capsules. This data is presented in the chart below.

Regulatory

In April 2025, we announced details of

a Type C written meeting response with the FDA. The purpose of this meeting was

to obtain feedback on the completed Phase 3 STRIVE-ON safety trial of GTx-104

and our NDA submission, including clinical, non-clinical, and CMC requirements.

Feedback from the FDA informed our data and regulatory packages, and we submitted the NDA for GTx-104 on June 25, 2025. Acceptance of the NDA will be subject to the FDA’s review of the complete filing.

GTx-102 Overview

GTx-102 is a novel, concentrated oral-mucosal spray of betamethasone intended to improve neurological symptoms of A-T for which there are currently no FDA-approved therapies. GTx-102 is a stable, concentrated oral spray formulation comprised of the gluco-corticosteroid betamethasone that, together with other excipients, can be sprayed conveniently over the tongue of the A-T patient and is rapidly absorbed.